The US Mint’s February sales report for American Eagle gold bullion coins revealed slow sales in February continuing the weak sales trend set in 2014.

The US Mint’s February sales report for American Eagle gold bullion coins revealed slow sales in February continuing the weak sales trend set in 2014.

For the month of February 2015 total sales of the American Eagle gold bullion coins rang in at only 18,500 ounces, down 40.3 percent from the comparable prior year’s month and down a whopping 77.2 percent from the prior month’s sales of 81,000 ounces. Who needs gold when you can buy government debt at negative interest rates?

The situation with gold and all other assets classes has been distorted beyond all traditional metrics by the ultra easy monetary policies of the world’s central banks. Leverage in the world financial system now exceeds by many orders of magnitude that which existed prior to the financial crisis of 2008 which nearly brought the system to a grinding halt. Where and when we go from here is anyone’s guess but I think it’s fair to conclude that at some future point gold will be acknowledged as the only store of value that cannot be devalued by desperate governments and central banks.

Until the investment masses reach that moment of clarity when they conclude that central banks cannot provide prosperity to the masses by printing money and monetizing government debt, gold may remain on the deep discount rack. One has to wonder about the critical thinking skills of citizens such as Greece or Russia or Venezuela or many other countries in which the currency is plunging in value and life savings are being wiped out but yet the masses are not moving into a traditional universally accepted store of value such as gold. Considering the fragile state of paper currencies and concerted efforts by central banks to destroy the purchasing value of the currency, it should be impossible to buy any amount of gold in many countries since no logical sellers would offer their gold at any bid.

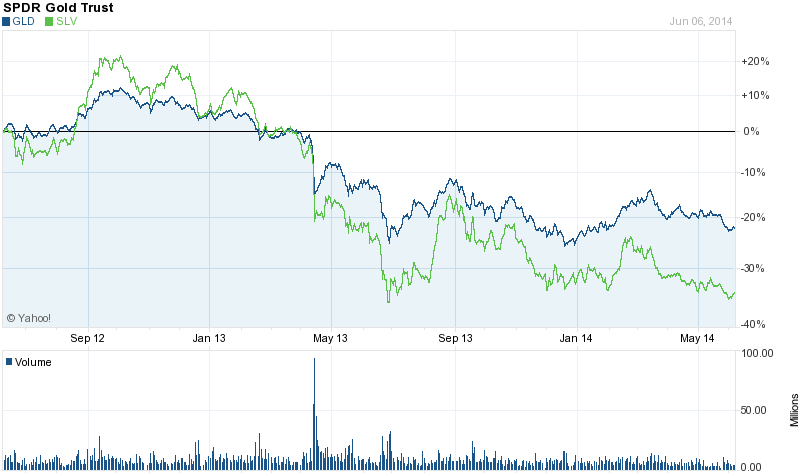

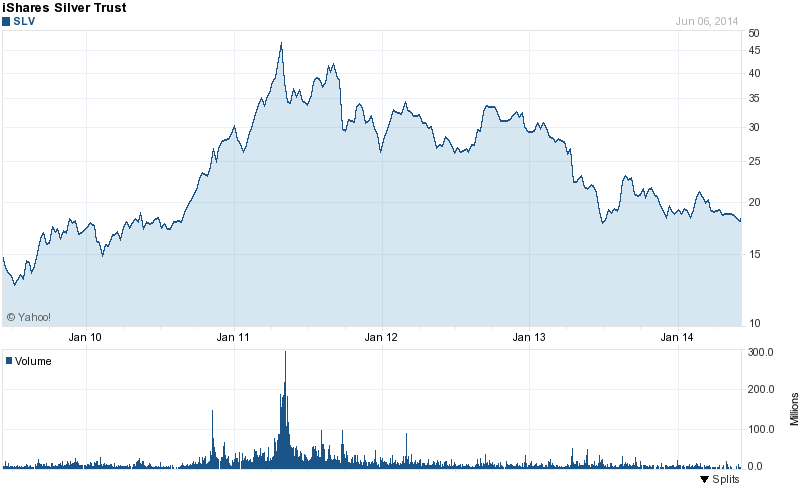

Gold bullion sales in 2014 dropped to only 524,500 ounces after fairly robust sales of about 800,000 ounces during both 2012 and 2013. The decline in the sale of US Mint gold bullion coins can be seen in the chart below. Note that sales figures for 2015 include year to date totals through the end of February.

Although sales of gold bullion coins has been in a definite downtrend it is interesting to note that sales of the coins are still fairly robust compared to average sales in the years prior to the financial crisis. After an increase in sales during 2013, sales of the gold bullion coins have declined every year since peaking during 2009 despite the fact that gold bullion did not reach its peak price of almost $1,900 per troy ounce during late 2011.

Listed below are the annual sales of the US Mint American Eagle gold bullion coins since 2000.

| Gold Bullion U.S. Mint Sales Since 2000 | ||

| Year | Total Ounces Sold | |

|

2000 |

164,500 |

|

|

2001 |

325,000 |

|

|

2002 |

315,000 |

|

|

2003 |

484,500 |

|

|

2004 |

536,000 |

|

|

2005 |

449,000 |

|

|

2006 |

261,000 |

|

|

2007 |

198,500 |

|

|

2008 |

860,500 |

|

|

2009 |

1,435,000 |

|

|

2010 |

1,220,500 |

|

|

2011 |

1,000,000 |

|

|

2012 |

753,000 |

|

|

2013 |

856,500 |

|

|

2014 |

524,500 |

|

|

2015 |

99500 |

|

| TOTAL |

9,483,000 |

|

| 2015 totals through February 28, 2015 | ||

Will 2015 turn out to be another year of low demand for American Eagle gold bullion coins? Time will tell but based on annualzied year to date sales, total US Mint gold bullion coins would total 597,000 ounces, slightly above 2014 coin sales.

![gold Technical chart [Kitco Inc.]](https://www.kitco.com/lfgif/au0730lf_ma.gif)

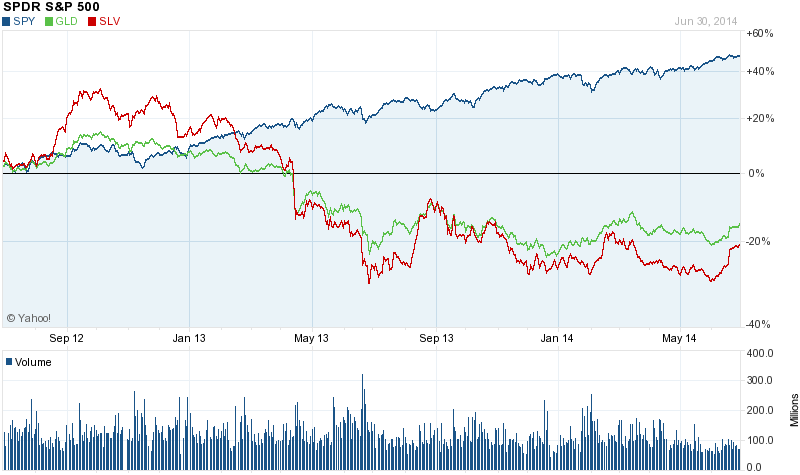

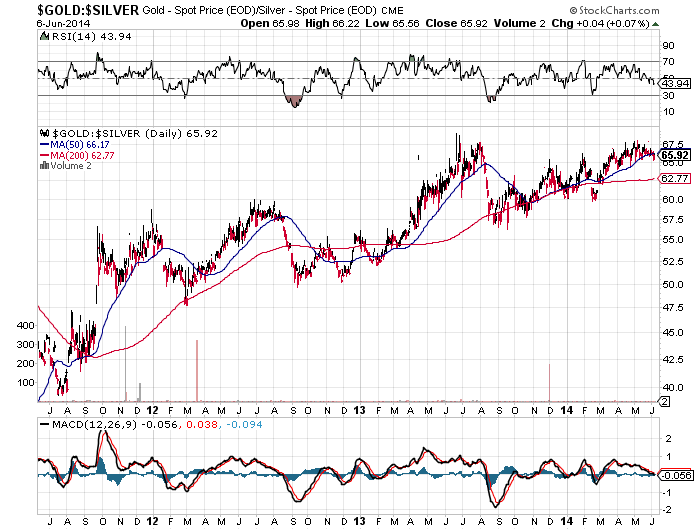

After almost a three year bear market in gold and silver it’s safe to conclude that most of precious metal bears have sold out and moved on. As gold and silver prices corrected sharply over the past three years, the chorus of bearish sentiment in the mainstream press has become endemic, thus setting the stage for a powerful and unexpected contra rally.

After almost a three year bear market in gold and silver it’s safe to conclude that most of precious metal bears have sold out and moved on. As gold and silver prices corrected sharply over the past three years, the chorus of bearish sentiment in the mainstream press has become endemic, thus setting the stage for a powerful and unexpected contra rally.