In India, the problem with inflation shows most clearly when you examine the country’s current level of gold trade and importation. Shipments have increased to 800 metric tons from 557 tons in the last year. That is an all time high and forecasts say that the number is still rising.

In India, the problem with inflation shows most clearly when you examine the country’s current level of gold trade and importation. Shipments have increased to 800 metric tons from 557 tons in the last year. That is an all time high and forecasts say that the number is still rising.

The purchase of all this gold shows clearly the concerns that investors have regarding the local economy and the central bank’s battle with inflation.

Why Buy Gold?

“Gold is being used as a store of value to protect against never ending inflation,” according to the head of fixed income at Canara Robeco Asset Management Ltd., Ritesh Jain.

It makes sense, since in India gold is historically and culturally tied to the concepts of wealth and prosperity. Investors are used to buying into gold either as a physical asset or on the exchange market where gold can be purchased and traded without ever taking physical possession. And while the value of gold has climbed in India—the value of the rupee and of the bonds that support the central bank have not done nearly as well.

The Inflation Situation

In the last year alone, more investment dollars flowed out of India’s economy than in. Global funds sold $250 million more shares in Indian companies than they bought. Meanwhile, inflation has been on the rise, such that food prices have risen by 18.3% in the final weeks of 2010.Citizens and politicians alike are calling for actions to be taken to curb this inflation—all the while investing in more and more gold.

China and its people have a long held interest in the gold market. The country’s history has been marked by periods of unrest, and its people have regularly chosen to heed history’s warnings when it comes to investment. Their general preference has been for investments that they perceive as safe and solid, as opposed to paper instruments. Thus, their top two investment choices are gold and real estate.

China and its people have a long held interest in the gold market. The country’s history has been marked by periods of unrest, and its people have regularly chosen to heed history’s warnings when it comes to investment. Their general preference has been for investments that they perceive as safe and solid, as opposed to paper instruments. Thus, their top two investment choices are gold and real estate. The Associated Press reported that gold and silver are responding to an improved U.S. economy by losing ground in the investment market. Since the start of the year, gold has dropped nearly $50 per ounce, measuring a decline of about 3.5% while silver has fallen by $2.31 per ounce, or 7.5%.

The Associated Press reported that gold and silver are responding to an improved U.S. economy by losing ground in the investment market. Since the start of the year, gold has dropped nearly $50 per ounce, measuring a decline of about 3.5% while silver has fallen by $2.31 per ounce, or 7.5%.

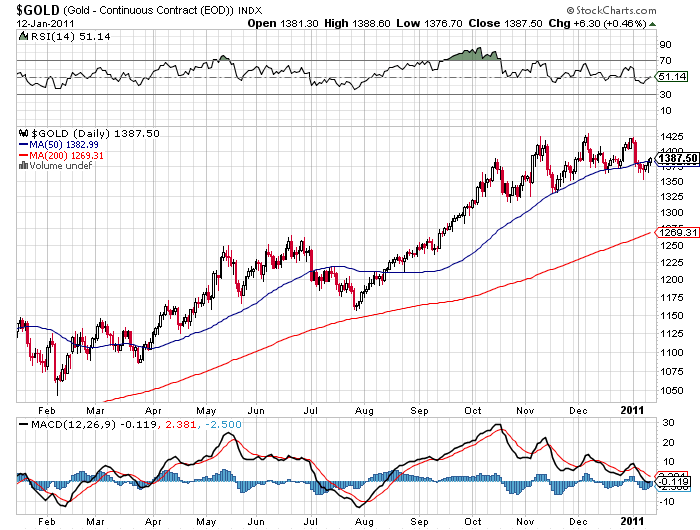

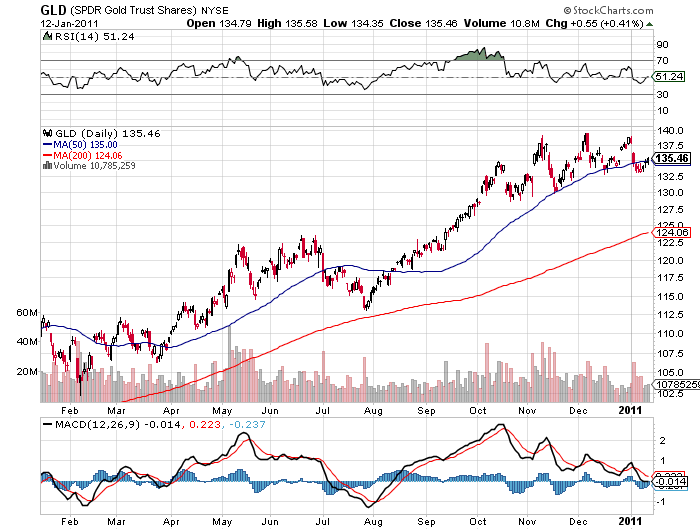

Investors and analysts alike are looking at the record prices of gold last year and trying to predict the future. Last year the price of gold rose by more than 27%, contributing to an increase of more than 400% over the past decade.

Investors and analysts alike are looking at the record prices of gold last year and trying to predict the future. Last year the price of gold rose by more than 27%, contributing to an increase of more than 400% over the past decade. Gold just had an amazing year, in which it reached a new all time high, rising about 25%. Silver provided an even more stellar performance, with a gain of about 75% and counting. It’s no wonder then, that more and more investors are becoming interested in the potential offered by silver.

Gold just had an amazing year, in which it reached a new all time high, rising about 25%. Silver provided an even more stellar performance, with a gain of about 75% and counting. It’s no wonder then, that more and more investors are becoming interested in the potential offered by silver. A press release was distributed last week indicating the Aurion Resources Ltd has signed a binding letter of intent with Gammon Gold Inc. This letter of intent will ultimately give Gammon the option to earn up to a 70% interest in Aurion’s 100% owned La Bandera gold project in Durango Mexico.

A press release was distributed last week indicating the Aurion Resources Ltd has signed a binding letter of intent with Gammon Gold Inc. This letter of intent will ultimately give Gammon the option to earn up to a 70% interest in Aurion’s 100% owned La Bandera gold project in Durango Mexico.