According to the latest report from the U.S. Mint, sales of gold bullion coins increased by over 13% during June, while total sales of the silver bullion coins were essentially unchanged from May.

According to the latest report from the U.S. Mint, sales of gold bullion coins increased by over 13% during June, while total sales of the silver bullion coins were essentially unchanged from May.

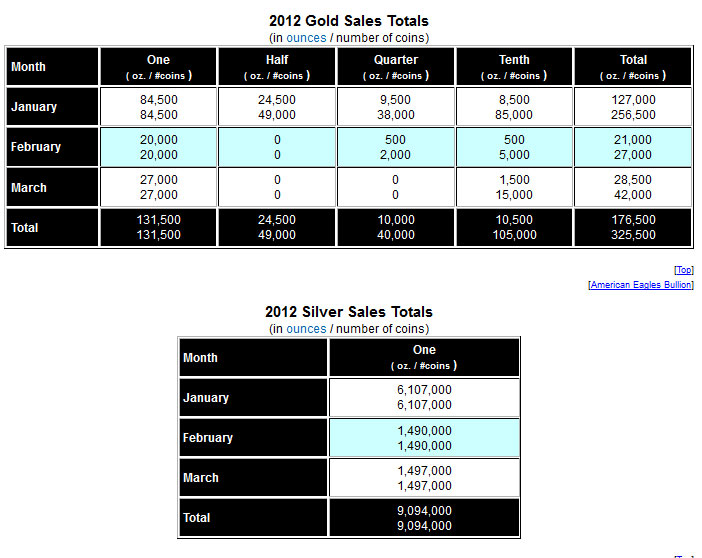

Monthly sales of the American Eagle gold bullion coin have fluctuated considerably during 2012 with sales reaching a monthly high of 127,000 ounces in January and a monthly low of 20,000 ounces in April. Sales rebounded strongly in May to 53,000 ounces and continued higher in June with the sale of 60,000 ounces.

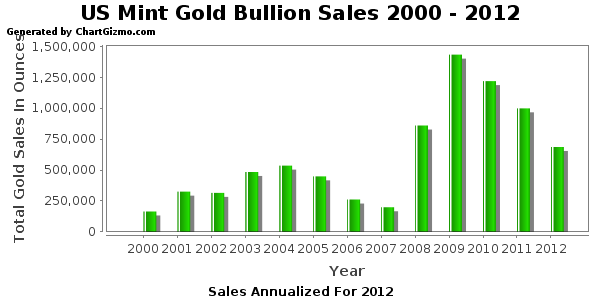

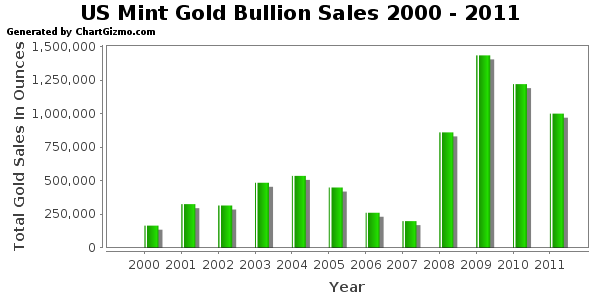

Sales of the American Eagle gold bullion coin can vary dramatically from month to month based on many factors. The all time yearly sales record for the gold bullion coins of 1,435,000 ounces was reached in 2009 when many people feared that the financial system would collapse. Sales volume of the gold bullion coins have not, however, had a direct correlation to the price of gold. Gold closed 2009 at $1,087.50 per ounce and subsequently went on to hit a 2011 high of $1,895 on September 5th. Despite the fact that gold increased by over 74% since year end 2009, total gold bullion coin sales declined in both 2010 and 2011.

If the European financial storm continues to unwind into a collapse similar to what we experienced in 2008, sales of the gold bullion coins could easily expand dramatically over the record levels seen in 2009. With each passing day, there seem to be fewer reasons to maintain confidence in the paper money system as central bankers and governments attempt to prop up a debt burdened world economy with additional debt and money printing.

Listed below are the yearly sales of the American Eagle gold bullion coins since 2000. The total for 2012 is through June 30th.

| Gold Bullion U.S. Mint Sales By Year | ||

| Year | Total Sales Oz. | |

| 2000 | 164,500 | |

| 2001 | 325,000 | |

| 2002 | 315,000 | |

| 2003 | 484,500 | |

| 2004 | 536,000 | |

| 2005 | 449,000 | |

| 2006 | 261,000 | |

| 2007 | 198,500 | |

| 2008 | 860,500 | |

| 2009 | 1,435,000 | |

| 2010 | 1,220,500 | |

| 2011 | 1,000,000 | |

| 2012 | 343,500 | |

| Total | 7,593,000 | |

If the sales trend of American gold bullion coins continues on the pace it has been on thus far, 2012 may turn out to be the fourth year in a row of lower sales. The graph below shows gold bullion coin sales since 2000 with figures for 2012 annualized based on sales through June 30th.

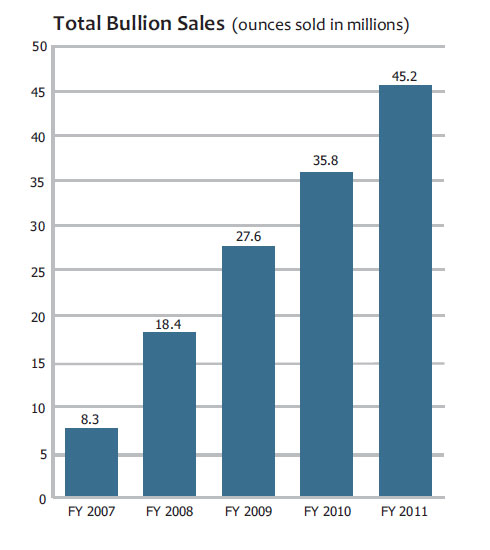

U.S. Mint sales of the American Eagle silver bullion coin continued strong in June at 2,858,000 ounces, down slightly from the May total of 2,875,000 ounces. After a strong start in January with sales of over 6 million ounces, sales dipped below 2 million ounces in February and April. Year to date sales through June 2012 of the silver bullion coins total 17,392,000 ounces, down by 22% from the comparable sales period in 2011 when 22,303,500 ounces were sold.

If sales of the silver bullion coins continue at the same pace for the remainder of 2012, total sales could exceed 34 million ounces, not far below the record set during 2011 of 39.9 million ounces. Considering that silver has corrected in price from $48.70 reached during April of 2011, the volume of silver bullion coin sales is very robust, with buyers taking advantage of lower prices.

In addition to gold and silver bullion coins, the U.S. Mint sells numismatic series of both gold and silver American Eagle coins which the public can purchase directly from the U.S. Mint. Bullion versions of the gold and silver American Eagles are only sold to Authorized Purchasers who in turn resell the product to the general public and other dealers.

Total annual U.S. Mint sales of the American Silver Eagle bullion coins since 2000 are shown below. Sales totals for 2012 are through June 30th.

| American Silver Eagle Bullion Coins | ||

| YEAR | OUNCES SOLD | |

| 2000 | 9,133,000 | |

| 2001 | 8,827,500 | |

| 2002 | 10,475,500 | |

| 2003 | 9,153,500 | |

| 2004 | 9,617,000 | |

| 2005 | 8,405,000 | |

| 2006 | 10,021,000 | |

| 2007 | 9,887,000 | |

| 2008 | 19,583,500 | |

| 2009 | 28,766,500 | |

| 2010 | 34,662,500 | |

| 2011 | 39,868,500 | |

| 2012 | 17,392,000 | |

| TOTAL | 215,792,500 | |

According to the latest report from the U.S. Mint, sales of both gold and silver bullion coins rebounded strongly during May.

According to the latest report from the U.S. Mint, sales of both gold and silver bullion coins rebounded strongly during May. Long term gold and silver investors who have gradually accumulated physical precious metals over the years have seen the value of their holdings increase substantially when measured against the value of the paper dollar. Astute investors realize that a large part of the “gains” on their precious metals have merely preserved purchasing power compared to paper money which has been consistently debased by the monetary and fiscal policies of the government and federal reserve.

Long term gold and silver investors who have gradually accumulated physical precious metals over the years have seen the value of their holdings increase substantially when measured against the value of the paper dollar. Astute investors realize that a large part of the “gains” on their precious metals have merely preserved purchasing power compared to paper money which has been consistently debased by the monetary and fiscal policies of the government and federal reserve.

The latest sales figures from the U.S. Mint show a continuing trend of lower gold bullion coin sales. Sales of American Gold Eagle bullion coins hit an all time high in 2009 when the Mint sold 1,435,000 ounces. During 2010, sales declined to 1.2 million ounces and in 2011 only 1 million ounces of gold bullion coins were sold.

The latest sales figures from the U.S. Mint show a continuing trend of lower gold bullion coin sales. Sales of American Gold Eagle bullion coins hit an all time high in 2009 when the Mint sold 1,435,000 ounces. During 2010, sales declined to 1.2 million ounces and in 2011 only 1 million ounces of gold bullion coins were sold.

The recent declines in precious metals seem to have shifted some investors preferences. For the current month to date, US Mint sales of gold bullion sales are on pace for the highest levels of the year, while silver bullion sales remain at typical levels.

The recent declines in precious metals seem to have shifted some investors preferences. For the current month to date, US Mint sales of gold bullion sales are on pace for the highest levels of the year, while silver bullion sales remain at typical levels.

The United States Mint currently has three gold and silver bullion coins available to its network of authorized purchasers. This includes the one ounce American Silver Eagle; the 22 karat American Gold Eagle available in one ounce, half ounce, quarter ounce, and tenth ounce sizes, and the recently released 24 karat American Gold Buffalo coins.

The United States Mint currently has three gold and silver bullion coins available to its network of authorized purchasers. This includes the one ounce American Silver Eagle; the 22 karat American Gold Eagle available in one ounce, half ounce, quarter ounce, and tenth ounce sizes, and the recently released 24 karat American Gold Buffalo coins.