By: John Townsend at The TSI Trader.

The usefulness of sentiment’s stealth crystal ball is about to be revealed to the litany of unsuspecting precious metal bears and skeptics who have convinced themselves that gold’s bull market is either over or, at the minimum, in need of lengthy ongoing retesting, restructuring and consolidation.

This article will bring us up to date as to the degree of current bearish sentiment regarding both gold and silver using no fewer than 5 sentiment indicators (with 9 illustrative charts), as well as provide the reader with an opportunity to observe the price outcome of previous bearish extremes using these sentiment indicators.

But first, let’s briefly consider the concept of investor sentiment.

Sentiment extremes, simply put, tell us that there are too many traders at one end of the boat and therefore the boat is about to tip over. Sentiment can strongly suggest that the trade, as some say, has become “crowded”. When someone finally yells “fire” in the “crowded” room there are so many of the market’s participants motivated to get out the same door and in the same direction that most get trampled – unable to reverse their trade fast enough.

Another way of characterizing a sentiment extreme is to say that the trade simply runs out of buyers or sellers, as the case may be. The extreme price momentum in one direction “exhausts” itself of all available ammunition to continue the trend and is sometimes signaled when someone yells “fire” in the “crowded” room, but often comes to a conclusion unrecognized by most traders as price reverses direction in an unassuming manner.

You may have heard comments when a particular market bottoms and then begins to trade higher and then continues to trade even higher yet, despite “bad” news, the assertion that the bullish price movement seems to make no sense – that it cannot possibly be sustained. At this time it appears to nearly everyone the common sense question to ask is how “bad” news that used to cause a market to go into free fall now seems to have absolutely no negative effect? And to observe that as this market continues higher, it always leaves behind those traders stuck in pessimism to declare that the market is “climbing a wall of worry”. That is, the “bad” news continues in the media, yet this particular market’s price reversal continues upwards.

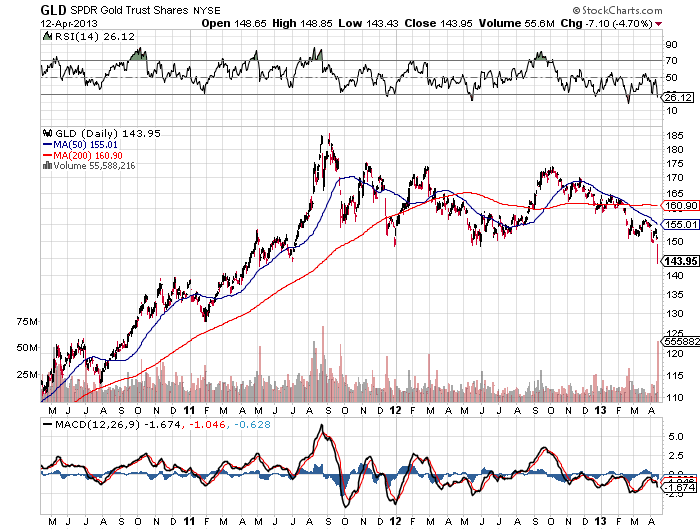

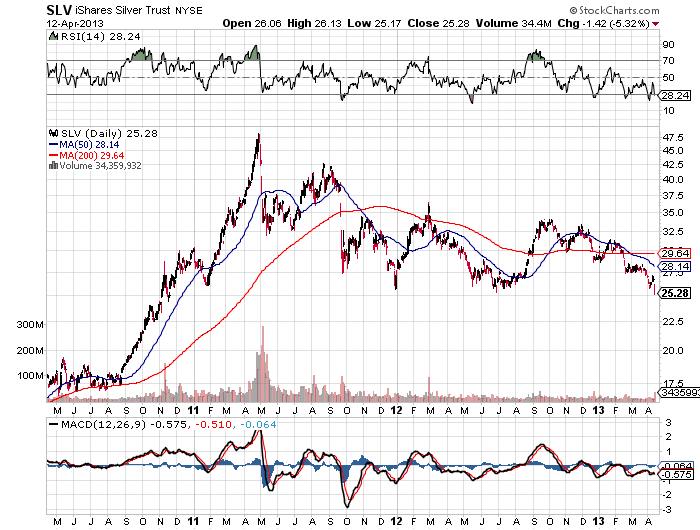

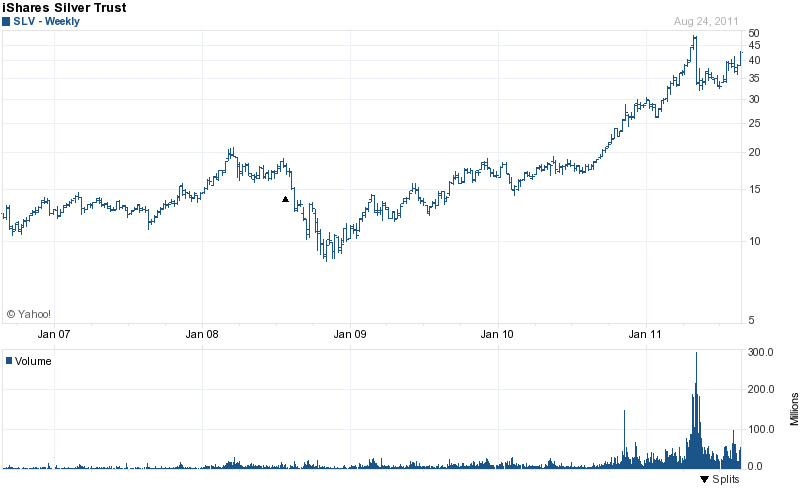

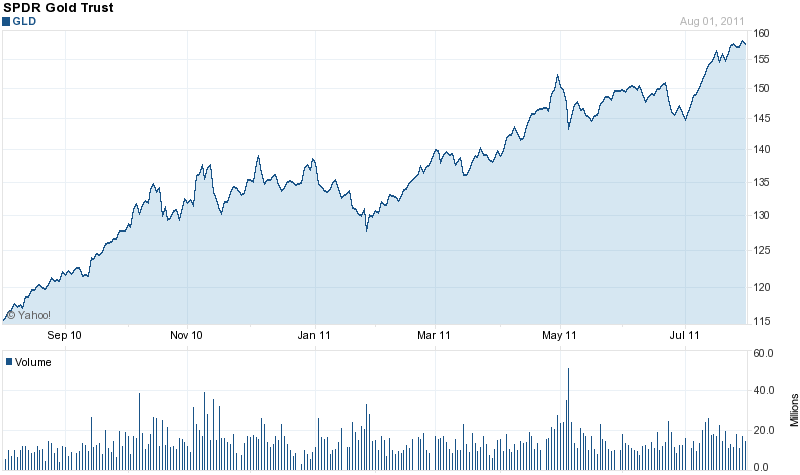

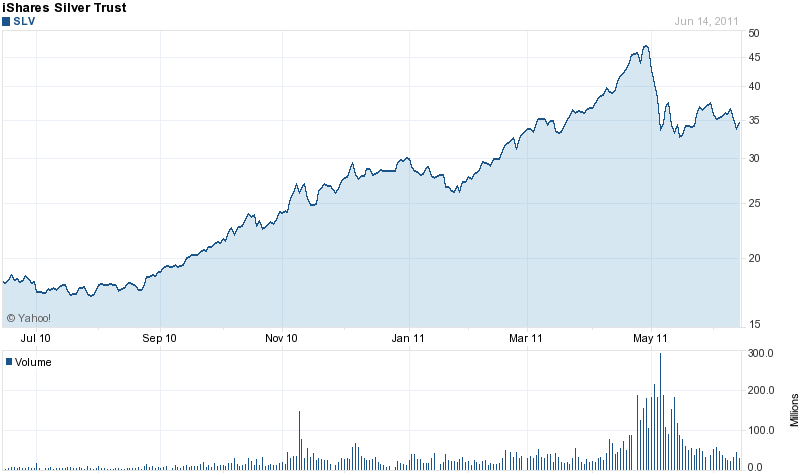

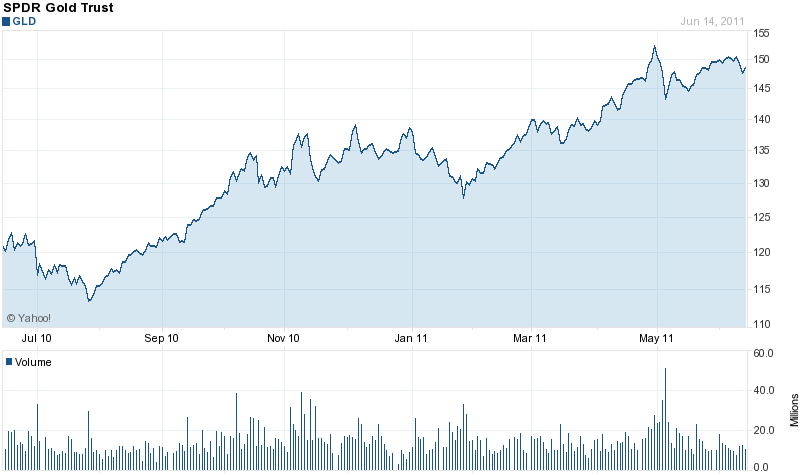

We will begin with the put / call volume ratio of the options trade of the Silver Trust ETF (SLV) and the SPDR Gold Trust (GLD). Charts courtesy of Schaeffer’s Investment Research.

The red line in the charts are the ETF’s price movement over the recent 2 years (GLD above, SLV below). The blue line is the put / call volume ratio. This considers the trading day’s volume of puts traded and is divided by the volume of calls traded. Generally, the higher the put / call ratio, the more bearish traders are about the ETF’s likely price movement, while the lower the put / call ratio, the more traders believe the ETF is bullish and going to rally higher.

Undoubtedly you have noticed that both charts reveal that the put / call ratio is at the highs of the past two years; meanwhile price is at the lows of the past two years. I will leave it to you to observe the repetitively flip flop relationship between this sentiment indicator and price movement. For me, anyway, this indicator leaves little doubt as to the upcoming direction of GLD and SLV.

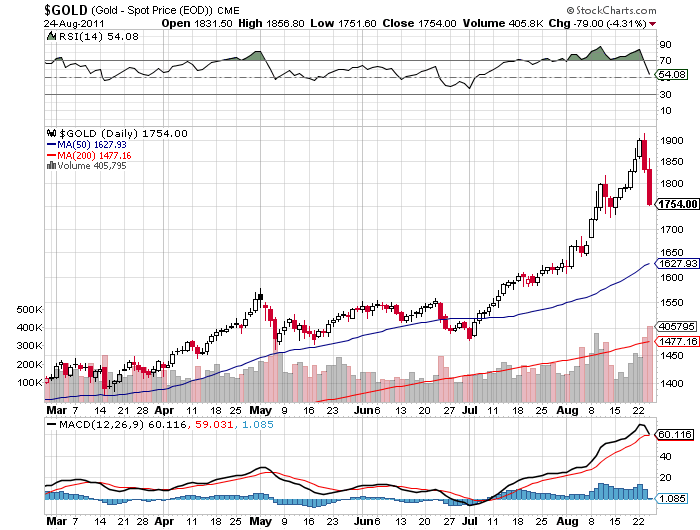

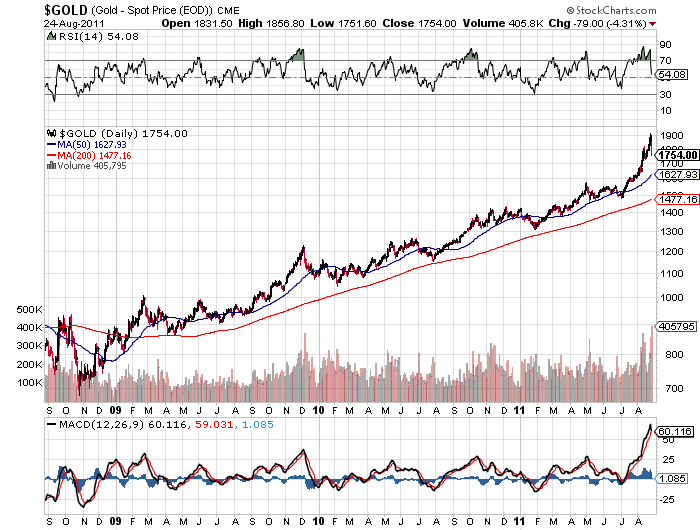

Next up is the Hulbert Gold Sentiment Index. This chart courtesy of Mark Hulbert’s Newsletters.

This first Hulbert Gold Sentiment Index chart shows us that gold sentiment at present is even more depressed than at gold’s infamous 2008 low.

So there you have it. Sentiment on GLD and SLV options is crazy extreme, Hulbert’s Gold Sentiment Index reveals sentiment is not only more bearish than the 2008 bottom – it’s more bearish than anytime in the past 17 years (at least).

Read complete article here.

In a week of volatile precious metals trading, holdings of both the iShares Silver Trust (SLV) and the SPDR Gold Shares Trust (GLD) saw modest declines.

In a week of volatile precious metals trading, holdings of both the iShares Silver Trust (SLV) and the SPDR Gold Shares Trust (GLD) saw modest declines.