Consider our economic world from two perspectives:

The Deviant View – as represented by those who visit deviantinvestor.com, read alternate media, are skeptical of the “official” news, and who critically examine the financial world.

or

The others – call it the mainstream media view.

Deviant readers are more likely to believe:

- The US government gold supposedly stored in Fort Knox and at the NY Federal Reserve is mostly gone. (Deviant Investor survey showed that over 81% believe that less than 20% of the gold is actually available.)

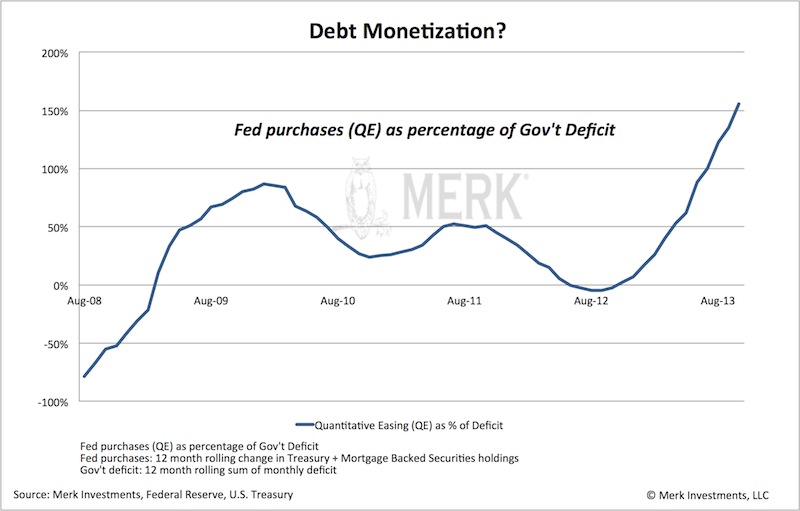

- The Federal Reserve will eventually be forced to increase QE instead of reducing it. (Deviant Investor survey showed that 62% believe that QE will be increased to $100 Billion per month, or more, by the end of 2014.)

- Gold bottomed in December and is going to new highs. (Deviant Investor survey indicates that 92% believe that gold has bottomed and is going to new highs.)

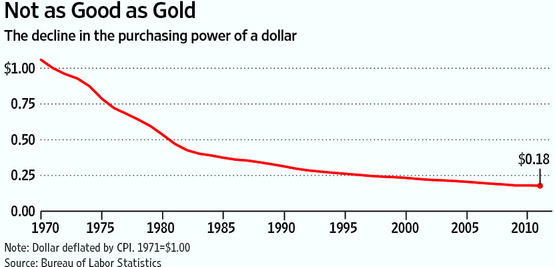

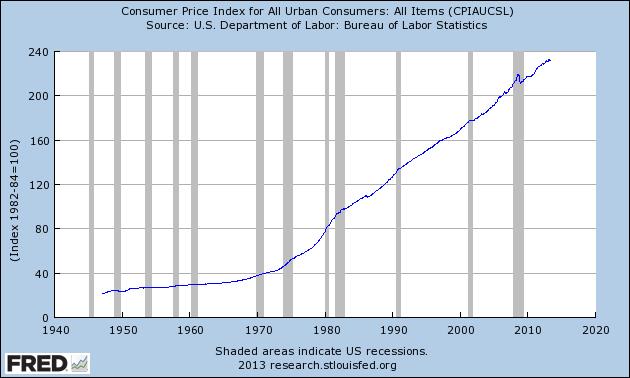

- The Federal Reserve has, over the past 100 years, debased the dollar, produced inflation, and substantially increased the profits for the financial industry mostly at the expense of the American people.

- Dollars are unbacked debt based Federal Reserve Notes that work well for daily commerce. However, they have no intrinsic value and, in terms of decades, been not been a good store of value.

- Gold and silver are excellent for savings and investing at the present time, have intrinsic value, and are a store of value over the long term.

Mainstream Media View

- Of course the gold is still physically stored in Fort Knox and at the NY Federal Reserve! Why would it not be there?

- QE will be reduced, the economy is beginning to grow, and the economy will appear much healthier in time for the 2016 elections.

- The Syria intervention that did not happen was mostly about human rights, not gas pipelines or control over energy markets.

- The stock market is a good measure of economic health, even though it primarily benefits the upper ten percent of the US populace.

- Pension funds are seriously underfunded, but they will be fine – with only a few exceptions – as always.

- Social Security is a “pay as you go” retirement plan for Americans; and even though it is a legally sanctioned “Ponzi Scheme,” it is a solid system.

- Politicians will be politicians, but for the most part, the US political system works with only a modest amount of corruption and inefficiency.

- If you like your health plan, you can keep it. If Crimea votes to join Russia, they can. If you don’t want to pay taxes, … well, that is a different issue.

- If you run a too-big-to-fail bank, you need not worry about breaking the law or prosecution, since the bank is necessary for the survival of the economy.

- Stocks are good, gold is bad. Per Warren Buffett, “Gold gets dug out of the ground in Africa, or someplace. Then we melt it down, dig another hole, bury it again and pay people to stand around guarding it.” From Charlie Munger, “Civilized people don’t buy gold.”

And there you have it – a simple summary of the Deviant view versus the Mainstream view.

Implications

Suppose that 50% to 80% of the gold in Fort Knox and the NY Fed is either gone, leased, or rehypothecated. Suppose that China has amassed the largest horde of gold in the world. Do these suggest the price of gold is likely to increase over the next few years?

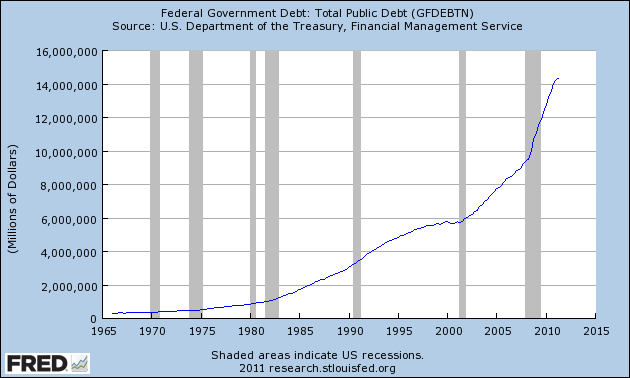

Suppose that the Federal Reserve is forced via market conditions (interest rates rising, the S&P crashing, war, dollar collapse, financial melt-down, or other possibilities) to expand the QE program and to “print and purchase” $100,000,000,000 or more per month of distressed paper, damaged derivatives, flaky mortgage-backed securities, and increasingly large quantities of dumped T-bonds and notes. Do you think this will support the price of gold over the next few years?

Suppose that gold double bottomed in June and December 2013 after being crushed by the naked short sales in April and June of 2013. Suppose that the unintended consequence of that market take-down was increased demand for physical gold, particularly from Asia and the Middle East. Does the new uptrend and increasing world-wide demand for gold suggest higher prices in the next few years?

Suppose that, for whatever reason, the world launches into another cycle of war, several countries send troops to various spots around the world, and the US engages in one or several hot wars. Will this increase the deficit, increase the national debt, increase financial and social anxiety, upset the stock market, and suggest higher gold prices?

Summary

The Deviant View: Gold has bottomed, the US deficit will expand, the national debt will continue its exponential increase, and consumer prices for the things we need, such as food and energy, will substantially increase. War, fraud, and corruption will increase prices more rapidly.

The Mainstream View: You can keep your health plan, NSA spying on everyone is mostly good, wars keep the economy healthy and moving, the stock market will continue to roar higher, and, as former Vice President Dick Cheney stated, “Reagan proved that deficits don’t matter.”

Another View On Gold: The following are comments that I have paraphrased from another site that dislikes gold. (I disagree with all of these comments.)

- If and when humanity advances, the value of gold will be zero.

- The problem is that gold is not an asset because it produces no return.

- Gold is not only high-risk but also costly since it pays no return.

- Gold is not a savings vehicle.

I express my opinions, and I expect others to do the same. There will be disagreements. We all experience the consequences of our thoughts and actions. This is why it is so important to perceive economic reality clearly. A belief in current delusions and the uselessness of gold will be expensive.

Additional Reading

Andrew Hoffman: “Deflation,” and Why You Must Own Precious Metals – Now!

Hugo Salinas Price: We Cannot Get Away From Gold or Silver

GE Christenson

aka Deviant Investor

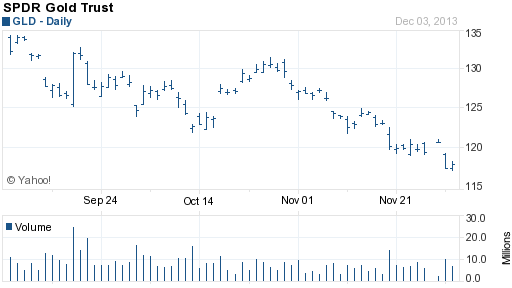

November has traditionally been a kind month for gold investors. Since 2004 the price of gold during November (as measured by using the SPDR Gold Shares (GLD) as a proxy) has been up 75% of the time with an average return of almost 5%.

November has traditionally been a kind month for gold investors. Since 2004 the price of gold during November (as measured by using the SPDR Gold Shares (GLD) as a proxy) has been up 75% of the time with an average return of almost 5%.