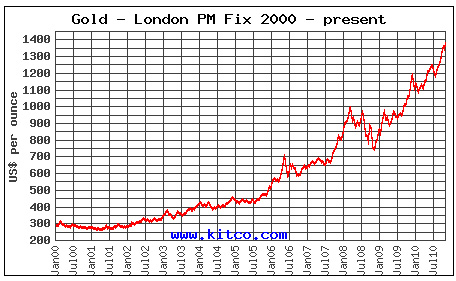

Gold and silver just seem to go together. They’re two precious metals that we love to invest in, especially after the strong performance of the metals during 2011, and gold’s string of consecutive annual gains stretching back a decade.

Gold and silver just seem to go together. They’re two precious metals that we love to invest in, especially after the strong performance of the metals during 2011, and gold’s string of consecutive annual gains stretching back a decade.

This year, gold futures have grown as much as 25% this year and silver futures as much as 75%. It’s this last figure that really interests us though. It is indicative of growing investor interest in a metal that is much more affordable than gold, but still offers many of the same benefits in the precious metals market.

Gold and Silver Investment Options

The major similarities that we can point to are related to the various ways that gold and silver are sold and traded among investors. In most cases, a potential investor has a few different options:

- They can invest in bullion coins

- They can invest in numismatic coins

- They can invest in exchange traded funds or ETFs

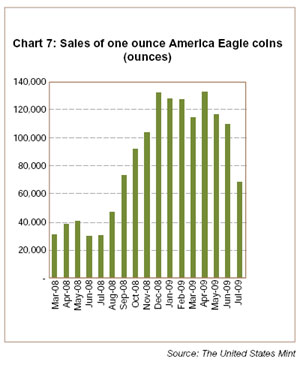

Gold and silver bullion coins are produced by a number of different world mints. A few of the most widely traded options include the American Silver Eagle from the United States Mint, the Silver Maple Leaf from the Royal Canadian Mint, and the Silver Philharmonic from the Austrian Mint. These coins are issued each year and are generally sold based on the market price of silver plus a mark up. The mark ups might be $2.50 to $4.00 per coin, depending on the quantity purchased.

Numismatic gold and silver coins are those which are valued not only based on their intrinsic value, but also their rarity and condition. In some cases, a rise in the price of precious metals might not result in an increase in value for numismatic coins since other factors come into play. It takes some understanding of the coin market and grading scales to invest in numismatic coins.

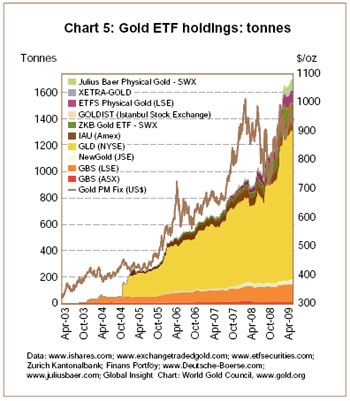

For many beginning investors, Exchange Traded Funds provide a useful alternative. Precious metals ETFs are traded on stock exchanges in the same manner as stocks and generally track the price of the underlying metals. There are different types of ETFs, which use either physical metal or futures and contracts to track the price of the underlying metal. The largest and widely held precious metals ETFs are the SPDR Gold Shares ETF (GLD) and the iShares Silver Turst (SLV).

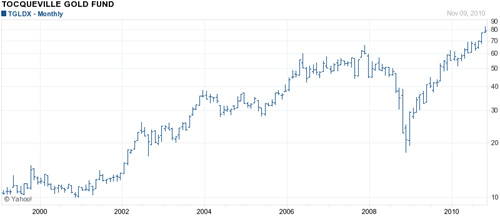

In its quest to determine the best way to make money from investing in gold, the Wall Street Journal recently took an in depth look at four different gold investment strategies. Each was represented by a preeminent investor, one whose method has seen some success recently.

In its quest to determine the best way to make money from investing in gold, the Wall Street Journal recently took an in depth look at four different gold investment strategies. Each was represented by a preeminent investor, one whose method has seen some success recently.

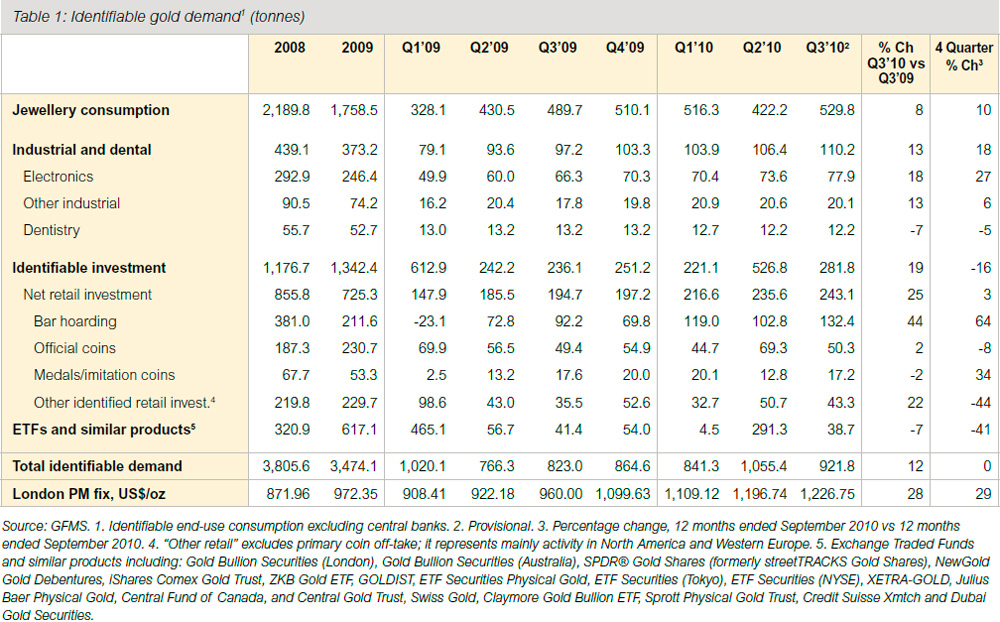

Total identifiable gold demand for the third quarter showed an increase of 12% above year ago levels at 921.8 tonnes. Increases in demand from jewelry consumption, industrial sectors, and net retail investment more than offset a decline in demand from electronically traded funds, according to information published by the

Total identifiable gold demand for the third quarter showed an increase of 12% above year ago levels at 921.8 tonnes. Increases in demand from jewelry consumption, industrial sectors, and net retail investment more than offset a decline in demand from electronically traded funds, according to information published by the

Gold investors have two basic choices – buying gold bullion or buying shares in companies that produce or own gold. As we examine the two basic investment vehicles available to gold investors, it becomes apparent that choosing the best investment option can be a complex decision. Some of the questions that a gold investor should consider include the following.

Gold investors have two basic choices – buying gold bullion or buying shares in companies that produce or own gold. As we examine the two basic investment vehicles available to gold investors, it becomes apparent that choosing the best investment option can be a complex decision. Some of the questions that a gold investor should consider include the following.