Despite the correction in gold prices since last summer, investors in gold ETFs have increased their stakes. Worldwide holdings of gold ETFs are now at a record 2,417 metric tons according to Bloomberg News.

Despite the correction in gold prices since last summer, investors in gold ETFs have increased their stakes. Worldwide holdings of gold ETFs are now at a record 2,417 metric tons according to Bloomberg News.

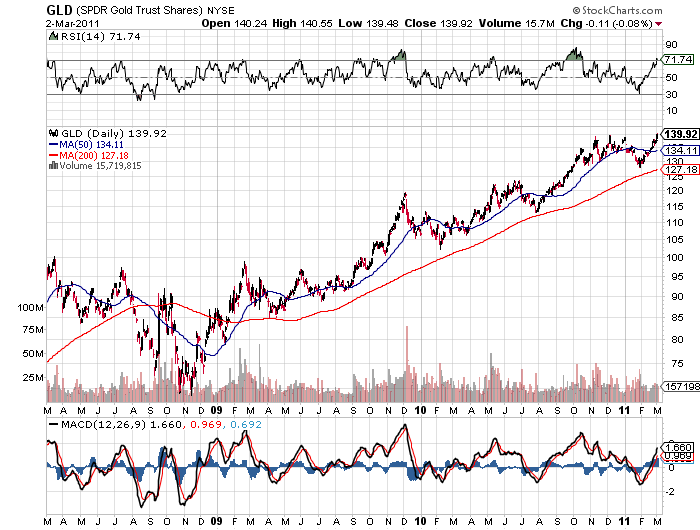

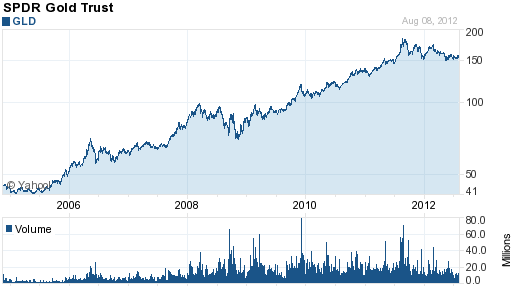

The SPDR Gold Trust (GLD) is the largest gold ETF and has returned a lustrous annual return of 18.4% since the fund’s inception on November 18, 2004. The GLD currently holds 1,258.15 tonnes (40.45 million ounces) of gold in trust valued at $64.8 billion. The all time record high holdings of the SPDR Gold Trust was 1,320.47 tonnes on June 29, 2010.

The slight decline from record gold holdings of the GLD do not represent a lessening of gold demand by investors. Numerous competing gold trusts such as the iShares Gold Trust (IAU) which holds $9.3 billion of gold bullion have simply given investors a wider choice of options and expanded the overall market for gold ETFs.

Word that two of the world’s most successful investors have increased their stakes in the SPDR Gold Trust highlight the fact that the bull market in gold is far from over. Billionaires John Paulson and George Soros, both long time investors in the GLD , both recently increased their holdings.

While Paulson has increased his massive stake in the GLD over time, Soros attempted to time the market. In the first quarter of 2011, Soros sold 4.7 million shares of the GLD which brought his holdings down to a token 49,400 shares. Subsequent to his sale, gold soared about $500 per ounce higher to $1,900 during August 2011. Short term trading is difficult for anyone, including one of the world’s most successful investors. Since the fundamental reasons for owning gold have only become more compelling, small investors would be best advised to hold long term instead of trying to trade a temporary price pullback.

According to Bloomberg, Paulson and Soros Add Gold As Price Declines Most Since 2008.

Billionaire investors George Soros and John Paulson increased their stakes in the biggest exchange- traded fund backed by gold as prices posted the largest quarterly drop since 2008.

Soros Fund Management more than doubled its investment in the SPDR Gold Trust to 884,400 shares as of June 30, compared with three months earlier, a U.S. Securities and Exchange Commission filing for second-quarter holdings showed yesterday. Paulson & Co. increased its holdings by 26 percent to 21.8 million shares.

Paulson, 56, who became a billionaire in 2007 by betting against the U.S. subprime mortgage market, lost 23 percent in his Gold Fund through July as lower bullion prices and slumping mining stocks contributed to declines.

Still, prices have rallied for 11 consecutive years, gaining more than sevenfold, as investors snapped up the metal after government and central bank stimulus programs boosted speculation that inflation would accelerate. The metal is up 2.4 percent this year.

“People expect prices to rise in the third quarter since historically it has been proved that it’s one of the best periods for gold, and investors who see easing coming in from various central banks are either increasing or holding on to their positions,” Donald Selkin, the New York-based chief market strategist at National Securities Corp., which manages about $3 billion of assets, said by telephone.

Paulson’s increased stake in the GLD should come as no surprise. In a previous post during July, it was noted that Paulson remained steadfastly bullish on gold with a $4,000 target.

The iShares Silver Trust (SLV) continued to add large amounts of silver to its holdings while the SPDR Gold Shares Trust (GLD) experienced another small decline in holdings.

The iShares Silver Trust (SLV) continued to add large amounts of silver to its holdings while the SPDR Gold Shares Trust (GLD) experienced another small decline in holdings.