An investor who was correctly bullish on gold in late 2004 had three basic investment options to capitalize on an increase in the price of gold:

An investor who was correctly bullish on gold in late 2004 had three basic investment options to capitalize on an increase in the price of gold:

- Invest in physical gold

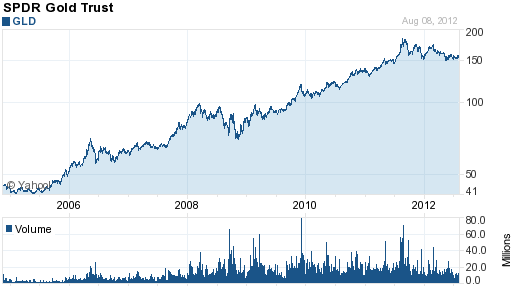

- Invest in a proxy for physical gold such as the SPDR Gold Shares (GLD)

- Invest in gold mining companies

The investor who picked option three does not have a lot to be cheerful about even after gold’s historic increase in value since 2004. Why did gold stocks do so poorly in spite of a 500% increase in the price of gold bullion? Merk Investment takes a look at gold versus gold stocks and explains why Gold Stocks Ain’t Gold.

A frequent mistake made by investors

is to invest in gold mining companies

(both juniors and majors) as a substitute

for gold. There are a couple of reasons

why this may be a mistake. Firstly, gold

mining company’s stock price does not

precisely track the price of gold. That’s

because lots of other factors influence the

share price of a company: management,

cost pressures, mining diversification,

stage of the mining process, to name just

a few.This problem is generally more

acute for juniors than majors, because

juniors often have yet to “strike gold,”

therefore the stock price often trades more

like an option. Moreover, many mining

companies don’t only mine gold, many

also mine silver, palladium, diamonds

etc.This dynamic also holds for baskets

of mining companies – baskets of miners

have significantly underperformed the

price of gold over recent years. Some investors believe gold mining stocks may provide more attractive

investment exposure to gold than gold

itself. The investment thesis is as follows:

gold mining companies are able to take

advantage of an increase in the price

of gold through enhanced operational

leverage; as the gold price goes up, mining companies’ margins widen, ultimately increasing the bottom line.However, this theory is predicated on fixed costs staying

relatively constant. Unfortunately, recent

performance does not support this

investment idea. Indeed, gold mining

stocks, on aggregate, have significantly

underperformed the price of gold.The reality is that mining is a highly energy-

intensive undertaking, and therefore

many of the costs are closely linked to

energy prices, such as oil, which has also

experienced significant increases in price.

As a result, many mining companies

have not produced the anticipated

high level of profits. Additionally,

governments may demand higher taxes

and employees higher wages from mining

companies should profitability increase,

further limiting the upside potential for

shareholders.

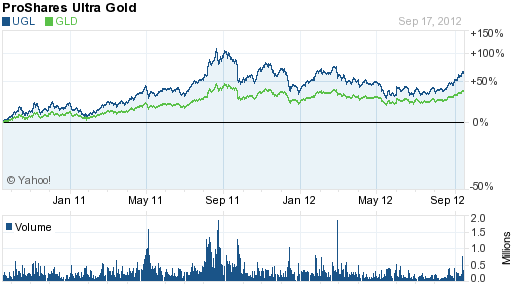

The results for each investment option are shown below for physical gold, the GLD and the Vanguard Precious Metal and Mining Fund (VGPMX) used as a stock proxy. Note that despite the horrible long term performance, a nimble investor in the VGPMX could have reaped considerable gains by selling in early 2008 and then getting back into gold stocks after the crash of 2008.

PHYSICAL GOLD

SPDR GOLD SHARES TRUST (GLD)

VANGUARD PRECIOUS METALS FUND (VGPMX)

Large scale liquidation of gold backed exchange-traded products (ETP) sent gold prices into a tailspin during April. Billionaire investor George Soros, who had sold 55% of his holdings in the SPDR Gold Shares (GLD) during the last quarter of 2012, further reduced his gold positions during the first quarter. Soros is a legendary trader and investor who has made billions moving ahead of the crowd.

Large scale liquidation of gold backed exchange-traded products (ETP) sent gold prices into a tailspin during April. Billionaire investor George Soros, who had sold 55% of his holdings in the SPDR Gold Shares (GLD) during the last quarter of 2012, further reduced his gold positions during the first quarter. Soros is a legendary trader and investor who has made billions moving ahead of the crowd. You know the world is changing when the head of the world’s biggest bond fund recommends gold as his first asset choice.

You know the world is changing when the head of the world’s biggest bond fund recommends gold as his first asset choice.

By

By

John Paulson, hedge fund titan, seemed invincible in the opening days of 2011. Based on a huge bearish position in mortgage bonds, Paulson’s hedge funds earned an astonishing $15 billion during 2007.

John Paulson, hedge fund titan, seemed invincible in the opening days of 2011. Based on a huge bearish position in mortgage bonds, Paulson’s hedge funds earned an astonishing $15 billion during 2007.