Evaluating risk is a part of any investment decision process. A quick look at the recent past reveals that every asset can fluctuate in value, sometimes very rapidly. Housing prices declined around fifty percent during the financial/banking crisis that started in 2018. Commodities are notoriously volatile, subject to wide swings in demand and supply. Even stocks, which for the past two years have been on a nonstop upside ride can have long stretches without gains or sudden sharp downdrafts. Stock returns for the decade 2000 to 2010 were just a shade above zero.

Evaluating risk is a part of any investment decision process. A quick look at the recent past reveals that every asset can fluctuate in value, sometimes very rapidly. Housing prices declined around fifty percent during the financial/banking crisis that started in 2018. Commodities are notoriously volatile, subject to wide swings in demand and supply. Even stocks, which for the past two years have been on a nonstop upside ride can have long stretches without gains or sudden sharp downdrafts. Stock returns for the decade 2000 to 2010 were just a shade above zero.

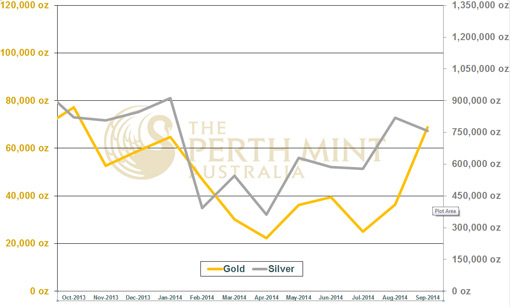

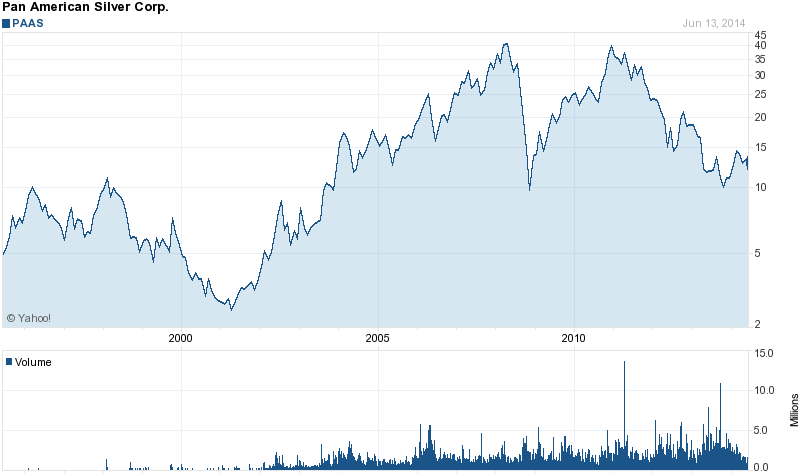

Gold and silver, the only currencies to retain value for thousands of years, will continue to shine but will also have periods during which pullbacks will occur. Holding physical silver in large quantities can be problematic when considering the cost of storage and security.

One alternative to holding physical silver is to purchase shares of the iShares Silver Trust (SLV) which holds physical silver stored by a custodian. The value of the SLV over time will correlate closely to changes in the price of silver which makes it a relatively good proxy for holding physical silver.

As discussed above, every asset class has risk and owning the SLV is no exception. If you are of the opinion that the greatest risk to the SLV (and to your personal wealth) is the government, you would be right.

As discussed in the SLV proxy statement, among the various risks of owning the SLV, adverse and/or confiscatory actions by the government is the number one risk of owning the iShares Silver Trust.

Future governmental decisions may have significant impact on the price of silver, which may result in a significant decrease or increase in the value of the net assets and the net asset value of the Trust.

Generally, silver prices reflect the supply and demand of available silver. Governmental decisions, such as the executive order issued by the President of the United States in 1934 requiring all persons in the United States to deliver silver to the Federal Reserve, have been viewed as having significant impact on the supply and demand of silver and the price of silver. Future governmental decisions may have an impact on the price of silver and may result in a significant decrease or increase in the value of the net assets and the net asset value of the Trust. Further regulations applicable to U.S. banks and non U.S. bank entities operating in the United States with respect to their trading in physical commodities, such as precious metals, may further impact the price of silver in the United States.

The SLV currently holds approximately $12.25 billion in silver bullion.