In an interview with Bloomberg TV, Greg Smith, chairman of Global Commodities, is forecasting $2,000 gold by Christmas.

Long term investors in gold would have a very merry Christmas since a price of $2,000 would equate to a 2012 price gain of over 25% from gold’s opening price on January 3, 2012.

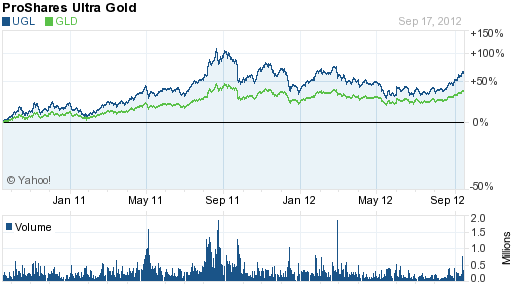

From today’s closing gold price, a $2,000 per ounce price by year end equates to a gain of $241 per ounce or 13.7%. Aggressive investors have many different ways to leverage gains on a potential run up in gold by year end. For example, a position in Pro Shares Ultra Gold (UGL) would yield a gain of about 27% if gold hits $2,000 by year end.

The UGL does not hold physical gold but rather invests in futures, forward contracts, options and swap agreements designed to yield gains of 200% of the daily performance of gold bullion. Last summer when gold soared to an all time high, the UGL returned twice the gains of the SPDR Gold Shares ETF (GLD). Keep in mind that leverage works both ways – if gold declines, an investment in the UGL would produce twice the losses compared to holding physical gold or shares in the GLD.

Courtesy: yahoo finance