Bargain prices for gold and silver is fueling global demand for bullion coins.

Bargain prices for gold and silver is fueling global demand for bullion coins.

During September sales by the U.S. Mint of American Eagle gold and silver bullion coins increased dramatically. Sales of the American Eagle gold bullion coins during September rose to 58,000 ounces, up from 25,000 in August. Sales of the American Eagle silver bullion coins rose to 4,140,000 ounces in September, more than double the 2,007,500 ounces sold in the previous month (see also Must Know Facts Before Buying American Eagle Silver Bullion Coins).

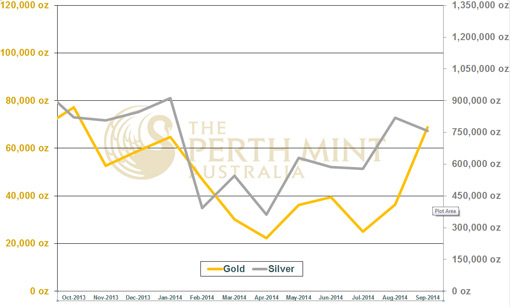

The increased demand for gold and silver coins seen in the U.S. was mirrored at other major world mints which have seen steadily increasing demand during the third quarter.

The Perth Mint of Australia, one of the largest mints in the world, has also experienced a sales spike in demand for gold and silver bullion. During September The Perth Mint sold 756,839 ounces of silver bullion up from under less than 450,000 ounces earlier in the year. The Perth Mint actually sold more gold bullion during September than the U.S. Mint with sales of 68,781 ounces.

The Perth Mint sells gold and silver bullion as both coin and minted bars and has a much wider product category than the U.S. Mint.

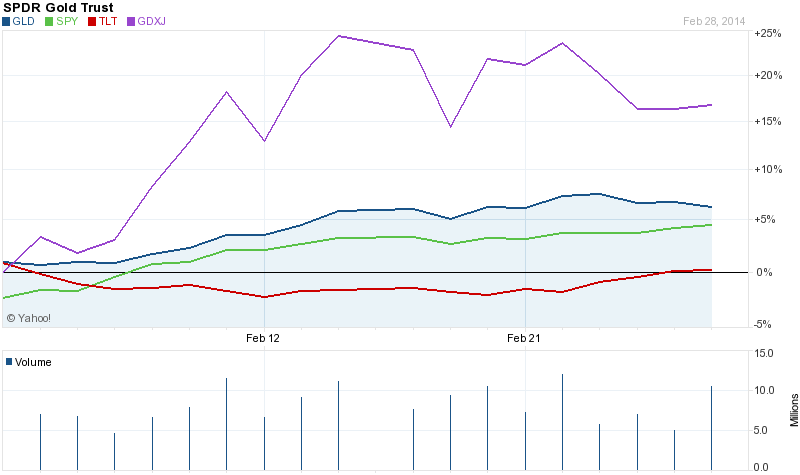

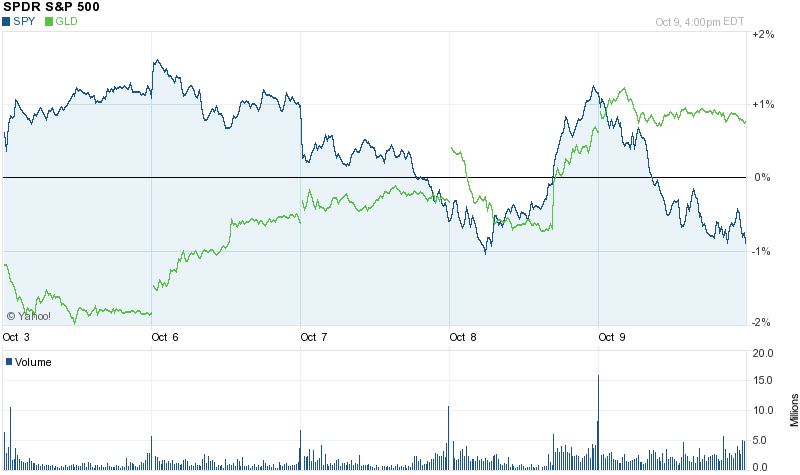

Further declines in the overextended and over-leveraged financial markets due to economic worries is likely to accelerate the recent trend into safe haven assets such as gold and silver.

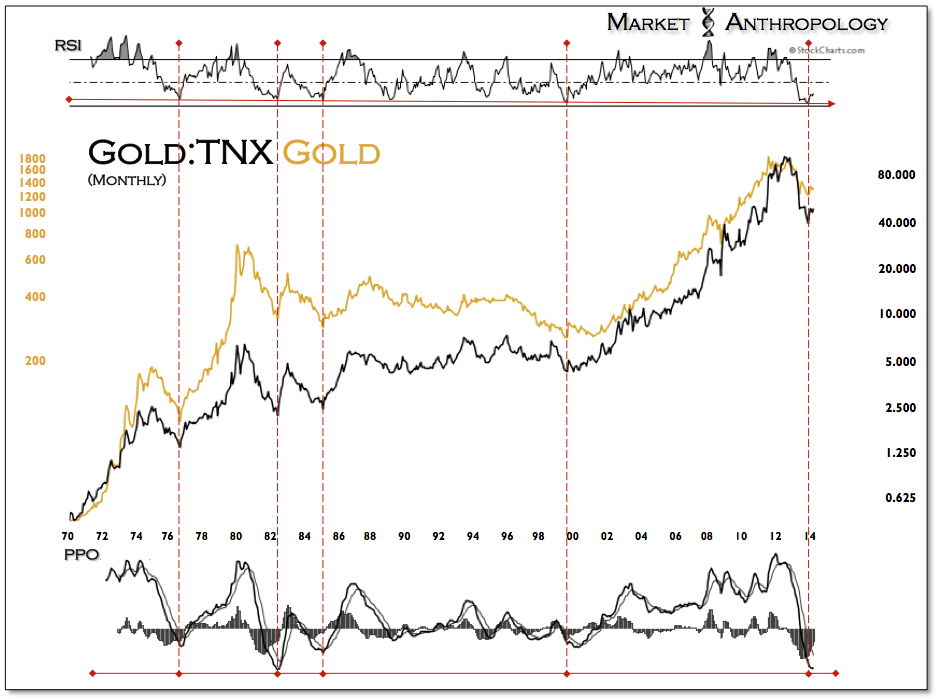

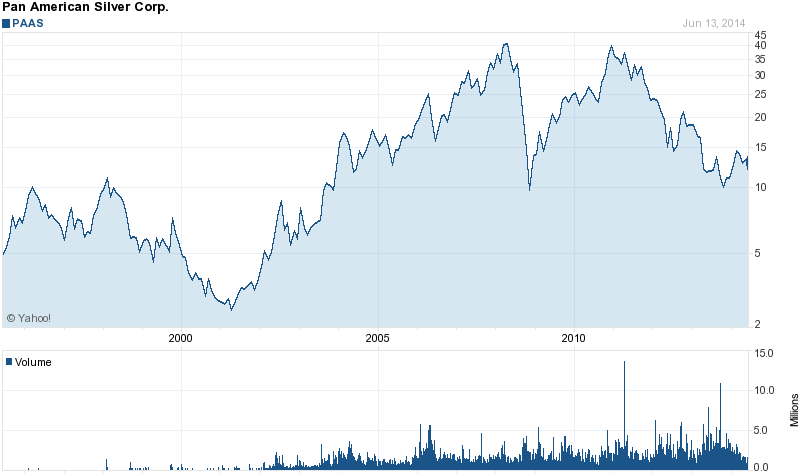

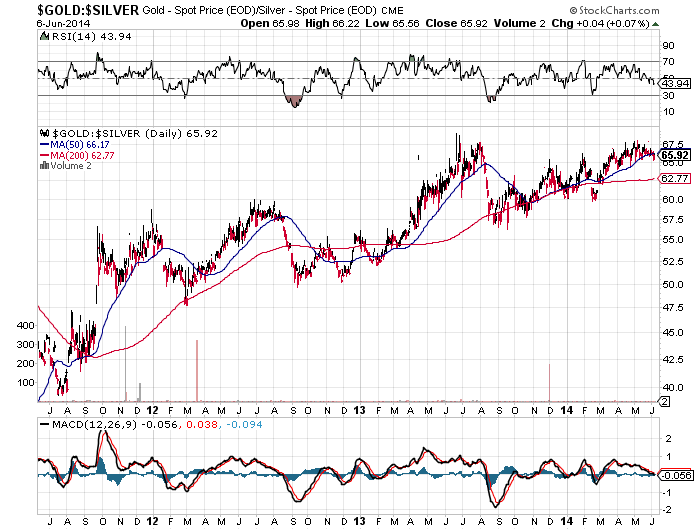

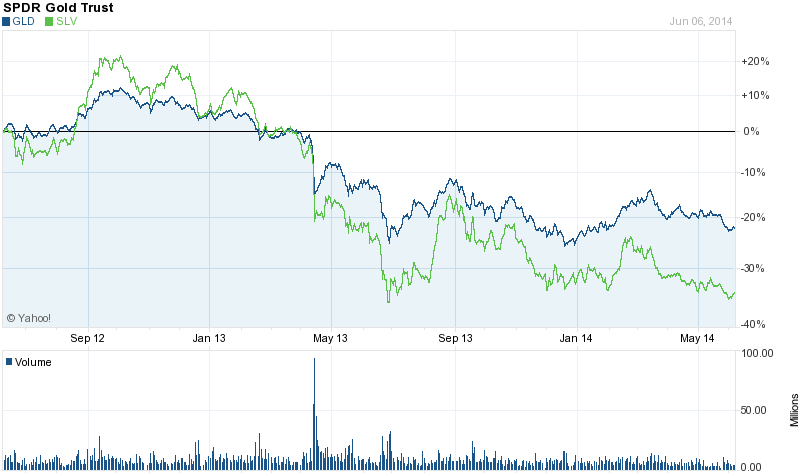

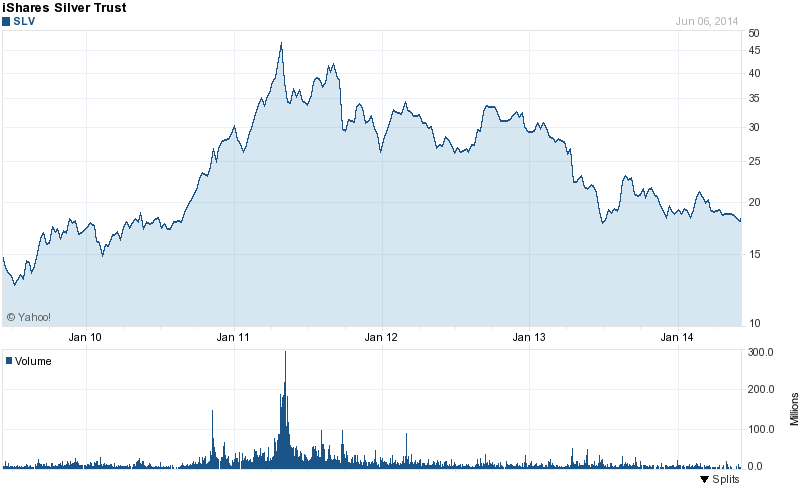

After almost a three year bear market in gold and silver it’s safe to conclude that most of precious metal bears have sold out and moved on. As gold and silver prices corrected sharply over the past three years, the chorus of bearish sentiment in the mainstream press has become endemic, thus setting the stage for a powerful and unexpected contra rally.

After almost a three year bear market in gold and silver it’s safe to conclude that most of precious metal bears have sold out and moved on. As gold and silver prices corrected sharply over the past three years, the chorus of bearish sentiment in the mainstream press has become endemic, thus setting the stage for a powerful and unexpected contra rally.