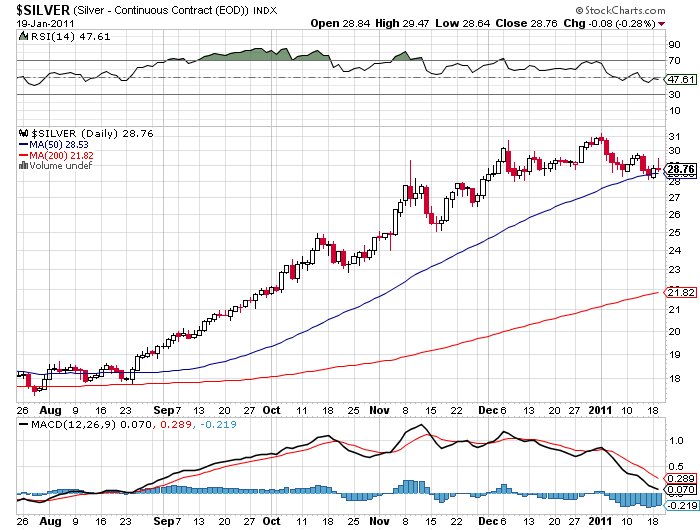

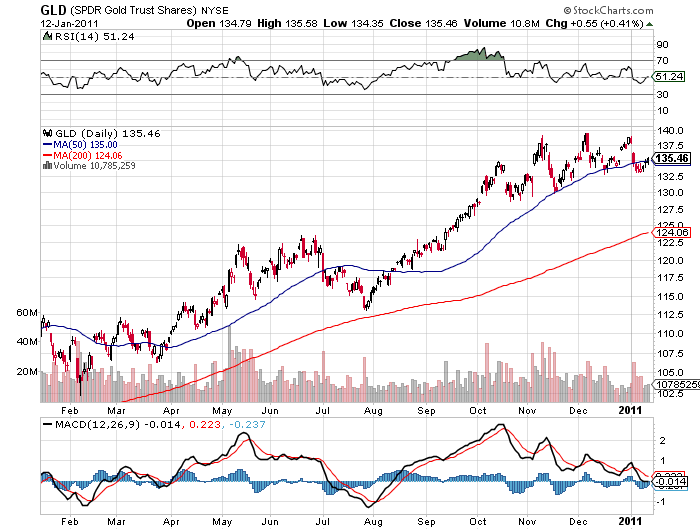

In a week of volatile precious metals trading, holdings of both the iShares Silver Trust (SLV) and the SPDR Gold Shares Trust (GLD) saw modest declines.

In a week of volatile precious metals trading, holdings of both the iShares Silver Trust (SLV) and the SPDR Gold Shares Trust (GLD) saw modest declines.

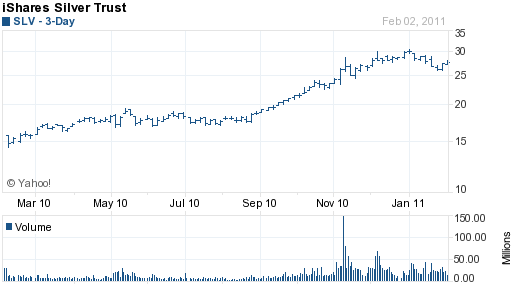

The holdings of the SLV declined by 130.49 tonnes or 1.2% from last week to 11,053.20 tonnes. Looking at the daily changes, however, provides a a better indication of the volatility in SLV holdings during the week.

The holdings of the SLV hit an all time record high amount of 11,390.06 tonnes on Monday April 25th. The substantial decline of 336.86 tonnes over the following two days mirrors the volatile price action of the SLV, which declined more than $2 on Tuesday before recovering to all time highs at Wednesday’s closing price.

The SLV currently holds 355.4 million ounces of silver valued at $16.1 billion. The SLV is currently the largest silver ETF and has seen tremendous growth in holdings since the Trust’s inception in April 2006, when it held a mere 653.17 tonnes valued at $263.5 million. According to the Silver Institute, at the end of the first quarter 2011, total holdings held by all silver ETFs was 612 million ounces.

Despite the tremendous appreciation of the SLV, the silver market remains a relatively small market which leads to speculation that silver prices are being manipulated. Volatility in silver trading over the past week was enhanced by rumors of massive short positions by traders, attempts to corner the market by larger players, and the inability to deliver physical silver on futures contracts.

The recent volatility in silver is likely to continue as additional players are drawn into one of the hottest markets of 2011 and wide price swings may become the norm over the short term.

For long term investors, the fundamentals of the silver market should overweight any short term volatility. Sales of Silver Eagles by the US Mint in the first quarter of 2011 was 37% higher than the previous year reflecting continuing investor demand.

GLD and SLV Holdings (metric tonnes)

| April27-2011 | Weekly Change | YTD Change | |

| GLD | 1,229.64 | -0.61 | -51.08 |

| SLV | 11,053.20 | -130.49 | +131.63 |

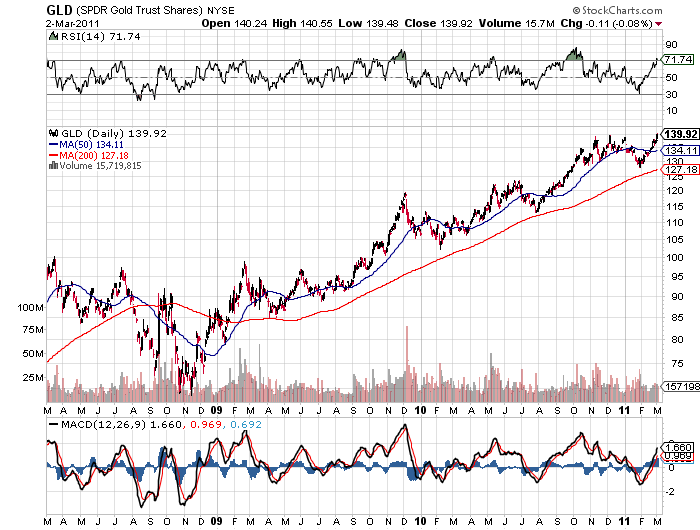

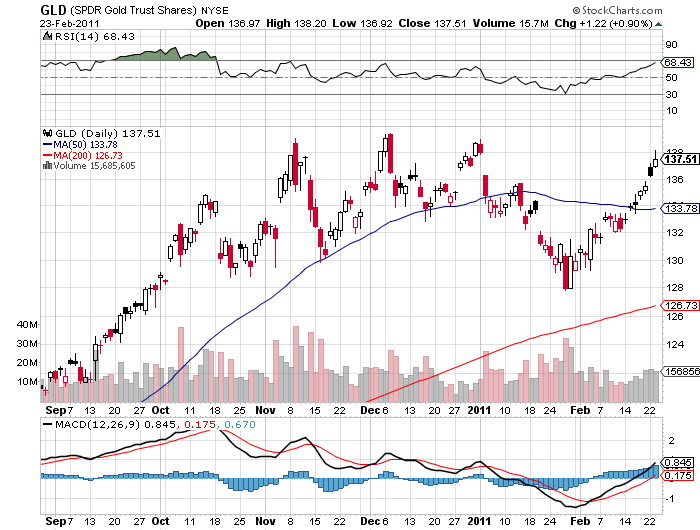

Gold holdings in the GLD declined modestly by 0.61 tonnes after an increase of 17.29 tonnes for the previous week. The current holdings of the GLD amount to 39.5 million ounces of gold valued at $59.7 billion.

Gold hit another all time high today, recently trading at $1,531. The Federal Reserve ignited a sharp rally in gold and silver after releasing details of this week’s FOMC meeting. The precious metal markets moved higher after the Federal Reserve said it would continue super aggressive monetary policies despite the June wind down of QE2. The Fed indicated that it would not reduce the size of its balance sheet and would leave short term interest rates at zero.

The Fed also left the door open to future unconventional policy moves if deemed necessary. Since the Fed cannot move rates below zero, any additional “unconventional easing” would almost certainly mean additional money printing by the Fed. The US dollar traded lower on Fed comments and is now threatening to break to new all time lows.

The iShares Silver Trust (SLV) continued to add large amounts of silver to its holdings while the SPDR Gold Shares Trust (GLD) experienced another small decline in holdings.

The iShares Silver Trust (SLV) continued to add large amounts of silver to its holdings while the SPDR Gold Shares Trust (GLD) experienced another small decline in holdings.

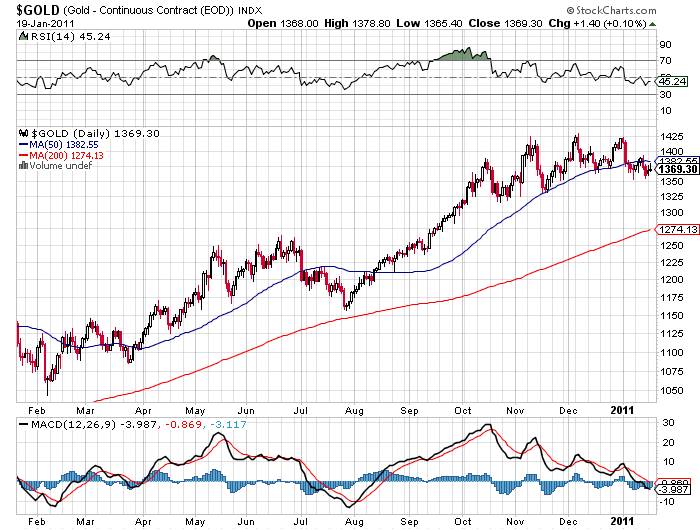

Given the recent pullback in the prices of gold and silver, it was not unexpected to see another decline in the holdings of both the SPDR Gold Shares Trust (GLD) and the iShares Silver Trust (SLV).

Given the recent pullback in the prices of gold and silver, it was not unexpected to see another decline in the holdings of both the SPDR Gold Shares Trust (GLD) and the iShares Silver Trust (SLV).

As gold and silver continue to trade in a narrow range, investors have reduced their holdings in both the SPDR Gold Shares Trust (GLD) and the iShares Silver Trust (SLV).

As gold and silver continue to trade in a narrow range, investors have reduced their holdings in both the SPDR Gold Shares Trust (GLD) and the iShares Silver Trust (SLV).

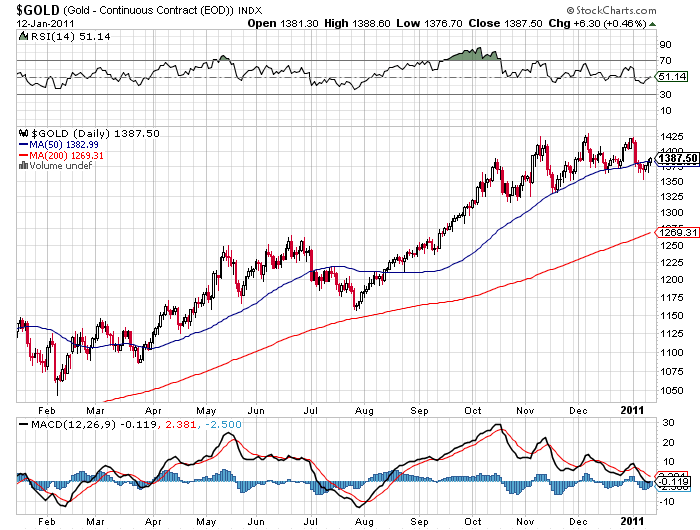

Until quite recently, the gold market has been experiencing a strong rise in prices. This has been due to factors such as concerns regarding weak currencies and unstable foreign governments. Gold has been viewed as a safe haven investment and has been attracting an increasing share of investment dollars. Despite the recent cool down, many market experts are predicting a continued rise in prices over the long term.

Until quite recently, the gold market has been experiencing a strong rise in prices. This has been due to factors such as concerns regarding weak currencies and unstable foreign governments. Gold has been viewed as a safe haven investment and has been attracting an increasing share of investment dollars. Despite the recent cool down, many market experts are predicting a continued rise in prices over the long term. I’m still catching up after a vacation in Europe. For now here are links to some recommended articles about gold, silver, and precious metals from around the net.

I’m still catching up after a vacation in Europe. For now here are links to some recommended articles about gold, silver, and precious metals from around the net.