Predictions that the global economic system will collapse have been coming at an accelerated pace lately. Usually, many of the most extreme scenarios are from sources more interested in gaining publicity rather than offering a balanced analysis.

Predictions that the global economic system will collapse have been coming at an accelerated pace lately. Usually, many of the most extreme scenarios are from sources more interested in gaining publicity rather than offering a balanced analysis.

What’s unusual is that lately, many of these apocalyptic predictions are coming from some of the most normally sedate institutions in the world such as the IMF and the World Bank.

Central bankers and the heads of world financial organizations usually speak in oblique and obfuscated terms designed to convey confidence. Either the financial powers are writing a new book of rules or we are all headed for some unimaginably horrific scenario of financial and social chaos.

Here’s a small sample of the latest warnings from the sedate and not so sedate.

IMF Chief Warns Europe Must Fuel Growth

BERLIN—The head of the International Monetary Fund warned that in addition to cutting yawning budget deficits Europe needs to do more to promote growth and stop the crisis from spreading to the world economy.

“It is about avoiding a 1930s moment, in which inaction, insularity, and rigid ideology combine to cause a collapse in global demand,” IMF Managing Director Christine Lagarde said before the German Council on Foreign Relations. “A moment, ultimately, leading to a downward spiral that could engulf the entire world,” she said.

World Bank Projects Global Slowdown

“Developing countries need to evaluate their vulnerabilities and prepare for further shocks, while there is still time,” said Justin Yifu Lin, the World Bank’s Chief Economist and Senior Vice President for Development Economics.

Developing countries have less fiscal and monetary space for remedial measures than they did in 2008/09. As a result, their ability to respond may be constrained if international finance dries up and global conditions deteriorate sharply.

“An escalation of the crisis would spare no-one. Developed- and developing-country growth rates could fall by as much or more than in 2008/09” said Andrew Burns, Manager of Global Macroeconomics and lead author of the report. “The importance of contingency planning cannot be stressed enough.”

Feliz Zulauf Sees More Trouble Ahead

Felix Zulauf: Yes, I believe the peripheral nations have entered recession territory, and I believe it will get worse.

So, the situation in Europe will get worse before it gets better. Moreover, the ECB, which has its roots in the German Bundesbank, will see to it that the ECB does not become the lender of last resort until they are absolutely forced into it by the market. For investors, this is very important to understand. The new leader Mr. Draghi may leave Trichet’s conservative path, however, as since he is in power he has talked one way and acted in another way. This is delicate as the credibility of the ECB could be lost quickly.

Euro Breakup Would Cause Global Meltdown

In his speech at Davos, Soros will say it is “now more likely than now” that Greece will formally default in 2012, Newsweek said. Soros nevertheless thinks the euro will survive, according to Newsweek.

The world is facing a period of “evil,” Soros said, adding that he foresees Europe descending into chaos and conflict, while rioting in the streets of the U.S. will lead to a curtailment of civil liberties and the global economic system possibly collapsing altogether, Newsweek reported.

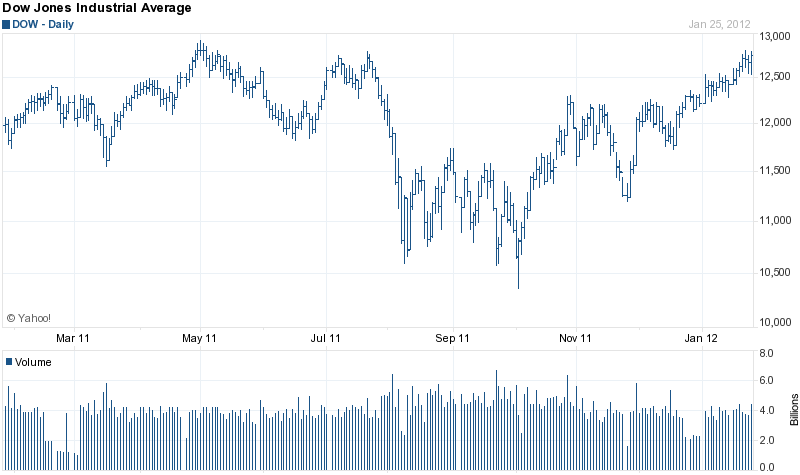

All of the risks to global prosperity mentioned above have been well known by investors for months now. The day the IMF Chief warned of a global depression worse than the 1930’s, the Dow Jones yawned and drop by 10 points.

Is there a major disconnect from reality by U.S. investors or has the worst already been discounted after the steep stock market sell off last August? Ever since an inside out day on October 3 of last year, the Dow Jones has powered higher, ignoring all the bad news and warnings of Armageddon. Exactly what is going on?

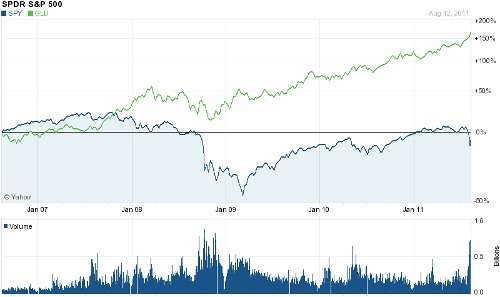

The answer is positive for both stocks and gold. The “collective wisdom” of the markets saw a resolution to the imminent threat of the European debt crisis last fall, and that resolution is known as quantitative easing. As previously noted in this blog last December, Every Solution To the Euro Crisis Involve Printing Money, which is exactly what happened. Both the European Central Bank (ECB) and the Federal Reserve stand ready to print whatever quantity of money is required to paper over the European and U.S. debt crisis.

The massive first phase of the ECB’s Long Term Refinancing Operation advanced about $780 billion to Europe’s insolvent banking system, buying time and postponing the day of reckoning. The ECB will hold a similar operation in February.

Long term this does little to solve Europe’s fundamental problems, but is short term bullish for stocks and extremely long term bullish for gold and silver.