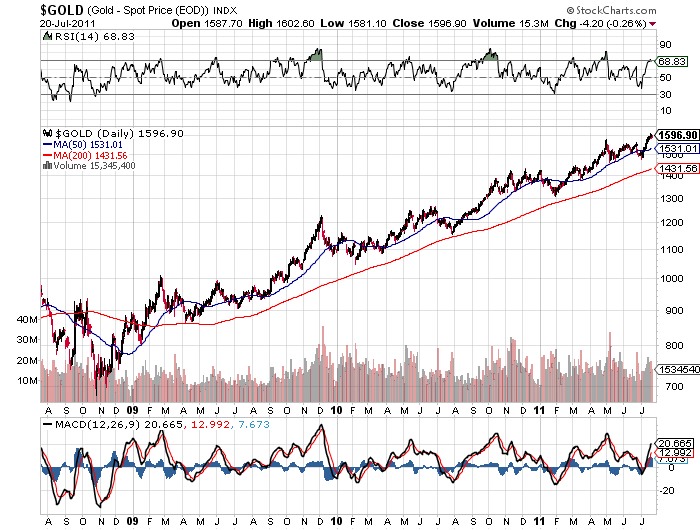

Gold has advanced almost nonstop since the beginning of July. As measured by the London PM Fix Price, gold has advanced in 10 out of the 14 trading days since July 1st, gaining $118. London gold closed today at $1,586.00 but soared in late New York trading to end the day at $1,602.90.

Gold has advanced almost nonstop since the beginning of July. As measured by the London PM Fix Price, gold has advanced in 10 out of the 14 trading days since July 1st, gaining $118. London gold closed today at $1,586.00 but soared in late New York trading to end the day at $1,602.90.

Gold has decisively broken out of the two month trading range it has been in since early May at the $1,500 level. All the fundamental factors driving gold higher continue to strengthen. The fragility of the paper financial system has been exposed. Efforts by politicians to solve the debt crisis are only serving to hasten the collapse of the system they are trying to preserve.

The debt ceiling problem in Washington continues to fester as politicians dither and delay. With every top official in Washington warning of financial Armageddon if the debt ceiling is not raised, the betting is that a compromise to increase the debt ceiling before August 2nd will be reached. Whatever compromise is reached is likely to be a meaningless “agreement to disagree later” as the debt ceiling is raised but the hard choice of where to cut spending is postponed. If gold sells off in a knee jerk reaction to Washington’s “solution” to the debt crisis, it will provide another buying opportunity for gold investors.

A solution to the nation’s spiraling debt crisis no longer seems possible. Neither political party has the will nor the desire to realistically address the basic problem of excessive deficit spending. There is no upside for those with the courage to call for the austerity measures needed to put the Nation on the path towards sound financial footing. A majority of Americans favor increasing the debt limit and that majority naturally consists of those who derive all or most of their income from government payments. Politicians get the message – keep the payments coming no matter what or we will vote you out of office. The strategy of dealing with too much debt will again be to increase debt.

With debt compounding at rates far in excess of the country’s income gains and with taxes already at punitively high levels, the only option left for servicing the debt is to debase the currency and repay creditors with devalued dollars (see Ron Paul Says US Is Already Defaulting on the Debt).

As long as Washington can keep selling its debt and as long as Ben Bernanke is there to purchase government debt with freshly printed money, the spending and deficits will continue until the entire financial system collapses. This is what the gold market recognizes and that is why there is no effective limit on the upside to gold prices.

A brief pause at the $1,600 level should soon be followed by an even stronger advance. Since 2009, every consolidation in the gold market has been followed by strong advances that lifted gold by hundreds of dollars per ounce. Gold could quickly get to the $2,000 range as the current rally progresses, given the rapidly deteriorating condition of the global financial system.

In the final analysis, it doesn’t even matter what the imperial leaders in Washington decide to do – we are already beyond the tipping point – the only matter of consequence is how to prepare for the inevitable collapse of the world fiat monetary system.