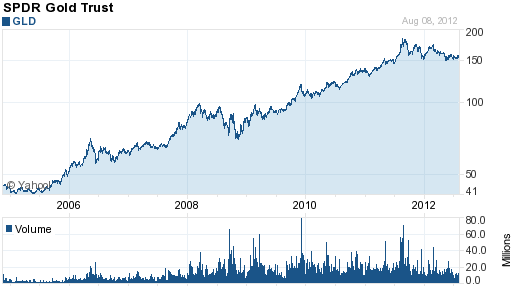

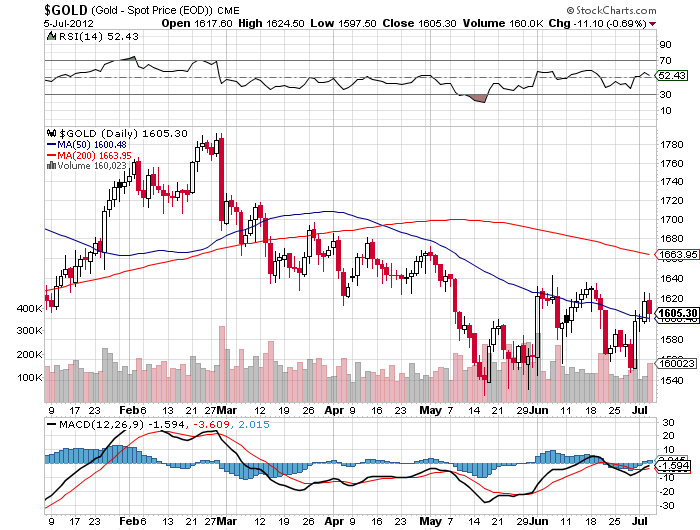

In an interview with Bloomberg TV, Greg Smith, chairman of Global Commodities, is forecasting $2,000 gold by Christmas.

Long term investors in gold would have a very merry Christmas since a price of $2,000 would equate to a 2012 price gain of over 25% from gold’s opening price on January 3, 2012.

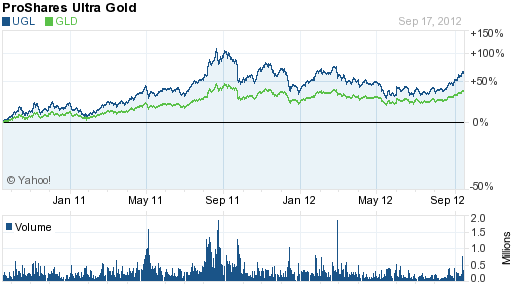

From today’s closing gold price, a $2,000 per ounce price by year end equates to a gain of $241 per ounce or 13.7%. Aggressive investors have many different ways to leverage gains on a potential run up in gold by year end. For example, a position in Pro Shares Ultra Gold (UGL) would yield a gain of about 27% if gold hits $2,000 by year end.

The UGL does not hold physical gold but rather invests in futures, forward contracts, options and swap agreements designed to yield gains of 200% of the daily performance of gold bullion. Last summer when gold soared to an all time high, the UGL returned twice the gains of the SPDR Gold Shares ETF (GLD). Keep in mind that leverage works both ways – if gold declines, an investment in the UGL would produce twice the losses compared to holding physical gold or shares in the GLD.

Courtesy: yahoo finance

By

By

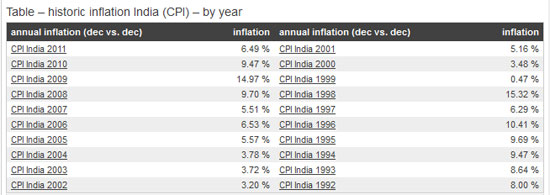

India may increase the import tax on gold for the third time this year in an attempt to shore up the weak rupee. Purchases of gold and silver account for a huge 12.5% of all Indian imports and are contributing to a record current-account deficit according to

India may increase the import tax on gold for the third time this year in an attempt to shore up the weak rupee. Purchases of gold and silver account for a huge 12.5% of all Indian imports and are contributing to a record current-account deficit according to

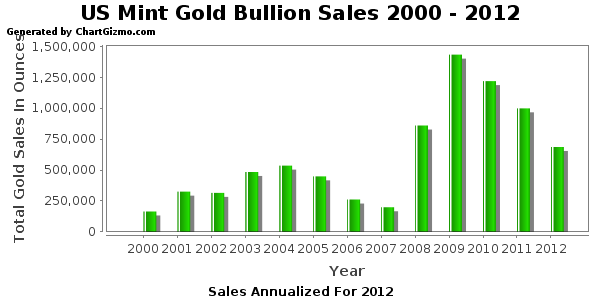

The latest sales figures from the U.S. Mint for August show a significant increase in sales of both gold and silver bullion coins.

The latest sales figures from the U.S. Mint for August show a significant increase in sales of both gold and silver bullion coins.

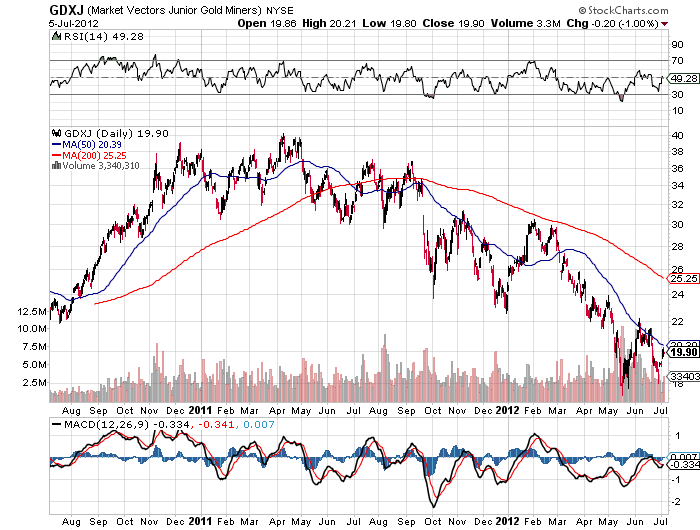

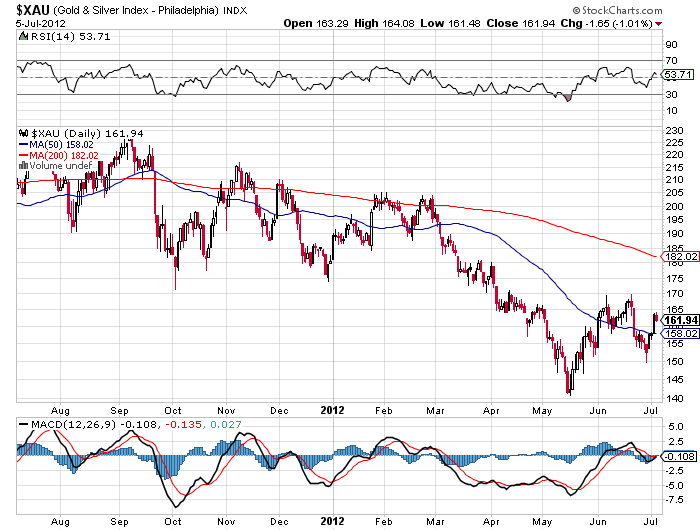

General Outlook for Gold and the Miners

General Outlook for Gold and the Miners

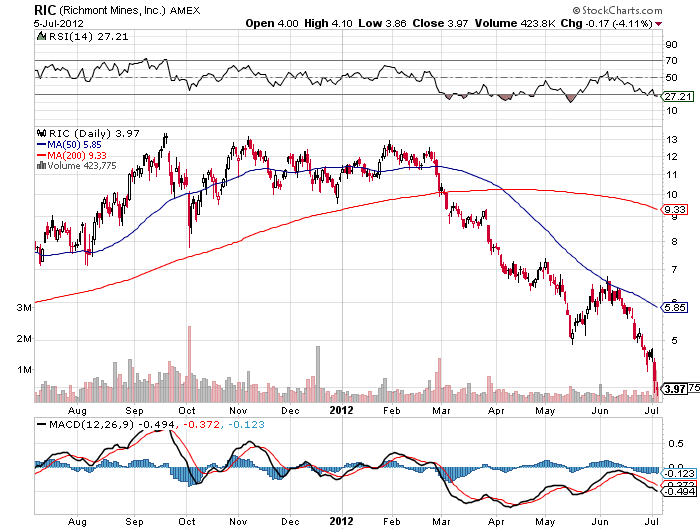

Each day another gold stock blows up. Last week it was NovaGold (NG) and then Newmont Mining (NEM) and before that a long list too painful to mention. Although I strongly prefer holding physical precious metals over mining companies, the gold stocks that I do own have put in less than a sterling performance.

Each day another gold stock blows up. Last week it was NovaGold (NG) and then Newmont Mining (NEM) and before that a long list too painful to mention. Although I strongly prefer holding physical precious metals over mining companies, the gold stocks that I do own have put in less than a sterling performance.

By Vin Maru

By Vin Maru

According to the latest report from the U.S. Mint, sales of gold bullion coins increased by over 13% during June, while total sales of the silver bullion coins were essentially unchanged from May.

According to the latest report from the U.S. Mint, sales of gold bullion coins increased by over 13% during June, while total sales of the silver bullion coins were essentially unchanged from May.