In an interview with CNBC, former GOP presidential candidate Ron Paul endorsed the efforts of his son, Senator Rand Paul, to hold up the nomination of Janet Yellen as Federal Reserve Chairman until laws are passed requiring more transparency from the Fed.

In an interview with CNBC, former GOP presidential candidate Ron Paul endorsed the efforts of his son, Senator Rand Paul, to hold up the nomination of Janet Yellen as Federal Reserve Chairman until laws are passed requiring more transparency from the Fed.

Senator Rand Paul has introduced legislation for an “Audit the Fed” bill which would require the Federal Reserve to disclose the details involving trillions of dollars the Fed has provided to both domestic and international financial institutions.

According to Ron Paul, “We don’t know the details of the trillions of dollars that were used to bail out banks and central banks around the world and corporations during the crisis. The numbers that they give you I don’t think are all that revealing.”

Ron Paul has been one of the few voices in the American government pushing for financial responsibility by both the Federal government and the Federal Reserve.

After the most recent capitulation by Republicans to reduce the exponential increase in Federal government debt and spending, Ron Paul lamented the hypocrisy of the deal to end the government shutdown.

The latest spending-and-debt deal was negotiated by Congressional leaders behind closed doors, and was rushed through Congress before most members had time to read it. Now that the bill is passed, we can see that it is a victory for the political class and special interests, but a defeat for the American people.

The debt ceiling deal increases spending above the levels set by the “sequester.” The sequester cuts were minuscule, and in many cases used the old DC trick of calling reductions in planned spending increases a cut. But even minuscule and phony cuts are unacceptable to the bipartisan welfare-warfare spending collation. The bill also does nothing to protect the American people from the Obamacare disaster.

Members of Congress and the public were told the debt ceiling increase was necessary to prevent a government default and an economic crisis. This manufactured fear supposedly justified voting on legislation without allowing members time to even read it, much less to remove the special deals or even debate the wisdom of intervening in overseas military conflicts because of a YouTube video.

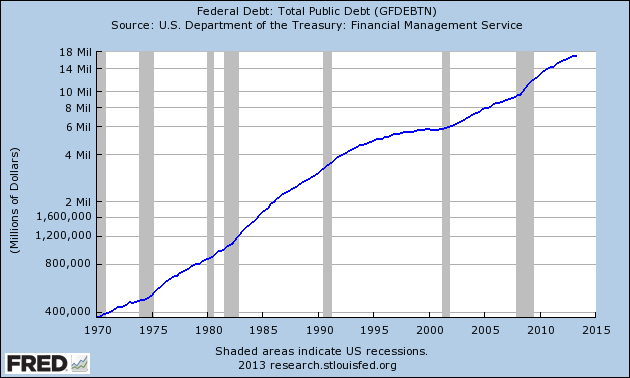

Congress surrendered more power to the president in this bill. Instead of setting a new debt ceiling, it simply “suspended” the debt ceiling until February. This gives the administration a blank check to run up as much debt as it pleases from now until February 7th. Congress can “disapprove” the debt ceiling suspension, but only if it passes a resolution of disapproval by a two-thirds majority. How long before Congress totally abdicates its constitutional authority over spending by allowing the Treasury permanent and unlimited authority to borrow money without seeking Congressional approval?

Hopefully, those of us who understand sound economics can convince enough of our fellow citizens to pressure Congress to make serious spending cuts before Congress’s reckless actions cause a total economic collapse.

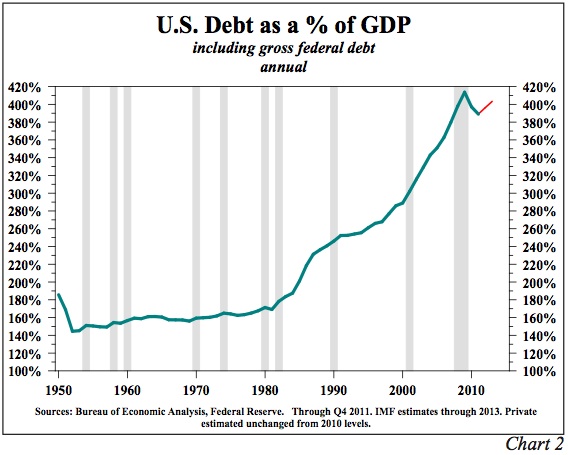

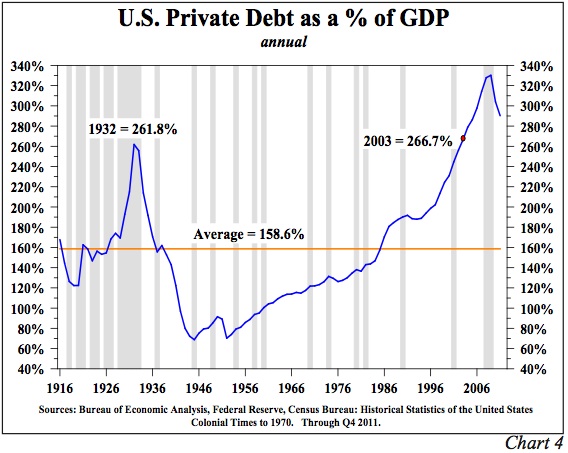

Sound advice Mr. Paul, but the odds of preventing an economic collapse decline with each additional dollar borrowed by the government and each additional dollar printed by the Federal Reserve. Debt at all levels is out of control and has overcome the ability of the nation to service the debt. Ironically, the only way to prevent a collapse today is through the Ponzi scheme method of further printing and borrowing which puts off the day of reckoning.

Realistically, Ron Paul has been ignored by the public and his fellow legislators for decades. The odds of controlling the growth of debt by the U.S. and other major industrialized countries is almost zero since legislators are elected based on promises to extend the social welfare state and serve special interests.

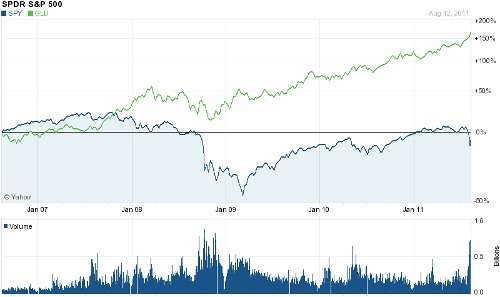

The odds of central banks reducing quantitative easing is even more remote since an absence of money printing would hasten the economic collapse Mr. Paul warns about. The future collapse predicted by Mr. Paul seems inevitable at some point and the only concern of an investor should be finding a safe haven for wealth preservation.

By: GE Christenson

By: GE Christenson By: GE Christenson

By: GE Christenson

By: GE Christenson

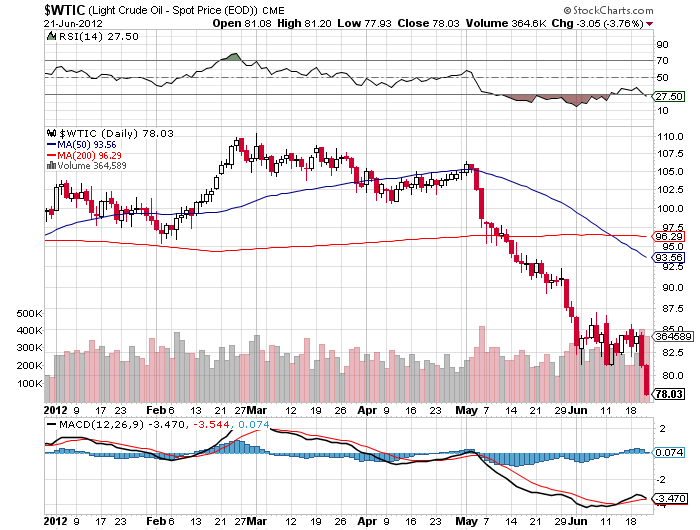

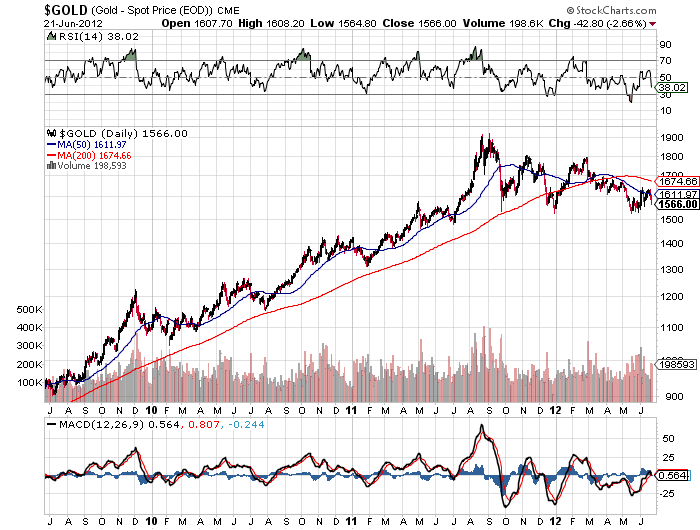

By: GE Christenson The combination of increasingly ominous economic reports along with the Fed’s failure to announce bold new monetary initiatives resulted in a brutal reassessment of risk by investors. Stock, commodity and precious metal markets all plunged with the Dow down 250 points, gold down by $41.60 per ounce to $1,566 and silver off by 4.4% to $26.98. Crude oil in New York trading was off 4%, dropping below $80 a barrel for the first time in eight months.

The combination of increasingly ominous economic reports along with the Fed’s failure to announce bold new monetary initiatives resulted in a brutal reassessment of risk by investors. Stock, commodity and precious metal markets all plunged with the Dow down 250 points, gold down by $41.60 per ounce to $1,566 and silver off by 4.4% to $26.98. Crude oil in New York trading was off 4%, dropping below $80 a barrel for the first time in eight months.