After a fierce correction from the highs of 2011 have the market forces of supply and demand resulted in a stabilized silver price?

After a fierce correction from the highs of 2011 have the market forces of supply and demand resulted in a stabilized silver price?

On the demand side the industrial use of silver is at a nine year high with fabrication usage expected to rise to over 890 million ounces. A wide variety of businesses use huge amounts of silver in the production of such items as jewelry, solar panels, electronics, cars, tableware, and photography.

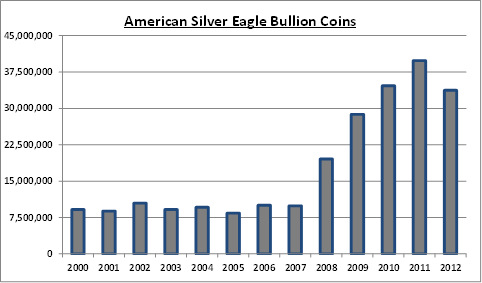

Although silver is most commonly associated by many people as a precious metal investment the industrial demand for silver far exceeds investment demand. For example, sales by the U.S. Mint of the ever popular American Eagle silver bullion coins hit a record last year of almost 42 million ounces (see Silver Bullion Coin Sales Soar) but this amount is a fraction of industrial usage. Since 2000 to date the U.S. Mint has sold over 292 million one ounce American Eagle silver bullion coins which amounts to only 32% of estimated industrial demand for just one year.

Even as industrial demand for silver booms, Bloomberg News reports that investment demand for silver has diminished due to tapering of quantitative easing by the Federal Reserve, reduction of the safe haven appeal of silver, reduced demand by China, and the correlation coefficient between gold and silver.

Silver is being undermined by its association with gold.

While makers of everything from jewelry to solar panels are buying the most silver in nine years, prices are languishing. Investors are dismissing industrial demand and instead focusing on the waning appeal of precious metals as a haven, with the Federal Reserve paring economic stimulus measures, inflation muted and equities rallying.

Silver has been dragged down by a yearlong slump in gold, the commodity most widely held by investors in exchange-traded funds, following a decade-long rally that saw prices for both surge more than sixfold. The five most-accurate precious-metals analysts tracked by Bloomberg over the past two years predict silver will average $18.80 an ounce in the third quarter, the lowest since 2010, and gold will drop 7.3 percent.

“The industrial driver can help, but I don’t think it’s as influential as the investor,” said Robin Bhar, head of metals research at Societe Generale SA in London and the most-accurate forecaster tracked by Bloomberg. “Investors were bullish silver because gold was in a bull market. Now that we have gold in a bear market, there’s less enthusiasm coming from investors.”

The correlation has been strong. From December 2008 to June 2011, silver tripled and gold surged 70 percent, with both touching all-time highs, as the Fed pumped more than $2 trillion into the financial system and cut interest rates to a record in a bid to boost the economy. Last year, when signs of economic growth sent gold down 28 percent, silver plunged 36 percent. The declines were the most for both metals since 1981.

Goldman said in an April 13 report that in the long term, silver tends to track gold, and its forecast reflects the historical ratio to gold. An ounce of gold bought 67.21 ounces of silver in London on April 30, the highest since July. The average over the past 30 years is 64.8.

The link with gold is stronger than that with industrial metals. The mean of silver’s 30-week correlation coefficient to gold was 0.86 over the past five years, compared with 0.51 with the London Metal Exchange Index of industrial metals, data compiled by Bloomberg show. A figure of 1 means two assets always move in the same direction.

“The precious-metal characteristic is likely to dominate,” said Barnabas Gan, an analyst at Oversea-Chinese Banking Corp. in Singapore, and the second-most accurate precious metals forecaster over the past two years. “The risk of higher real interest rates may likely magnify in the middle-long run, and thus raises the opportunity cost for holding silver. The improving global economic picture is also likely to pale safe-haven demand.”

Concern over the value of haven assets is trumping signs that industrial demand is improving. Half of silver supply is used to make things, more than the 10 percent for gold, and demand is picking up as economic growth fuels sales of electronics and cars from China to the U.S.

Since precious metals generally earn returns only through price gains, silver investors were “disillusioned” by the slump over the past year and put their money elsewhere, New York-based researcher CPM said in an April 29 report. Investment demand tumbled 42 percent last year to 105.3 million ounces, the lowest since 2008, according to CPM, which forecast average prices in 2014 will be lower for a third straight year.

At the same time, fabrication usage including by makers of cars, jewelry and tableware will rise 2.9 percent this year to 890.7 million ounces, the most since 2005, CPM said. Silver content is increasing in vehicles with more electronics, according to Metals Focus Ltd., a London-based research company. After dropping last year, demand from electronics and battery makers will rebound in 2014, CPM forecasts.

Most industrial metals will get a boost from growth. The world economy expanded 2.1 percent in 2013 and will increase 2.8 percent this year and 3.1 percent in 2015, according to economists surveyed by Bloomberg. While that will help spur a 2.1 percent gain in industrial and photographic demand for silver, investors will sell 250 metric tons from funds backed by the metal, Barclays Plc estimates.

“Silver is not benefiting even though it has so much industrial use as people still call it a precious metal,” James Paulsen, the Minneapolis-based chief investment strategist at Wells Capital Management, which oversees about $357 billion in assets, said. “Its a tug of war between its safe-haven appeal and its use as industrial metal.”

Hedge funds have cut their bets on higher silver prices by 90 percent in the past two months on the Comex in New York, holding a net-long position of 2,620 futures and options in the week to April 22, U.S. Commodity Futures Trading Commission data show. The five-year average is about 20,510 contracts.

Despite a huge appetite for silver by industrial users, the reduction of investment demand and a production oversupply may continue to pressure silver prices. During 2014 HSBC is projecting an increase in silver supply to 1.09 billion ounces with demand remaining flat at 938 million ounces.

Until the financial system blows up again, the tug of war between supply and demand in the silver market is likely to restrain silver prices for the immediate future.

The American public’s love affair with the U.S. Mint American Eagle silver bullion coin continues unabated. Ever since the financial meltdown of 2008 there has been an explosion in demand for the silver coins. Average yearly sales of the silver bullion coins have increased by almost 500% since 2008 and sales for 2013 are on the verge of shattering all previous yearly sales records.

The American public’s love affair with the U.S. Mint American Eagle silver bullion coin continues unabated. Ever since the financial meltdown of 2008 there has been an explosion in demand for the silver coins. Average yearly sales of the silver bullion coins have increased by almost 500% since 2008 and sales for 2013 are on the verge of shattering all previous yearly sales records. The American Eagle silver bullion coins cannot be purchased by individuals directly from the U.S Mint. The coins are sold only to the Mint’s network of authorized purchasers who buy the coins in bulk based on the market value of silver and a markup by the U.S. Mint. The authorized purchasers sell the silver coins to coin dealers, other bullion dealers and the public. The Mint’s rationale for using authorized purchasers is that this method makes the coins widely available to the public with reasonable transaction costs.

The American Eagle silver bullion coins cannot be purchased by individuals directly from the U.S Mint. The coins are sold only to the Mint’s network of authorized purchasers who buy the coins in bulk based on the market value of silver and a markup by the U.S. Mint. The authorized purchasers sell the silver coins to coin dealers, other bullion dealers and the public. The Mint’s rationale for using authorized purchasers is that this method makes the coins widely available to the public with reasonable transaction costs. There is no denying that it has been a really tough year for silver investors with silver dropping from $32.23 in January to a yearly low of $18.61 in June. Is the silver price correction finally over? The ridiculously low price of silver has resulted in a strong surge of demand worldwide and the price of silver has soared by 23% since the June low.

There is no denying that it has been a really tough year for silver investors with silver dropping from $32.23 in January to a yearly low of $18.61 in June. Is the silver price correction finally over? The ridiculously low price of silver has resulted in a strong surge of demand worldwide and the price of silver has soared by 23% since the June low. The exploding demand for physical gold and silver has become a worldwide phenomenon. Shortly after the price plunge of early April buyers rushed in to take advantage of bargain prices. Dealers and mints worldwide have reported off the charts demand for physical gold and silver.

The exploding demand for physical gold and silver has become a worldwide phenomenon. Shortly after the price plunge of early April buyers rushed in to take advantage of bargain prices. Dealers and mints worldwide have reported off the charts demand for physical gold and silver.

Sales of the American Eagle gold bullion coin soared during the first month of the year. According to the US Mint, gold bullion coin sales totaled 150,000 ounces, up 97.4% from December 2012 when 76,000 ounces were sold. Sales for the month were up 18.1% from comparable sales of 127,000 ounces a year ago during January 2012.

Sales of the American Eagle gold bullion coin soared during the first month of the year. According to the US Mint, gold bullion coin sales totaled 150,000 ounces, up 97.4% from December 2012 when 76,000 ounces were sold. Sales for the month were up 18.1% from comparable sales of 127,000 ounces a year ago during January 2012. According to the U.S. Mint, total sales of the American Silver Eagle bullion coins for December 2012 totaled only 1,635,000 ounces, down by 18.6% from 2,009,000 coins sold during December 2011. The lowest monthly sales for the year occurred in February when 1,490,000 Silver Eagle Bullion coins were sold. The highest monthly sales of the Silver Eagles occurred in January when 6,107,000 coins were sold.

According to the U.S. Mint, total sales of the American Silver Eagle bullion coins for December 2012 totaled only 1,635,000 ounces, down by 18.6% from 2,009,000 coins sold during December 2011. The lowest monthly sales for the year occurred in February when 1,490,000 Silver Eagle Bullion coins were sold. The highest monthly sales of the Silver Eagles occurred in January when 6,107,000 coins were sold.