Gold soared to a new all time high over $1,700 in Asian trading after the credit downgrade of the United States by Standard & Poors and news that the ECB would conduct large scale purchases of Italian and Spanish bonds. These two event have escalated the debt crisis in Europe and the United States to a new dangerous level. Investor confidence has been shattered in both equity and bond markets as events seem on the verge of spiraling out of control.

Gold soared to a new all time high over $1,700 in Asian trading after the credit downgrade of the United States by Standard & Poors and news that the ECB would conduct large scale purchases of Italian and Spanish bonds. These two event have escalated the debt crisis in Europe and the United States to a new dangerous level. Investor confidence has been shattered in both equity and bond markets as events seem on the verge of spiraling out of control.

The European Central Bank has been unable to form a coherent strategy to deal with the debt crisis and the Federal Reserve seems to be running out of policy options. The governments that “saved the world in 2008” through massive fiscal and monetary stimulus now need to be saved themselves.

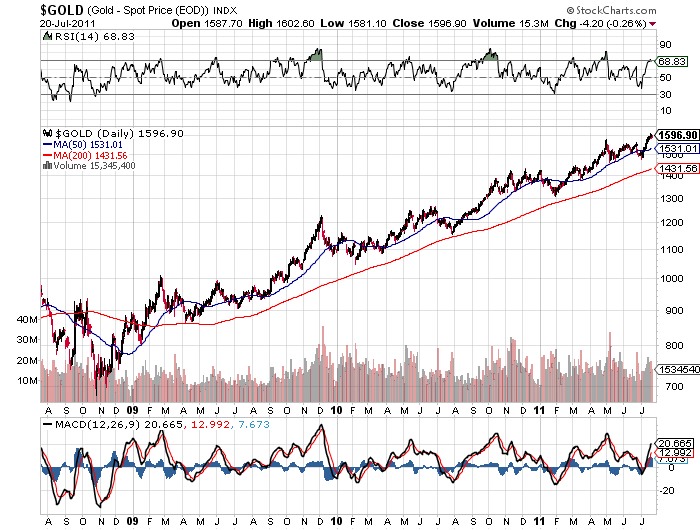

The relentless rise of gold since the financial crisis began reflects the increasing risk of sovereign defaults and the rampant debasement of paper money. The gold market is effectively a report card on the failed policies of governments and the grade is an F.

The response by U.S. policy makers to the S&P downgrade reflects a dangerous disconnect from reality and political posturing. In a shoot the messenger response, Treasury Secretary Geithner said that S&P used “terrible judgment” and have “shown a stunning lack of knowledge about the basic US fiscal budget math”. A more realistic assessment of the US debt downgrade came from investor Jimmy Rogers who said two months ago that “America should already be downgraded. It should have been downgraded years ago. These people, the rating agencies, have got it wrong for 10-15 years now. America is bankrupt”.

The Federal Reserve, which could not recognize the housing bubble, has also been at a loss to deal effectively with the debt crisis. Consider Bernanke Models Prove Faulty:

“We haven’t had any historical event that really would allow us to reliably statistically calibrate an event like the one we’ve had,” David Stockton, director of the Fed’s Division of Research and Statistics, who has overseen forecasting for a decade, said in an interview at the end of June. “There isn’t going to be a simple story here.”

Stockton calls the 2007-2009 period “an unprecedented financial crisis in the lives of almost every economic agent.”

“That had profound effects on people’s balance sheets, on their spending, and their impetus to deleverage,” he said in the interview. “Something beyond transitory factors are at work.”

Suite of Models

The suite of models used by Fed staff to forecast changes in consumption and investment rely to some extent on past relationships between interest rates, income, and profits. Most also assume credit will be supplied and demanded at a given price or interest rate. Without adjustments, they revert to the mean — after a period of slump they begin to point upward, in line with previous recoveries.

All of those tendencies have made the models less trusty guideposts for what is happening in the current recovery. The staff has to venture judgments and explore new analyses.

“Something new and different is going on,” said Allen Sinai, chief global economist at Decision Economics Inc. in New York. “Neither monetary nor fiscal policy is giving us the kind of bang we have traditionally got. The household sector is simply not spending as it has in the past.”

Ordinarily, monetary policy works by making borrowing cheaper so households and businesses can access credit and keep their consumption stable through an economic slump. Now, that channel is less effective.

Banks have raised lending standards, and the private sector’s expectations about consumption may be shifting to a lower path, said Julia Coronado, chief economist for North America for BNP Paribas in New York, who worked for Stockton from 1997 to 2005.

“This is a standard-of-living shock,” Coronado said. “What we thought we could afford, and what we leveraged to, is much more than we can afford at present and in the future.”

In other words, the problem is too much debt, and the Fed’s response has been to encourage more debt by dropping interest rates to zero and printing money. As long as the Fed continues its failed policies, the price of gold will continue to soar.