Sales of the United States Mint’s 2010 Gold and Silver Eagle bullion coins are off to a fast start. Sales levels for the one ounce silver coins have already eclipsed the levels achieved in the year ago period. The one ounce gold coin sales were also strong.

Sales of the United States Mint’s 2010 Gold and Silver Eagle bullion coins are off to a fast start. Sales levels for the one ounce silver coins have already eclipsed the levels achieved in the year ago period. The one ounce gold coin sales were also strong.

After going on sale January 19, the 2010 Silver Eagles recorded sales of 2.44 million coins on the first day of availability. Earlier in the month, the US Mint had sold 367,500 coins, representing the remnants of the inventory of 2009-dated coins.

The month to date total for Silver Eagle bullion coin sales has now reached 3,592,500. By comparison, in January 2009, the US Mint had sold 1,900,000 coins. The high monthly sales total is made even more impressive by the fact that the one ounce silver bullion coins were completely unavailable for six days during the month between the sell out of 2009 coins and the start of sales for 2010 coins.

The 2010 Gold Eagles, which also went on sale January 19, recorded sales of 30,500 on the first day of availability. The US Mint additionally sold 18,500 of the 2009-dated coins on the same day, since authorized purchasers were required to take a certain amount of the old dated coins for each 2010-dated coins ordered.

For the month to date, gold eagle sales have reached 85,000 of the one ounce coins. This compares to 92,000 sold in the year ago period.

Today the US Mint began accepting orders from authorized purchasers for the 2010 Gold and Silver Eagle bullion coins. The initial ordering date this year comes a bit later than usual and carries some special stipulations.

Today the US Mint began accepting orders from authorized purchasers for the 2010 Gold and Silver Eagle bullion coins. The initial ordering date this year comes a bit later than usual and carries some special stipulations. During December, the United States Mint briefly offered 2009 American Gold Eagle bullion coins in fractional weights. This included one-half ounce coins, one-quarter ounce coins, and one-tenth ounce coins.

During December, the United States Mint briefly offered 2009 American Gold Eagle bullion coins in fractional weights. This included one-half ounce coins, one-quarter ounce coins, and one-tenth ounce coins. The United States Mint expanded its line of collectible American Gold Eagle coins in 2006. They introduced the collectible uncirculated Gold Eagle, sometimes referred to as “Burnished Gold Eagles.” These coins are struck on specially burnished blanks and carry the “W” mint mark. As opposed to bullion coins, these were sold directly by the US Mint and not through the network of authorized bullion dealers.

The United States Mint expanded its line of collectible American Gold Eagle coins in 2006. They introduced the collectible uncirculated Gold Eagle, sometimes referred to as “Burnished Gold Eagles.” These coins are struck on specially burnished blanks and carry the “W” mint mark. As opposed to bullion coins, these were sold directly by the US Mint and not through the network of authorized bullion dealers. The United States Mint has offered proof versions of the American Gold Eagle since 1986. These collectible versions of the popular bullion coins are minted using a special process where the coin is struck multiple times with specialized dies. The resulting coins feature sharp details and a cameo contrast of frosted raised elements and mirrored fields. Typically, the proof coins have been offered in 1 oz, 1/2 ounce, 1/4 ounce, and 1/10 ounce sizes, with a complete 4 Coin Set also offered. According to an announcement from the US Mint released this week, Proof Gold Eagles will not be minted during 2009.

The United States Mint has offered proof versions of the American Gold Eagle since 1986. These collectible versions of the popular bullion coins are minted using a special process where the coin is struck multiple times with specialized dies. The resulting coins feature sharp details and a cameo contrast of frosted raised elements and mirrored fields. Typically, the proof coins have been offered in 1 oz, 1/2 ounce, 1/4 ounce, and 1/10 ounce sizes, with a complete 4 Coin Set also offered. According to an announcement from the US Mint released this week, Proof Gold Eagles will not be minted during 2009. The United States Mint has officially announced the suspension of another slate of gold and silver products. The affected products are 2009 dated American Gold and Silver Eagle coins produced for collectors. These coins are considered collectible versions of the bullion coins.

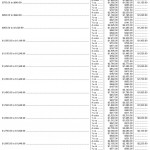

The United States Mint has officially announced the suspension of another slate of gold and silver products. The affected products are 2009 dated American Gold and Silver Eagle coins produced for collectors. These coins are considered collectible versions of the bullion coins. With the dust somewhat settled for the prior year, we now have some complete US Mint sales data on sales of gold, silver, and platinum bullion coins. As expected, the numbers show some large percentage increases from prior year sales. In particular silver bullion sales reached an all time record high with sales of nearly 20 million ounces.

With the dust somewhat settled for the prior year, we now have some complete US Mint sales data on sales of gold, silver, and platinum bullion coins. As expected, the numbers show some large percentage increases from prior year sales. In particular silver bullion sales reached an all time record high with sales of nearly 20 million ounces. The

The

The United States Mint recently released a memo to authorized bullion purchasers regarding the remaining 2008-dated bullion coins and the upcoming 2009-dated bullion coins.

The United States Mint recently released a memo to authorized bullion purchasers regarding the remaining 2008-dated bullion coins and the upcoming 2009-dated bullion coins.