Bargain prices for gold and silver is fueling global demand for bullion coins.

Bargain prices for gold and silver is fueling global demand for bullion coins.

During September sales by the U.S. Mint of American Eagle gold and silver bullion coins increased dramatically. Sales of the American Eagle gold bullion coins during September rose to 58,000 ounces, up from 25,000 in August. Sales of the American Eagle silver bullion coins rose to 4,140,000 ounces in September, more than double the 2,007,500 ounces sold in the previous month (see also Must Know Facts Before Buying American Eagle Silver Bullion Coins).

The increased demand for gold and silver coins seen in the U.S. was mirrored at other major world mints which have seen steadily increasing demand during the third quarter.

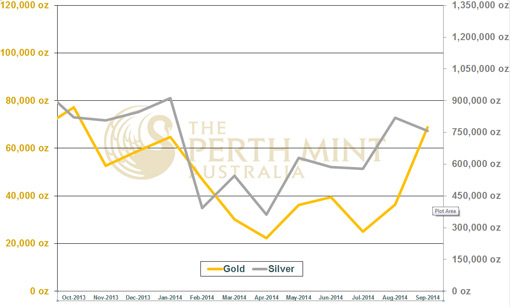

The Perth Mint of Australia, one of the largest mints in the world, has also experienced a sales spike in demand for gold and silver bullion. During September The Perth Mint sold 756,839 ounces of silver bullion up from under less than 450,000 ounces earlier in the year. The Perth Mint actually sold more gold bullion during September than the U.S. Mint with sales of 68,781 ounces.

The Perth Mint sells gold and silver bullion as both coin and minted bars and has a much wider product category than the U.S. Mint.

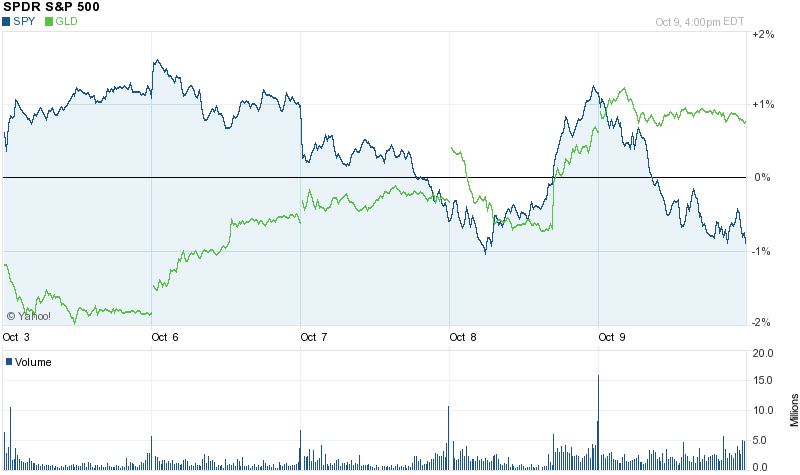

Further declines in the overextended and over-leveraged financial markets due to economic worries is likely to accelerate the recent trend into safe haven assets such as gold and silver.

The

The

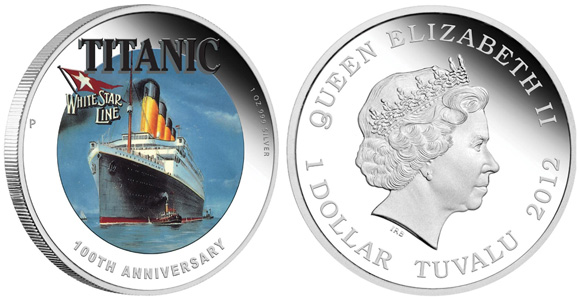

As will generally be the case with silver products, the smaller weight offerings carry a larger premium than than larger weight products. This can be the result of the fixed costs associated with manufacture or volume discounts which may be available for purchases in bulk quantities.

As will generally be the case with silver products, the smaller weight offerings carry a larger premium than than larger weight products. This can be the result of the fixed costs associated with manufacture or volume discounts which may be available for purchases in bulk quantities. During May 2010, the United States Mint’s gold and silver bullion sales levels reached their highest level in a decade or more for the two most popular offerings. This heavy

During May 2010, the United States Mint’s gold and silver bullion sales levels reached their highest level in a decade or more for the two most popular offerings. This heavy

For much of the year, the United States Mint has been touting the upcoming recreation of what they have called the “nation’s most beautiful coin.” Augustus Saint Gaudens’ design for the

For much of the year, the United States Mint has been touting the upcoming recreation of what they have called the “nation’s most beautiful coin.” Augustus Saint Gaudens’ design for the