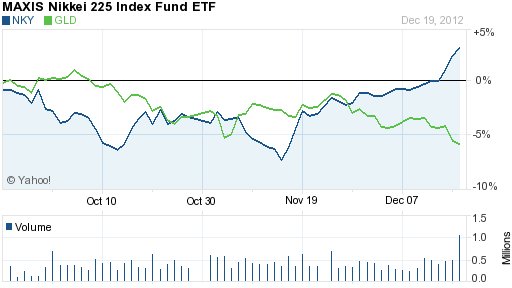

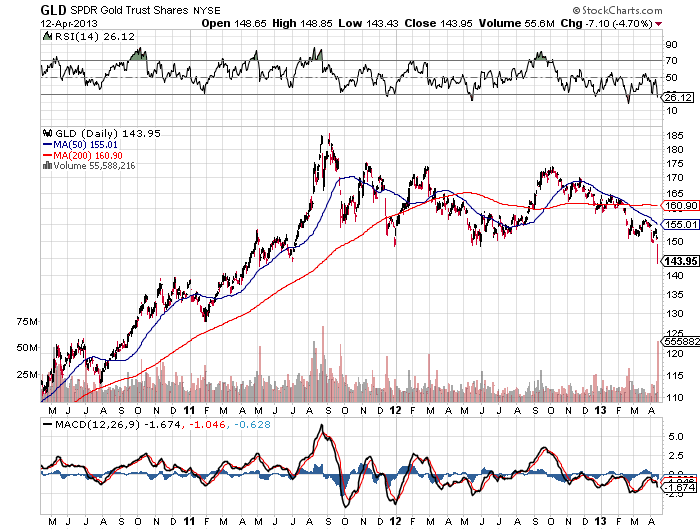

Large scale liquidation of gold backed exchange-traded products (ETP) sent gold prices into a tailspin during April. Billionaire investor George Soros, who had sold 55% of his holdings in the SPDR Gold Shares (GLD) during the last quarter of 2012, further reduced his gold positions during the first quarter. Soros is a legendary trader and investor who has made billions moving ahead of the crowd.

Large scale liquidation of gold backed exchange-traded products (ETP) sent gold prices into a tailspin during April. Billionaire investor George Soros, who had sold 55% of his holdings in the SPDR Gold Shares (GLD) during the last quarter of 2012, further reduced his gold positions during the first quarter. Soros is a legendary trader and investor who has made billions moving ahead of the crowd.

In an interview published by the South China Morning Post on April 8, Soros said that gold was no longer a safe haven after the metal failed to rally last year despite fears of a euro collapse. Shortly after Soros made his comments, other investors began to sell and within days gold had tumbled by $200 per ounce. Northern Trust Corp and BlackRock Inc also made large cuts in their holdings of ETPs, while John Paulson lost about $165 million by maintaining his stake in the GLD.

According to Bloomberg, assets held by ETPs declined in value by $42 billion as gold prices tumbled.

Global ETP holdings have tumbled 16 percent in 2013 after rising every year since the first product was listed in 2003, according to data compiled by Bloomberg. Assets in SPDR have plunged 22 percent, and they will probably drop by an additional 2 million to 4 million ounces after slumping 9.7 million ounces since mid-December, Deutsche Bank AG said in a report on May 14.

Further Drop

While the selloff has been faster than expected, a further drop in ETP holdings will probably mean more price declines, Goldman Sachs Group Inc. analysts including Jeffrey Currie wrote in a report dated May 14.

Northern Trust cut its SPDR stake by 57 percent to 6.9 million shares, according to a filing dated May 1. The asset-management company, as a custodian, holds assets without discretion over how they are invested, Doug Holt, the head of global corporate communications, said yesterday in an e-mail.

“We made one change to our global tactical asset allocation policy this month: eliminating our tactical position in gold,” Jim McDonald, chief investment strategist in Chicago at Northern Trust, which oversees about $810 billion, said in a report on March 13.

BlackRock, the world’s biggest money manager, trimmed its holdings by half to 4.1 million shares, a filing dated April 12 showed. On May 9, Robert Kapito, president of the New York-based company, said that he would still buy the metal.

The large scale liquidation of gold exchange traded funds was confirmed today in the latest quarterly demand and supply statistics published by the World Gold Council. Overall gold demand for the first quarter declined by a considerable 13% with outflows from gold ETFs accounting for the bulk of the decline. During the first quarter there were outflows of 177 tonnes from global gold ETF holdings.

The sale by large speculators of the gold ETPs seem to be the trigger that set off last month’s decline in gold prices. The drop in gold could turn out to be a temporary factor as other buyers eagerly absorb supply by adding to their gold holdings at lower prices.

Aside from the sale of gold by holders of exchange traded products, demand for gold in the first quarter remained robust. The World Gold Council noted that almost every other category of gold demand increased even as supplies are being constrained by lower mine output.

- Mine production of 1,052 tonnes during the first quarter showed no growth and supply from scrap gold declined due to the drop in gold prices.

- Jewelry demand surpassed the previous quarter and hit a new record with sales of $28.9 billion.

- Demand from India and China, who collectively consume 62% of global gold jewelry sales, increased by 15% and 19% respectively.

- Physical bar and coin demand during the first quarter increased by 8% and 18% respectively. Demand for gold bar and coins in China exploded to 110 tonnes, double the average of the last five year quarterly sales.

- Central banks added 109 tonnes of gold to their reserves in the first quarter, accounting for 11% of total gold demand. Central banks have increased their purchases of gold for nine consecutive quarters.

Wholesale liquidation of gold positions by very large and wealthy speculators adversely impacted gold prices this year. As gold demand from virtually every other sector continues to grow, the increased gold outflows from ETFs will eventually be absorbed. In addition, as central banks continue to print money on an unprecedented scale, it would not be surprising to see large investors once again pour money into the gold ETFs.

By: GE Christenson

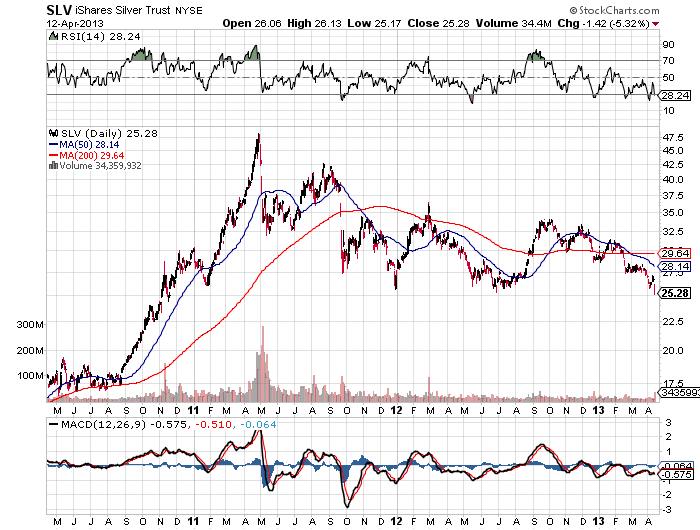

By: GE Christenson Don’t precious metal investors read newspapers? Despite proclamations from the mainstream press that the bull market in gold and silver is over, a buying frenzy in precious metals is occurring worldwide. The gold rush mentality to buy gold and silver at bargain prices has resulted in stock out conditions for many retail sellers of precious metals, including

Don’t precious metal investors read newspapers? Despite proclamations from the mainstream press that the bull market in gold and silver is over, a buying frenzy in precious metals is occurring worldwide. The gold rush mentality to buy gold and silver at bargain prices has resulted in stock out conditions for many retail sellers of precious metals, including  The stunning and unprecedented April gold crash has staggered investors with huge losses. Over the course of the first two weeks of April gold has declined by $203.50 or almost 13%. Since the beginning of the year, gold has crashed $313.75 or 18.5%.

The stunning and unprecedented April gold crash has staggered investors with huge losses. Over the course of the first two weeks of April gold has declined by $203.50 or almost 13%. Since the beginning of the year, gold has crashed $313.75 or 18.5%.

Kyle Bass recently summed up the thoughts of many gold investors when he said “the largest central banks in the world, they have all moved to unlimited printing ideology. Monetary policy happens to be the only game in town. I am perplexed as to why gold is as low as it is. I don’t have a great answer for you other than you should maintain a position.”

Kyle Bass recently summed up the thoughts of many gold investors when he said “the largest central banks in the world, they have all moved to unlimited printing ideology. Monetary policy happens to be the only game in town. I am perplexed as to why gold is as low as it is. I don’t have a great answer for you other than you should maintain a position.”

The deluge of bearish articles on gold continues with a Wall Street Journal article entitled “

The deluge of bearish articles on gold continues with a Wall Street Journal article entitled “ By GE Christenson:

By GE Christenson:

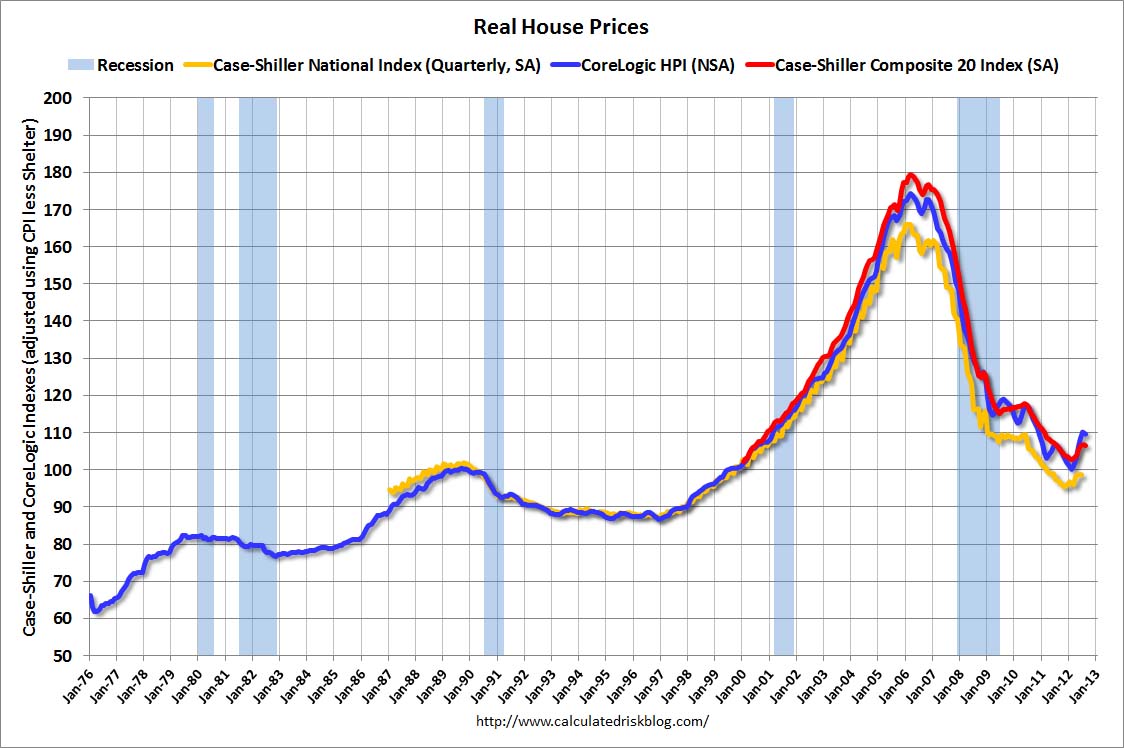

Anyone predicting that gold would outperform housing in 2001 would likely have been viewed as being seriously deranged. After all, housing prices had increased for decades and by the peak of the housing market in 2007, real estate was believed to be a “can’t lose investment.” The mantra that housing values only go up proved to be disastrous for many Americans as the over-leveraged real estate market imploded, shattering the wealth dreams of both naive homeowners and investors.

Anyone predicting that gold would outperform housing in 2001 would likely have been viewed as being seriously deranged. After all, housing prices had increased for decades and by the peak of the housing market in 2007, real estate was believed to be a “can’t lose investment.” The mantra that housing values only go up proved to be disastrous for many Americans as the over-leveraged real estate market imploded, shattering the wealth dreams of both naive homeowners and investors.

Both the Federal Reserve and the Bank of Japan have gone all in with their attempts to revive weak, debt burdened economies with a pledge of unlimited money printing.

Both the Federal Reserve and the Bank of Japan have gone all in with their attempts to revive weak, debt burdened economies with a pledge of unlimited money printing.