The United States Mint has officially announced the suspension of another slate of gold and silver products. The affected products are 2009 dated American Gold and Silver Eagle coins produced for collectors. These coins are considered collectible versions of the bullion coins.

The United States Mint has officially announced the suspension of another slate of gold and silver products. The affected products are 2009 dated American Gold and Silver Eagle coins produced for collectors. These coins are considered collectible versions of the bullion coins.

Although these are collectible coins, they represent a sizable amount of precious metals sales and represent a method of gold and silver investment for many individuals. Last year, the US Mint sold 1,157,911 ounces of silver in the form of Silver Eagle coins minted for collectors. They also sold 155,740 ounces of gold in the form of Gold Eagle and Gold Buffalo coins minted for collectors.

The following message was posted on the US Mint’s website in the space where the collectible Gold Eagle coins typically appear. The proof coins has been offered uninterrupted since 1986. The uncirculated version has been offered since 2006.

Production of United States Mint American Eagle Gold Proof and Uncirculated Coins has been temporarily suspended because of unprecedented demand for American Eagle Gold Bullion Coins. Currently, all available 22-karat gold blanks are being allocated to the American Eagle Gold Bullion Coin Program, as the United States Mint is required by Public Law 99-185 to produce these coins “in quantities sufficient to meet public demand . . . .”

The United States Mint will resume the American Eagle Gold Proof and Uncirculated Coin Programs once sufficient inventories of gold bullion blanks can be acquired to meet market demand for all three American Eagle Gold Coin products. Additionally, as a result of the recent numismatic product portfolio analysis, fractional sizes of American Eagle Gold Uncirculated Coins will no longer be produced.

A similar message is posted in the section where collectible American Silver Eagle coins would typically appear. The proof coins have also been offered uninterrupted since 1986 and the uncirculated coins since 2006.

Production of United States Mint American Eagle Silver Proof and Uncirculated Coins has been temporarily suspended because of unprecedented demand for American Eagle Silver Bullion Coins. Currently, all available silver bullion blanks are being allocated to the American Eagle Silver Bullion Coin Program, as the United States Mint is required by Public Law 99-61 to produce these coins “in quantities sufficient to meet public demand . . . .”

The United States Mint will resume the American Eagle Silver Proof and Uncirculated Coin Programs once sufficient inventories of silver bullion blanks can be acquired to meet market demand for all three American Eagle Silver Coin products.

This adds to the lengthy list of 2009 dated precious metals products that have been “temporarily delayed” or suspended by the US Mint. In my previous post Actions of the US Mint Discourage Gold Ownership, I mentioned the delayed release of 2009 Gold Eagle fractional coins, 2009 Gold Buffalo coins, and all 2009 Platinum Eagle coins. The delay, which was first announced in November 2008, continues with no further explanation provided.

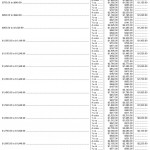

For those keeping track, here is a list of the US Mint’s 2009 precious metals products that have been “temporarily delayed” or suspended:

- 2009 American Gold Eagle 1/2 oz. (bullion)

- 2009 American Gold Eagle 1/4 oz. (bullion)

- 2009 American Gold Eagle 1/10 oz. (bullion)

- 2009 American Platinum Eagle 1 oz. (bullion)

- 2009 American Platinum Eagle 1/2 oz. (bullion)

- 2009 American Platinum Eagle 1/4 oz. (bullion)

- 2009 American Platinum Eagle 1/10 oz. (bullion)

- 2009 American Gold Buffalo 1 oz. (bullion)

- 2009-W Proof American Gold Eagle 1 oz. (collector)

- 2009-W Proof American Gold Eagle 1/2 oz. (collector)

- 2009-W Proof American Gold Eagle 1/4 oz. (collector)

- 2009-W Proof American Gold Eagle 1/10 oz. (collector)

- 2009-W Proof American Gold Eagle 4 Coin Set (collector)

- 2009-W Uncirculated American Gold Eagle 1 oz. (collector)

- 2009-W Proof American Silver Eagle (collector)

- 2009-W Uncirculated American Silver Eagle (collector)

In addition, the following precious metals related products were discontinued by the US Mint for 2009. These discontinuations were announced in November 2008. Amidst the environment of unprecedented demand for precious metals, the US Mint determined that these products were “unpopular.”

- Uncirculated American Gold Eagle 1/2 oz. (collector)

- Uncirculated American Gold Eagle 1/4 oz. (collector)

- Uncirculated American Gold Eagle 1/10 oz. (collector)

- Unriculated American Gold Eagle 4 Coin Set (collector)

- Uncirculated American Gold Buffalo 1 oz. (collector)

- Uncirculated American Gold Buffalo 1/2 oz. (collector)

- Uncirculated American Gold Buffalo 1/4 oz. (collector)

- Uncirculated American Gold Buffalo 1/10 oz. (collector)

- Unriculated American Gold Buffalo 4 Coin Set (collector)

- Proof American Gold Buffalo 1/2 oz. (collector)

- Proof American Gold Buffalo 1/4 oz. (collector)

- Proof American Gold Buffalo 1/10 oz. (collector)

- Proof American Gold Buffalo 4 Coin Set (collector)

- Uncircualted American Platinum Eagle 1 oz. (collector)

- Uncircualted American Platinum Eagle 1/2 oz. (collector)

- Uncircualted American Platinum Eagle 1/4 oz. (collector)

- Uncircualted American Platinum Eagle 1/10 oz. (collector)

- Uncircualted American Platinum Eagle 4 Coin Set (collector)

- Proof American Platinum Eagle 1/2 oz. (collector)

- Proof American Platinum Eagle 1/4 oz. (collector)

- Proof American Platinum Eagle 1/10 oz. (collector)

- Proof American Platinum Eagle 4 Coin Set (collector)

That makes a total of 38 precious metals products which have been delayed, suspended, or discontinued by the US Mint.

As it currently stands, investors or collectors looking to purchase newly minted American Eagle or American Buffalo precious metals products have only two options available. These are the 2009 1 oz. American Gold Eagle and the 2009 1 oz. American Silver Eagle. Both of these products continue to be subject to rationing.

With the dust somewhat settled for the prior year, we now have some complete US Mint sales data on sales of gold, silver, and platinum bullion coins. As expected, the numbers show some large percentage increases from prior year sales. In particular silver bullion sales reached an all time record high with sales of nearly 20 million ounces.

With the dust somewhat settled for the prior year, we now have some complete US Mint sales data on sales of gold, silver, and platinum bullion coins. As expected, the numbers show some large percentage increases from prior year sales. In particular silver bullion sales reached an all time record high with sales of nearly 20 million ounces. The

The

Today the United States Mint announced some sweeping cuts to the number of products that they will offer to coin collectors. The deepest cuts take place in the US Mint’s offerings of collectible versions of gold and platinum bullion coins.

Today the United States Mint announced some sweeping cuts to the number of products that they will offer to coin collectors. The deepest cuts take place in the US Mint’s offerings of collectible versions of gold and platinum bullion coins.