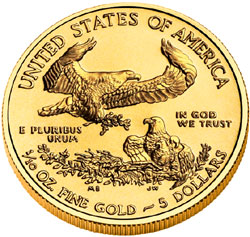

According to the latest report from the US Mint, sales of the American Gold Eagle bullion coins soared in March from both the previous month’s sales and the previous year.

According to the latest report from the US Mint, sales of the American Gold Eagle bullion coins soared in March from both the previous month’s sales and the previous year.

Total sales of the Gold Eagle bullion coins during March came in at 46,500 ounces, up by 151% from the previous month’s sales of 18,500 ounces. Sales of the gold bullion coins were also way ahead of the year ago month, with more than double the sales of 21,000 ounces in March 2014.

Although sales of the gold bullion coins have been declining since 2009, year to date sales for 2015 have slightly outpaced the previous comparable period. For the three month period ending March 31, 2015, the US Mint sold a total of 146,000 ounces, up from 143,500 ounces in the previous year’s quarter.

Sales of the gold bullion coins during 2014 totaled 524,500 ounces. If the sales pace for the first quarter continues, sales for 2015 should outpace last year by around 60,000 ounces.

The chart below shows sales by year since 2000 of the US Mint American Gold Eagle bullion coins.

The current price for a one ounce gold bullion coin is about $1,270, an expensive purchase for many people but the Mint also sells smaller weight coins. The American Eagle gold bullion coins are also available in one-half ounce, one-quarter ounce and one-tenth ounce sizes. A one-tenth ounce gold American Eagle coin currently costs only about $138. During March the US Mint sold a total of 70,000 one-tenth ounce coins, 8,000 quarter ounce coins, and 5,000 one-half ounce coins indicating solid demand by small investors for physical gold.

![gold Technical chart [Kitco Inc.]](https://www.kitco.com/lfgif/au0730lf_ma.gif)

Although sales totals vary from month to month, annual sales of the U.S. Mint American Eagle gold bullion coins are running at triple the levels prior to 2008 when the wheels came off the world financial system and central banks began an orgy of money printing.

Although sales totals vary from month to month, annual sales of the U.S. Mint American Eagle gold bullion coins are running at triple the levels prior to 2008 when the wheels came off the world financial system and central banks began an orgy of money printing.

We already knew from numerous

We already knew from numerous  We have probably all heard enough already from the mainstream nitwits who are forecasting the end of the gold bull market and further price declines. Funny thing though, most precious metal investors don’t need advice from self proclaimed experts on how to invest their money. The explicitly stated goal of central banks to increase the rate of inflation through currency debasement is blatantly obvious. Investors are acting accordingly by taking advantage of the recent decline in precious metal prices.

We have probably all heard enough already from the mainstream nitwits who are forecasting the end of the gold bull market and further price declines. Funny thing though, most precious metal investors don’t need advice from self proclaimed experts on how to invest their money. The explicitly stated goal of central banks to increase the rate of inflation through currency debasement is blatantly obvious. Investors are acting accordingly by taking advantage of the recent decline in precious metal prices.