US Mint Resumes Production of American Eagle Platinum Bullion Coin

US Mint Resumes Production of American Eagle Platinum Bullion Coin

The United States Mint first began minting the American Eagle platinum bullion coin in 1997 but suspended production in late 2008 when demand for gold and silver bullion coins skyrocketed in the wake of the financial crisis. With its production capacity strained by huge investor demand for gold and silver coins, the US Mint decided to suspend the production of platinum coins.

In 2007, the year before suspending production, annual sales of the platinum bullion coin totaled only 9,050 ounces. During 2008, the platinum bullion coin was sold up until November and a total of 33,700 ounces of coins were sold. The coin had been available in one ounce, one-half ounce, one-quarter ounce, and one-tenth ounce sizes with legal tender values of $100, $50, $25, and $10, respectively.

In addition to the bullion version of the American Eagle platinum coin a numismatic proof version of the coin was also available from 1997 to 2008 in all four sizes. Despite suspending production of the bullion platinum coins in 2008 the Mint continued to annually produce one numismatic version of the platinum coin for collectors. The numismatic proof version of the platinum coin undergoes a specialized minting process at the Mint where they are struck multiple times with special dies that result in the coin having a softly frosted finish with detailed images that seem to float above the mirror like surface of the coin.

The 2014 American Eagle Platinum bullion coins are produced by the West Point Mint and only come in a one ounce size. In March, the first month that the coins were available, the Mint sold 10,000 coins as authorized purchasers built up inventories for sale to the public. Just as with the American Eagle gold and silver bullion coins, the public cannot buy them directly from the Mint but must purchase them through US Mint authorized purchasers or coin dealers. April sales of the platinum bullion coins totaled only 1,200 ounces.

Platinum is one of the rarest of precious metals with annual production through mining and recycling of only about 7 million ounces. The vast majority of all platinum mined comes from South Africa and Russia both of which have unstable political situations which has resulted in frequently curtailed production. Platinum consumption is expected to exceed supply during 2014 with the deficit coming out of platinum stocks.

Resumption of the production of platinum coins by the US Mint now allows investors the opportunity to diversify their precious metal holdings

With the United States rapidly approaching the debt ceiling limit, a dysfunctional and divided Congress appears unable to agree on either spending cuts or an increase in the debt ceiling. Absent some grand Congressional compromise, America’s nonstop trillion dollar deficit spending will rapidly push the nation to the brink of default before the end of next month.

With the United States rapidly approaching the debt ceiling limit, a dysfunctional and divided Congress appears unable to agree on either spending cuts or an increase in the debt ceiling. Absent some grand Congressional compromise, America’s nonstop trillion dollar deficit spending will rapidly push the nation to the brink of default before the end of next month.

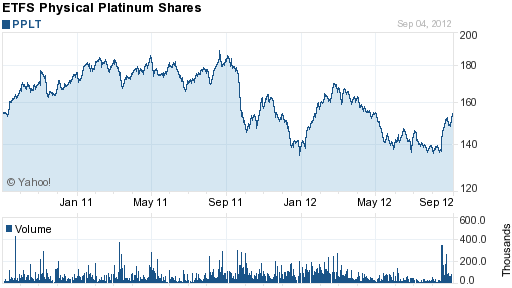

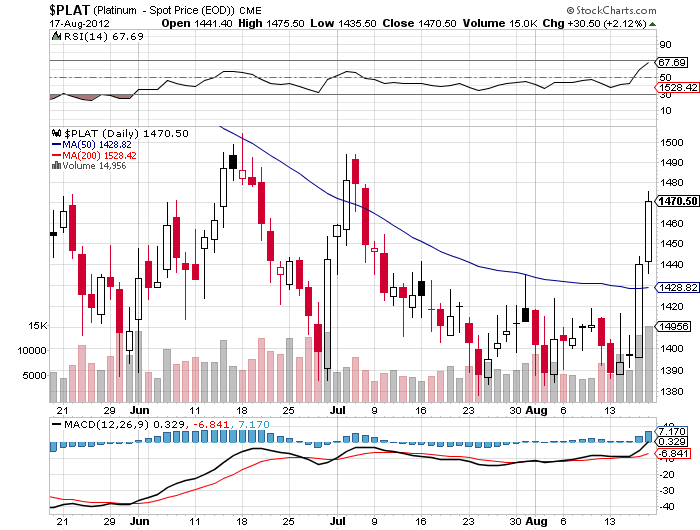

Since establishing multiple chart bottoms at $1,400 during June and July, platinum has soared along with other precious metals. Based on the London Fix Price, platinum has soared 16.5% from a low of $1,390 on August 3, 2012 to a September 20 closing price of $1,620.

Since establishing multiple chart bottoms at $1,400 during June and July, platinum has soared along with other precious metals. Based on the London Fix Price, platinum has soared 16.5% from a low of $1,390 on August 3, 2012 to a September 20 closing price of $1,620.

South Africa continues to be wracked by violence as striking platinum mine workers clash with police. In a confrontation between police and striking mine workers, a gunbattle resulted in the shooting deaths of 34 miners.

South Africa continues to be wracked by violence as striking platinum mine workers clash with police. In a confrontation between police and striking mine workers, a gunbattle resulted in the shooting deaths of 34 miners.

Despite the fact that the

Despite the fact that the  For the first time since

For the first time since