After major upward price movement during the later half of 2010, both the SLV and GLD continue their sideway price action.

As gold and silver prices continue to consolidate, gold holdings in the SPDR Gold Shares Trust (GLD) and silver holdings in the iShares Silver Trust (SLV) both declined.

The iShares Silver Trust, the largest exchange traded fund back by silver, has a market value of $10.2 billion. After a one year return of almost 80%, the SLV showed a weekly decline of 191.46 metric tonnes from the previous week. The SLV now holds a total of 10,725.73 metric tonnes of silver or 344.840 million ounces.

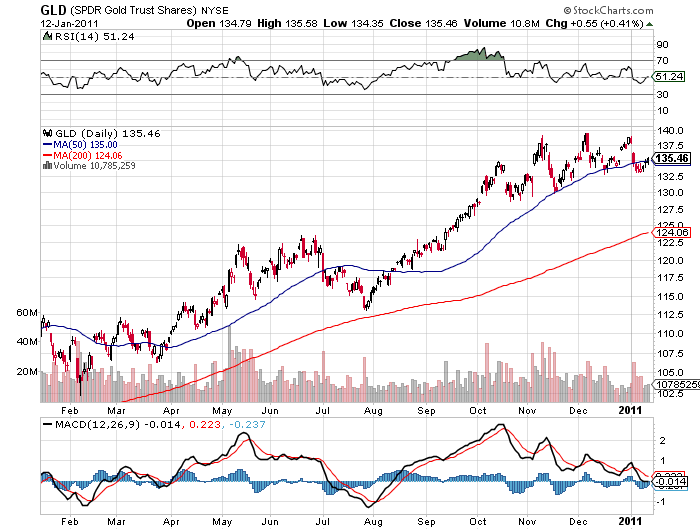

The holdings in the GLD declined by 1.21 metric tonnes in the past week to 1,271.47. The record high holdings of 1,320.47 tonnes in the GLD was reached last year on June 29 when gold bullion was trading in the $1250 range.

Despite the lack of correlation between gold prices and gold holdings of the GLD, investing in the GLD has produced approximately similar returns to owning bullion, disregarding transaction costs. The price gain during 2010 was approximately 28% for both gold bullion and the GLD. For those who choose to avoid holding the physical metal, the GLD was an excellent substitute choice for gold bullion in 2010.

GLD and SLV Holdings (metric tons)

| Jan 12, 2011 | Weekly Change | YTD Change | |

| GLD | 1,271.47 | -1.21 | -9.25 |

| SLV | 10,725.73 | -191.46 | -195.84 |

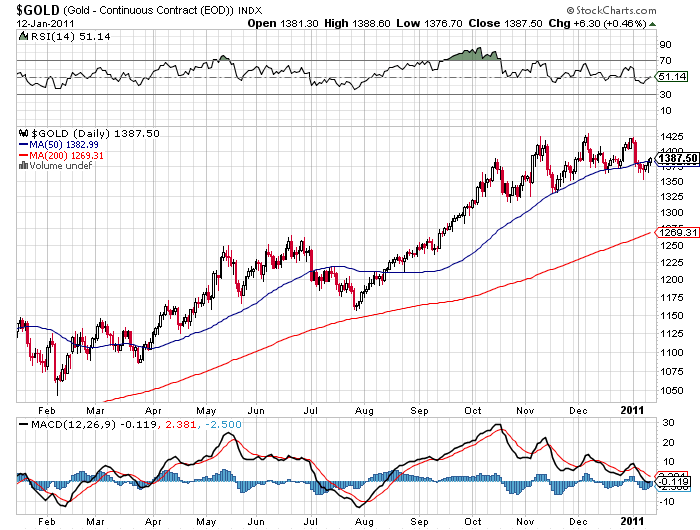

GOLD - COURTESY STOCKCHARTS.COM

GLD - COURTESY STOCKCHARTS.COM