Yahoo Finance ran a story today entitled “Gold, Silver & Copper Are All Heading Lower.” Nothing worth discussing about the specifics of the article – the real story here is that this a classic contrary headline seen at market bottoms, not tops.

Yahoo Finance ran a story today entitled “Gold, Silver & Copper Are All Heading Lower.” Nothing worth discussing about the specifics of the article – the real story here is that this a classic contrary headline seen at market bottoms, not tops.

What is the really smart money doing in the gold market as the mainstream press encourages John Q. Public to sell off his gold holdings? Here’s a nice recap from The Economic Collapse:

When men like John Paulson and George Soros start pouring huge amounts of money into gold, it is time to start becoming alarmed about the state of the global financial system.

The amount of money that these men are investing in gold is staggering….

And the central banks of the world are certainly buying gold at an unprecedented rate as well. According to the World Gold Council, the central banks of the world added 157.5 metric tons of gold last quarter. That was the biggest move into gold by the central banks of the globe that we have seen in modern financial history.

But that might just be the beginning.

According to a recent Marketwatch article, there are persistent rumors that China has plans to buy thousands of metric tons of gold….

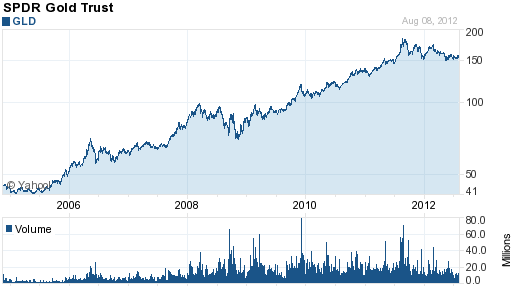

The gold bull market is far from over when two of the world’s most successful investors are increasing their gold holdings. The price correction in gold since last summer has provided another excellent buying opportunity for long term investors.

Why There Is No Upside Limit For Gold and Silver

Why Higher Inflation and $5,ooo Gold Are Inevitable

The Federal Reserve Can’t Produce Oil, Food or Jobs But They Will Continue To Produce Dollars

Ultimate Price of Gold Will Shock The World As Loss Of Global Confidence Leads To Economic Collapse

Gold Bull Market Could Last Another 20 Years With $12,000 Price Target