The SPDR Gold Shares Trust (GLD) continues to power higher in 2022 with a year-to-date gain of 7.5%. The value of gold holdings of the GLD from the beginning of the year increased by over $11 billion to $68.13 billion. Total gold held in trust by the GLD now amounts to over 1,106 tonnes.

The SPDR Gold Shares Trust (GLD) continues to power higher in 2022 with a year-to-date gain of 7.5%. The value of gold holdings of the GLD from the beginning of the year increased by over $11 billion to $68.13 billion. Total gold held in trust by the GLD now amounts to over 1,106 tonnes.

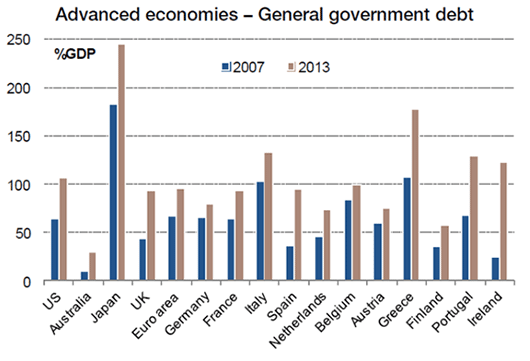

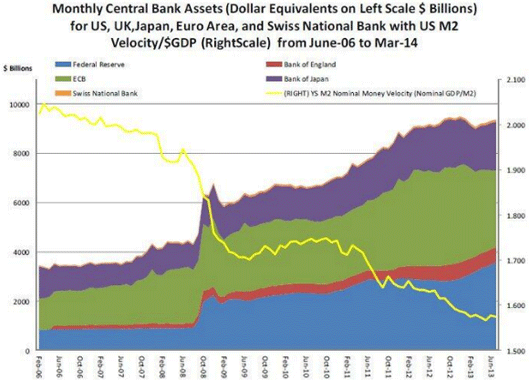

The GLD hit an all time high during early March when it reached $191.50. The demand for gold has increased due to of control inflation, a war in Europe that is spinning out of control, rampant money printing by the Federal Reserve and reckless spending by the Federal government.

Here are some basic facts about the GLD:

- An investment in GLD allows investors to purchase an interest in gold without the costs of purchasing, transporting, insuring and storage of gold bullion or coins.

- The fund expenses of the GLD are a modest 0.40% and allow an investor to purchase gold in whatever amount is desired, saving the cost of commissions and shipping on gold bullion.

- The GLD does not give the buyer the right to receive gold bullion in lieu of shares purchased.

- Purchases and sales can be done at any time during the trading day. The GLD has excellent liquidity and the discount or premium from the value of gold bullion held is usually minimal.

Gold has been going steadily upwards since 2016 with minor pullbacks during 2018 and 2021.

The return on the GLD from date of inception on November 18, 2004 has been 8.36%. In an uncertain world future returns look brighter every day.

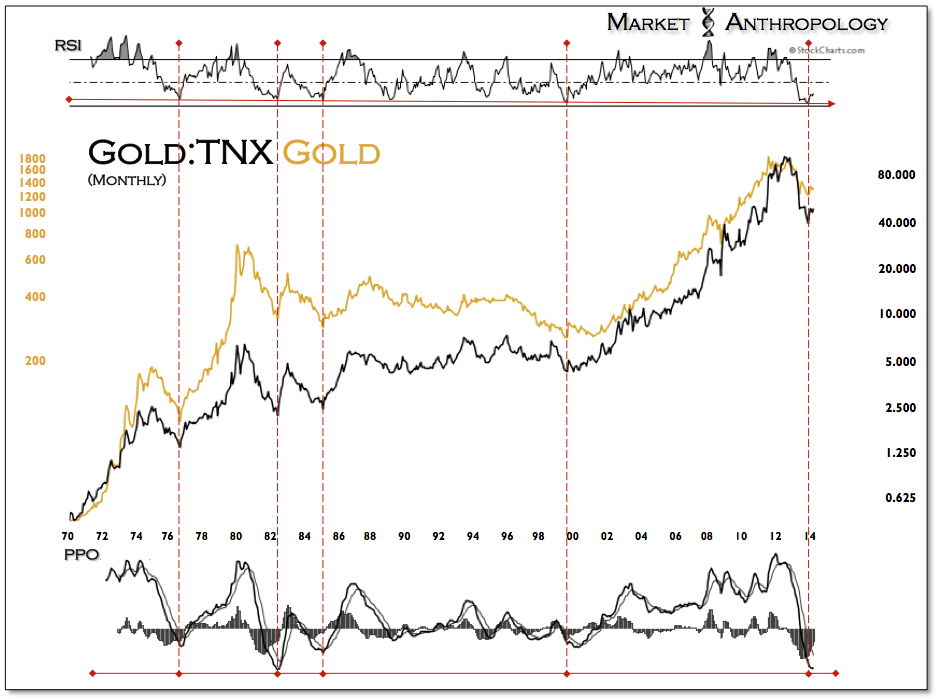

After almost a three year bear market in gold and silver it’s safe to conclude that most of precious metal bears have sold out and moved on. As gold and silver prices corrected sharply over the past three years, the chorus of bearish sentiment in the mainstream press has become endemic, thus setting the stage for a powerful and unexpected contra rally.

After almost a three year bear market in gold and silver it’s safe to conclude that most of precious metal bears have sold out and moved on. As gold and silver prices corrected sharply over the past three years, the chorus of bearish sentiment in the mainstream press has become endemic, thus setting the stage for a powerful and unexpected contra rally.