Late last year and early this year, a continual observation of the gold and silver markets was the disconnect between the prices quoted on paper markets and the prices that you would actually need to pay to buy physical precious metals. In the past few weeks premiums for physical gold and silver have declined as the prices quoted on the paper market have risen, basically bringing the two markets back into alignment.

Late last year and early this year, a continual observation of the gold and silver markets was the disconnect between the prices quoted on paper markets and the prices that you would actually need to pay to buy physical precious metals. In the past few weeks premiums for physical gold and silver have declined as the prices quoted on the paper market have risen, basically bringing the two markets back into alignment.

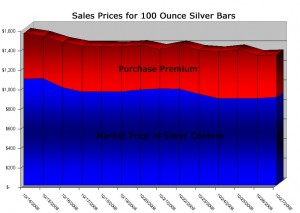

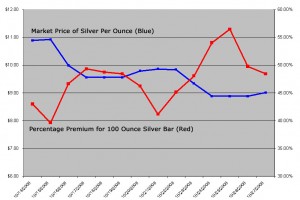

Back in October 2008, I had examined 100 ounce silver bars as an example of the excessive premiums being paid for physical precious metals. I collected some data from recently completed eBay auctions that showed the average price of the 100 ounce silver bar ranging from $1,329 to $1,557 while the market price of silver ranged from $8.88 to $10.89. This represented premiums ranging from $39.62% to 56.45%. This was particularly ridiculous since the 100 ounce silver bar has been traditionally viewed as a low premium method for silver investing.

Reviewing some data for eBay auctions completed yesterday now shows the prices paid for 100 ounce silver bars ranging from $1,450 to $1,500. At yesterday’s closing price of silver of $14.09, this represents a much more reasonable premium of about 3% to 6%.

Peculiarly, the decline in premium is a close match to the increase in price for spot silver. If you invested in silver by buying physical bars back in October, you might be showing zero profit even though the market price is up over 40%.

Future Gold and Silver Price Implications?

When the premiums for physical precious metals were high, it was viewed as a sign of heavy demand amidst a diminished supply that would eventually force market prices to move higher. Now that the disconnect between the paper and physical markets has seemingly resolved itself, is this a signal of slower demand that will lead to lower prices?

Despite the implication of slower demand, I think the realignment of the markets represents a long term positive for the price of gold and silver. Back when premiums were high, I am sure that many potential investors backed away from the market when they were faced with excessive premiums. Potential investors will now actually be able to buy physical gold and silver around the market prices. This is a much better environment for fostering mainstream demand to keep gold and silver moving higher.

[phpbay]100 ounce silver bar, 3, “”, “”[/phpbay]

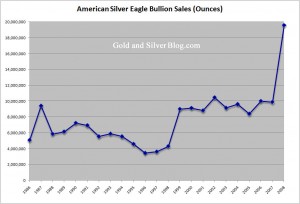

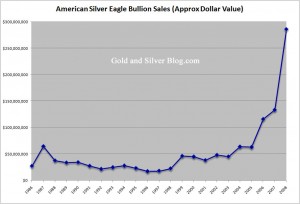

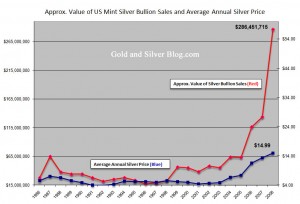

World mints have struggled to keep up with the booming demand for precious metals. The situation has been ongoing for more than a year and frustrated physical silver investors with suspensions, rationing, and delays. There are finally some signs that the shortage may be coming to an end, in particular for the American Silver Eagle bullion coin.

World mints have struggled to keep up with the booming demand for precious metals. The situation has been ongoing for more than a year and frustrated physical silver investors with suspensions, rationing, and delays. There are finally some signs that the shortage may be coming to an end, in particular for the American Silver Eagle bullion coin. With the first quarter at an end, let’s take a look at the performance of gold, silver, and platinum so far this year.

With the first quarter at an end, let’s take a look at the performance of gold, silver, and platinum so far this year.

Today, the United States Mint published notification that they would be raising the premiums charged for American Silver Eagle bullion coins. This refers to the premium above the price of silver at which the US Mint sells the bullion coins to Authorized Purchasers. The premium will increase from $1.40 per coin to $1.50 per coin. The increase will be effective from February 9, 2009.

Today, the United States Mint published notification that they would be raising the premiums charged for American Silver Eagle bullion coins. This refers to the premium above the price of silver at which the US Mint sells the bullion coins to Authorized Purchasers. The premium will increase from $1.40 per coin to $1.50 per coin. The increase will be effective from February 9, 2009. If you’ve tried buying physical silver recently, then you are undoubtedly aware of the incredibly high premiums charged above market value. I wrote previously about the

If you’ve tried buying physical silver recently, then you are undoubtedly aware of the incredibly high premiums charged above market value. I wrote previously about the