A mid 60s woman was chatting with two friends at a Starbucks. I overheard the conversation. It went something like this…

“When my husband and I retired, our financial advisor said we had enough money to last until we were both 95 years old. Now he is concerned that our savings might not last until we are 80.”

It gets worse.

“But if either of us dies then our pension income is reduced and the survivor has to make a choice – pay the mortgage or eat.”

It gets worse.

“And we still have to worry about healthcare.” She went on about sky-high health care costs, Obamacare, and her pre-existing conditions that prevented her from changing insurance.”

She probably does not see how much worse it can become.

What is the Problem?

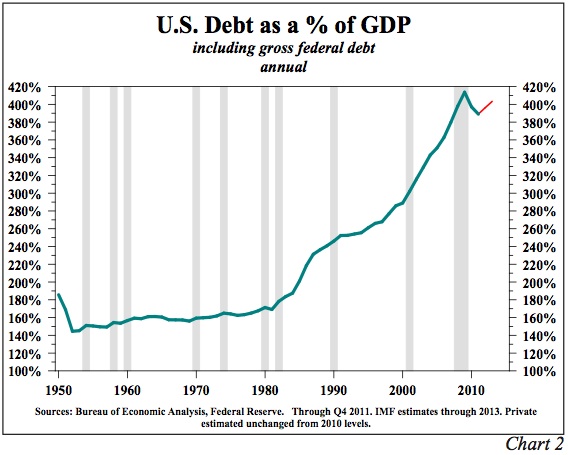

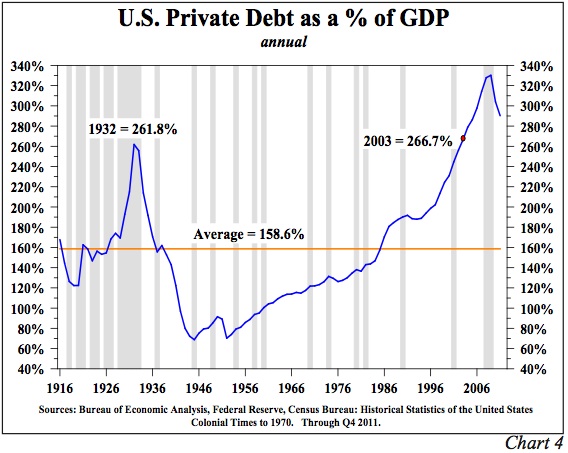

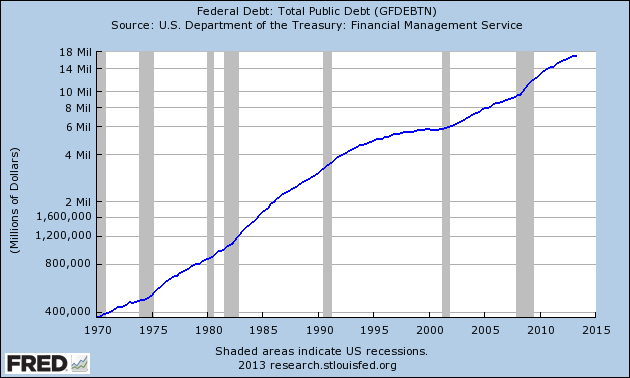

In simple terms the Federal Reserve has lowered short term interest rates to nearly zero (ZIRP – Zero Interest Rate Policy) and is “printing” $85 Billion per month (QE) to bail out bankers and our politicians who can’t balance the government budget or even pass a budget.

So What? Aren’t low interest rates good for the economy and for home prices?

Well, maybe in the short term they appear to be beneficial. The politicians and bankers have assured us of such. But politicians and bankers are benefitting from QE so perhaps we should question their assessment. Consider these points:

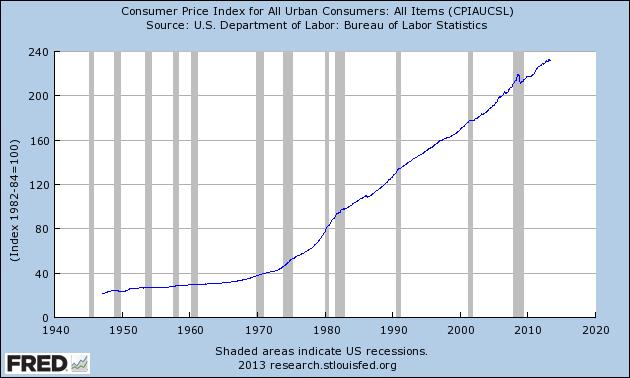

Would you loan your money for 30 years to an insolvent government that chronically spends far more than it collects in taxes? Would you consider that 30 year bond a wise investment if the government paid you less than 4% per year? Think back to what your expenses for gasoline, housing, food, and health care were in 1983 to help determine if 4% per year is enough to compensate for your guaranteed higher expenses and for the decline in the value of the dollar in the years to come. (Hint: NO!)

Retirement systems, life insurance policies, annuities, city and state government pensions and so much more depend upon the interest earned from government and corporate bonds, saving accounts, and Certificates of Deposit. If the interest earned over the past five years has been about 1% to 3.5% per year and most pension plans have assumed earnings in the (typical) 7% to 9% range, those pension plans have been underfunded by a larger amount each year. Think California public employees, Chicago public employees, New Jersey, Detroit and so on. Most pension plans for city and state employees are currently underfunded while they are optimistically assuming future interest earnings much higher than the Federal Reserve has repeatedly assured us will be possible.

Conclusion

The ZIRP and QE are causing the retirement funds for many governments and corporations to be more underfunded each year. If your retirement comes from a government pension, it is less secure each year. It can’t remain underfunded forever. Ask the retirees from Detroit!

Corporate pension systems invest similarly. If your retirement comes from a corporate pension, it is less secure each year. Ask the retirees from a bankrupt airline or from Enron Corporation.

If your retirement is funded by your personal savings and you have been earning perhaps 1% per year for the past five years, you already know the devastation that ZIRP and QE have caused in your personal finances.

The lady mentioned at the beginning understands that she and her husband are earning much less money in their retirement accounts than their financial advisor had projected, and so their retirement money will not last as long as originally hoped. What she probably does not realize is that her interest income will be kept low for the foreseeable future while her living expenses are very likely to substantially increase. In short, their retirement funds probably will be depleted well before she and her husband reach 80 years old. That is not a happy thought for her family and for millions of others who expected more “normal” interest earnings before the government and The Federal Reserve chose to bail out the financial industry. That bailout occurred at the direct expense of the taxpayers and at the indirect expense of savers, pension plans, and other retirement systems because of the unexpectedly low interest earnings created by the ZIRP and QE.

Karl Denninger has written a highly intelligent piece describing this process and the consequences. Read it for new insights. From that article:

“The bottom line is that QE produces what looks like a ‘benefit’ without cost at the start of the program, but that appearance is a con job.”

“In short at best QE is nothing more than pulling forward the ability to spend paid interest from tomorrow into today but for each dollar pulled forward to today it is taken from tomorrow’s spending.”

“How much harm are we talking about? Well, that’s difficult to determine, because you’d need a blended rate of interest across the entire lending continuum to figure it out. But it is certain that the $3 Trillion added to the Fed’s balance sheet is less than the actual amount pulled forward over that time.”

Summary

The Fed, through ZIRP and QE, has created $Trillions of benefits for the financial industry and much of that benefit has been created at the expense of government pension plans and individuals who depend upon interest earnings. This has a direct and negative consequence to many retirement plans, especially city and state public pensions.

It is especially destructive to those individuals who depend upon interest earnings to fund their cost of living.

Your savings are unlikely to last as long as you hoped.

Further Considerations

The Fed is “creating” $85 Billion per month for QE. This boosts the financial industry, the stock market and the bond market but the average person realizes little benefit from those markets. The average person is actually hurt by the lower than expected interest earnings in his personal accounts and in the pension accounts from which his pension is paid.

SILVER: The silver market is tiny. In very round numbers about a billion ounces are mined, worldwide, each year. This is approximately $20 Billion per year or only about one week of QE for bond monetization.

GOLD: The gold market is much larger than the silver market but still small compared to the QE process. In round numbers the worldwide annual gold mining market is 3,000 – 4,000 tons or about $ 130 – $170 Billion per year. Two months of QE “money printing” is enough to purchase all the gold mined each year in the whole world.

Does it seem “right or moral” to you that a privately owned central bank prints enough money each WEEK to buy the equivalent of all the silver mined worldwide in a year, or that TWO MONTHS of “printing” would purchase all the gold mined in a year? The politicians and bankers will not change this process but we can adapt to the consequences.

Does it seem likely that dollars, which are printed in excess every month, will retain their value against gold and silver?

Stated another way, does it seem likely that while gold and silver are limited in supply, and while the dollars used to purchase those metals are increasingly debased by both the central bank and the government, that the prices for gold and silver will remain stable or even decline?

The bullish case for gold and silver is reported in the alternate media and by numerous gold and silver “bugs” such as myself. The bearish viewpoint is easily obtained from the mainstream media, Goldman Sachs, and the Federal Reserve. Other intelligent individuals, such as Harry Dent and Robert Prechter, also promote the bearish viewpoint. I find the bearish analysis for gold and silver rather unlikely and often self-serving for those in the financial industry who make their living selling “paper.” But often it is valuable to analyze the perspective of those who disagree with you.

Decide for yourself! Your financial well-being and your retirement may depend on an intelligent assessment of the consequences of more QE, higher or lower gold and silver prices, and booms and busts in the stock and bond markets.

My vote is with gold and silver. Five thousand years of history support that viewpoint. Paper money does not retain its value or purchasing power. Hundreds of years of history support that viewpoint. Further, QE and ZIRP accelerate the decline in the value of paper dollars.

Gold and silver have been moving down, on average, for about 2.5 years. They might even be down another year, however I doubt it. In five years you might earn a total of 5 – 10% in a Certificate of Deposit. By contrast you are likely to double (quadruple or more) your savings if they are invested in gold or silver. Which will be more beneficial to your retirement?

Which sounds safer – gold or paper? Would you prefer something that has retained its value for 5,000 years or unbacked paper money – which has eventually and always declined in value to near zero?

GE Christenson

aka Deviant Investor

Let’s back away from the “smaller” questions like:

Let’s back away from the “smaller” questions like:

In an interview with CNBC, former GOP presidential candidate Ron Paul endorsed the efforts of his son, Senator Rand Paul, to hold up the nomination of Janet Yellen as Federal Reserve Chairman until laws are passed requiring more transparency from the Fed.

In an interview with CNBC, former GOP presidential candidate Ron Paul endorsed the efforts of his son, Senator Rand Paul, to hold up the nomination of Janet Yellen as Federal Reserve Chairman until laws are passed requiring more transparency from the Fed.

By: GE Christenson

By: GE Christenson

Most people can’t begin to comprehend

Most people can’t begin to comprehend

By: GE Christenson

By: GE Christenson Purchases of physical gold have been hitting new all time records. Demand has been fueled by the recent pullback in gold prices and the massive amount of money printing being conducted by central banks in Europe, Japan and the United States. The recent decision by the Federal Reserve to postpone any curtailment of its $85 billion per month of money printing could mark the end of the correction in gold and silver. The Fed’s refusal to reduce the ongoing program of securities purchases signals that QE has morphed from an emergency measure to a permanent Fed policy.

Purchases of physical gold have been hitting new all time records. Demand has been fueled by the recent pullback in gold prices and the massive amount of money printing being conducted by central banks in Europe, Japan and the United States. The recent decision by the Federal Reserve to postpone any curtailment of its $85 billion per month of money printing could mark the end of the correction in gold and silver. The Fed’s refusal to reduce the ongoing program of securities purchases signals that QE has morphed from an emergency measure to a permanent Fed policy.

Bridgewater’s Ray Dalio, one of the world’s most successful hedge fund investors, has put out a neat video explaining how the economic system works and how the suffocating burden of unmanageable debts can be reduced without propelling the world into uncontrollable inflation or a deflationary depression.

Bridgewater’s Ray Dalio, one of the world’s most successful hedge fund investors, has put out a neat video explaining how the economic system works and how the suffocating burden of unmanageable debts can be reduced without propelling the world into uncontrollable inflation or a deflationary depression.