Will silver hit $40 by year end?

Will silver hit $40 by year end?

The latest in depth report on silver from the Silver Institute builds a sound fundamental rationale for a price of $40/ounce or higher by 2011 year end. The Silver Institute report analyzes the current silver market, sources of investment demand, paper instruments linked to silver, silver mining stocks and privately held silver stocks.

Highlights of the Silver Institute report are summarized below and the full report can be found here.

1. China and India dominate retail demand for silver but demand from India can be volatile with periods of heavy disinvestment such as occurred in 2009. The key to silver demand in India remains linked to consumer price expectations and inflation in India has been soaring, reaching almost double digits.

Based on India’s current 9% inflation rate, 2012 is likely to see continued huge demand for both gold and silver. Paper assets currently have little appeal to Indians seeking to preserve their wealth since interest rates are currently negative. According to an article published at GATA, the yield on ten year notes is almost 1% below the rate of inflation resulting in an erosion of wealth for holders of paper assets. Savers are reacting accordingly and purchasing precious metals to preserve their wealth. During October, imports of gold and silver rose 40% to $7.2 billion.

2. The Silver Institute forecasts that gold and silver will benefit as a safe haven based on the expanding European sovereign debt crisis which appears to be spiraling out of control. Silver should also benefit from asset reallocation as recession in Europe causes losses in traditional paper assets.

Amazingly, as both paper currencies and governments continue to collapse, investors still have a blind misguided faith in paper assets back only by the “full faith and credit” of insolvent nations. Proof of this is seen by the Silver Institute’s forecast of only a 10% increase in retail demand for bullion coin and small bar in Europe. Demand for precious metals in the U.S. is forecast even lower at 7%. Such modest demand for the only currency that cannot be debased by government actions completely refutes those who claim that precious metals are in a bubble.

3. The Silver Institute forecasts that investment demand in 2011 will reach new record highs of $10 billion. Chinese demand for physical silver should grow by 25% and Indian demand for silver should increase by a massive 55% to 45 million ounces. The Institute Report also notes that the silver market in China is still very small since the market for silver was only recently liberalized in 2009.

U.S. investors have also taken the opportunity to capitalize on bargain silver prices. U.S. Mint sales of American Silver Eagle bullion coins should easily hit an all time record high of over 42 million ounces in 2011.

4. The Silver Institute notes that the rise in silver prices has correlated with the increased price of gold and also benefited from the introduction of ETF products, such as the iShares Silver Trust (SLV). The iShares Silver Trust has grown to $10.6 billion with holdings of 314.6 million ounces of silver since its launch in 2006.

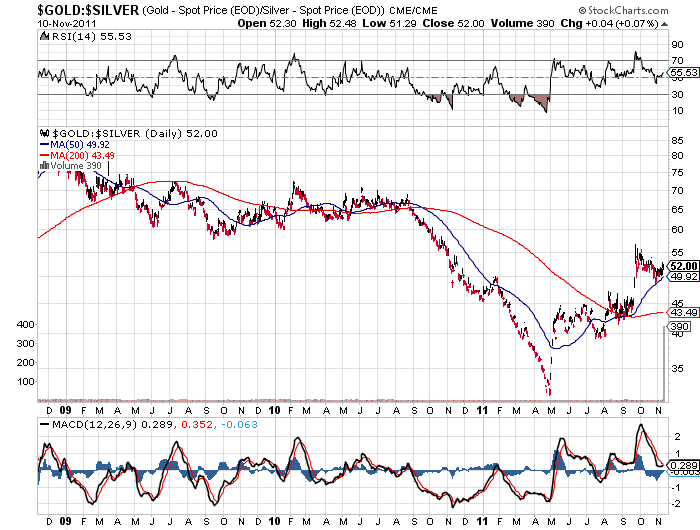

The correlation of silver to gold prices, as represented by the gold/silver ratio, also suggests that the price of silver is undervalued. From a long term historical perspective, a gold/silver ratio of 16 has prevailed. After dropping from 70 to 30 during the first half of the year, the gold/silver ratio has climbed to 52. If the gold/silver ratio returns to 16, silver prices could easily reach $110 per ounce based on the current price of gold.

The increasingly tenuous “value” of paper currencies combined with increased worldwide demand for silver as a safe haven asset makes a compellingly bullish case for additional investment in silver.

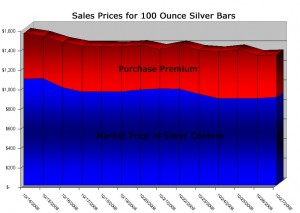

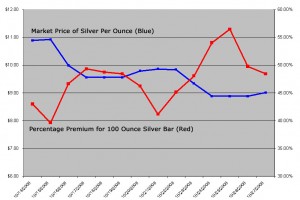

Late last year and early this year, a continual observation of the gold and silver markets was the disconnect between the prices quoted on paper markets and the prices that you would actually need to pay to buy physical precious metals. In the past few weeks premiums for physical gold and silver have declined as the prices quoted on the paper market have risen, basically bringing the two markets back into alignment.

Late last year and early this year, a continual observation of the gold and silver markets was the disconnect between the prices quoted on paper markets and the prices that you would actually need to pay to buy physical precious metals. In the past few weeks premiums for physical gold and silver have declined as the prices quoted on the paper market have risen, basically bringing the two markets back into alignment.