“We need to do massive stimulus, otherwise there’s going to be another Great Depression. Things are getting worse, and the big difference between now and a few years ago is that this time around we’re running out of policy bullets.” – Professor Nouriel Roubini

“We need to do massive stimulus, otherwise there’s going to be another Great Depression. Things are getting worse, and the big difference between now and a few years ago is that this time around we’re running out of policy bullets.” – Professor Nouriel Roubini

As the global financial system lurches towards financial Armageddon, would a safe haven asset such as gold maintain its value in a severe depression?

This and other questions were addressed in a Barron’s interview with Martin Murenbeeld, chief economist for Canada’s DundeeWealth, an asset management firm. Murenbeeld has held senior positions with various gold mining firms for 40 years and turned bullish on gold in 2001.

In response to questions from Barron’s, Mr. Murenbeeld provided the following insights on the gold market and where he thinks prices are headed.

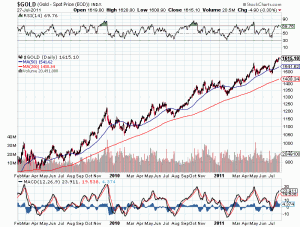

-Murenbeeld told Barron’s that the recent surge in gold prices was related to investor worries over impaired sovereign balance sheets, monetary reflation, global financial instability and strong demand for physical gold from Asia. In addition, global gold production has barely increased. Murenbeeld sees an average gold price of $2,200 in 2012 and only a 10% chance that gold will pull back to the $1,500 range.

-The current gold bull market could last another 10 years due to expanded Asian demand and unprecedented adverse financial conditions in the world economy. Murenbeeld says history “has shown that gold prices…go through very long cycles.” The last gold bull market of the early 1980’s was one of the shortest on record.

-Regarding the current disconnect between gold bullion and gold stocks, Murenbeeld notes that during times of severe financial stress, bullion outperforms gold stocks since investors avoid equity issues in general. Over the long term, however, gold stocks have outperformed bullion.

-If the world enters a major depression, gold prices would likely drop since “demand for everything falls off.” Murenbeeld notes, however, that monetary response to a depression would be fast and aggressive which would quickly propel gold prices higher.

-Murenbeeld says that current demand for gold in “unprecedented” and due to Federal Reserve policies, the introduction of gold ETFs and huge demand for physical gold by billions of consumers in Asia.

-In response to how world governments will deal with the current severe financial problems, Murenbeeld said “during my working life the risk of monetary debasement – the outright printing of money supply in the developed countries has never been higher. Thus, we see the unprecedented interest in gold…Most likely governments will meet the bulk of their debt obligations with currency devaluations and the monetizing of debt”.

-As far as the possibility that investors will lose interest in gold, Murenbeeld says that could happen if “confidence in monetary and fiscal policies is restored”. (Not much chance of that happening any time soon in this writer’s opinion.)

China and its people have a long held interest in the gold market. The country’s history has been marked by periods of unrest, and its people have regularly chosen to heed history’s warnings when it comes to investment. Their general preference has been for investments that they perceive as safe and solid, as opposed to paper instruments. Thus, their top two investment choices are gold and real estate.

China and its people have a long held interest in the gold market. The country’s history has been marked by periods of unrest, and its people have regularly chosen to heed history’s warnings when it comes to investment. Their general preference has been for investments that they perceive as safe and solid, as opposed to paper instruments. Thus, their top two investment choices are gold and real estate. Until quite recently, the gold market has been experiencing a strong rise in prices. This has been due to factors such as concerns regarding weak currencies and unstable foreign governments. Gold has been viewed as a safe haven investment and has been attracting an increasing share of investment dollars. Despite the recent cool down, many market experts are predicting a continued rise in prices over the long term.

Until quite recently, the gold market has been experiencing a strong rise in prices. This has been due to factors such as concerns regarding weak currencies and unstable foreign governments. Gold has been viewed as a safe haven investment and has been attracting an increasing share of investment dollars. Despite the recent cool down, many market experts are predicting a continued rise in prices over the long term.