Ron Paul explains better than anyone else the destructive economic forces unleashed by Federal Reserve monetary policies. According to Paul, loose monetary policies and manipulation of interest rates has caused “every single boom and bust that has occured in this country since the bank’s creation in 1913.”

Ron Paul explains better than anyone else the destructive economic forces unleashed by Federal Reserve monetary policies. According to Paul, loose monetary policies and manipulation of interest rates has caused “every single boom and bust that has occured in this country since the bank’s creation in 1913.”

In a Wall Street Journal editorial, Ron Paul explains exactly how the Fed has wrecked the economy, why they are clueless for the reasons behind their failures and why further Fed actions will only further exacerbate the problems caused by the Fed in the first place.

Adding new money increases the supply of money, making the price of money over time—the interest rate—lower than the market would make it. These lower interest rates affect the allocation of resources, causing capital to be malinvested throughout the economy. So certain projects and ventures that appear profitable when funded at artificially low interest rates are not in fact the best use of those resources.

Eventually, the economic boom created by the Fed’s actions is found to be unsustainable, and the bust ensues as this malinvested capital manifests itself in a surplus of capital goods, inventory overhangs, etc. Until these misdirected resources are put to a more productive use—the uses the free market actually desires—the economy stagnates.

Yet policy makers at the Federal Reserve still fail to understand the causes of our most recent financial crisis. So they find themselves unable to come up with an adequate solution.

The Fed fails to grasp that an interest rate is a price—the price of time—and that attempting to manipulate that price is as destructive as any other government price control. It fails to see that the price of housing was artificially inflated through the Fed’s monetary pumping during the early 2000s, and that the only way to restore soundness to the housing sector is to allow prices to return to sustainable market levels. Instead, the Fed’s actions have had one aim—to keep prices elevated at bubble levels—thus ensuring that bad debt remains on the books and failing firms remain in business, albatrosses around the market’s neck.

If the Fed would stop intervening and distorting the market, and would allow the functioning of a truly free market that deals with profit and loss, our economy could recover. The continued existence of an organization that can create trillions of dollars out of thin air to purchase financial assets and prop up a fundamentally insolvent banking system is a black mark on an economy that professes to be free.

Fed policies have pushed the U.S. and global economies to the precipice of a full blown depression. What are the odds that they reverse course and follow Ron Paul’s recommendations? Zero, in my opinion. Bernanke still believes in the fantasy illusion that creating more dollars at zero interest rates will somehow ignite economic growth. The Fed blindly ignores the fact that in all of recorded human history, once great powers that incurred massive debt loads have all failed.

Ron Paul concludes that the Fed will continue its self defeating policies because of the pressure to “just do something”. And right on cue, former Federal Reserve Vice Chairman Alan Blinder recommends (in his own concurrent Journal editorial) that the U.S. government needs to incur whatever amount of debt is necessary to cure the housing crisis. Blinder’s idiotic recommendation comes on the heels of previous failed and costly housing programs that cost billions and futher delayed the recovery in housing by keeping unqualified homeowners in homes they can’t afford to be in.

Here’s Blinder’s advice on How to Clean Up The Housing Mess, which is the exact opposite of Ron Paul’s free market solutions.

Given the huge magnitude of the aggregate gap between house values and mortgage balances, a comprehensive anti-foreclosure solution requires hundreds of billions of dollars.

So what can be done now? There is no silver bullet; we need different remedies for different types of (actual or prospective) foreclosures. And to succeed, we must overcome the three barriers. Foreclosure mitigation is expensive. It will encounter political resistance. It probably requires bending some property rights.

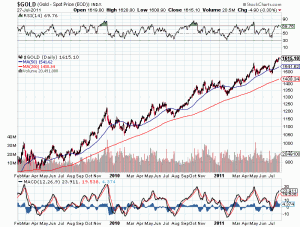

Blinder’s new spending plans and previous similar ones have cost the Government trillions, tremendously debased the dollar and accomplished nothing except to make the case for owning gold even more compelling.