As gold and silver continue to trade in a narrow range, investors have reduced their holdings in both the SPDR Gold Shares Trust (GLD) and the iShares Silver Trust (SLV).

As gold and silver continue to trade in a narrow range, investors have reduced their holdings in both the SPDR Gold Shares Trust (GLD) and the iShares Silver Trust (SLV).

Holdings in the GLD declined by 20.04 metric tonnes over the past week, a substantial decrease compared to last week’s reduction of 1.21 tonnes. The record high holdings of 1,320.47 tonnes in the GLD was reached last year on June 29 when gold bullion was trading in the $1250 range.

GLD and SLV Holdings (metric tonnes)

| Jan 19, 2011 | Weekly Change | YTD Change | |

| GLD | 1,251.43 | -20.04 | -29.29 |

| SLV | 10,575.32 | -150.41 | -346.25 |

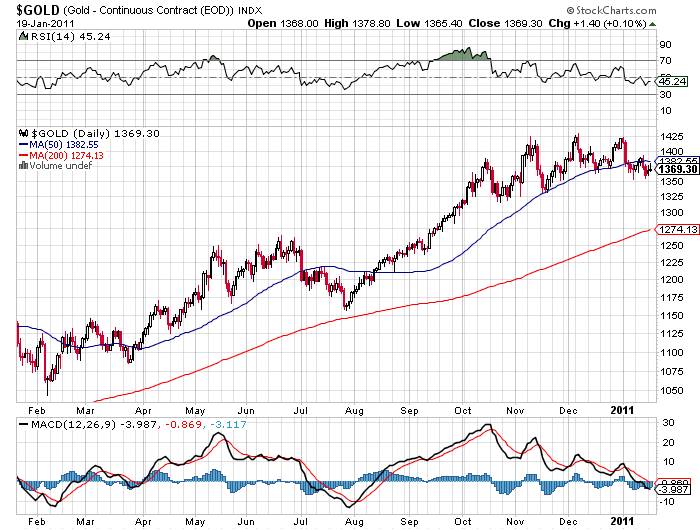

The price of gold has now dipped decisively below its 50 day moving average but is still well above the 200 day moving average. Last year’s July price correction in gold to slightly above the 200 day moving average was followed by a rally of $260 in the price of gold. A pullback to the 200 day moving average would result in a price decline of about $100 for gold.

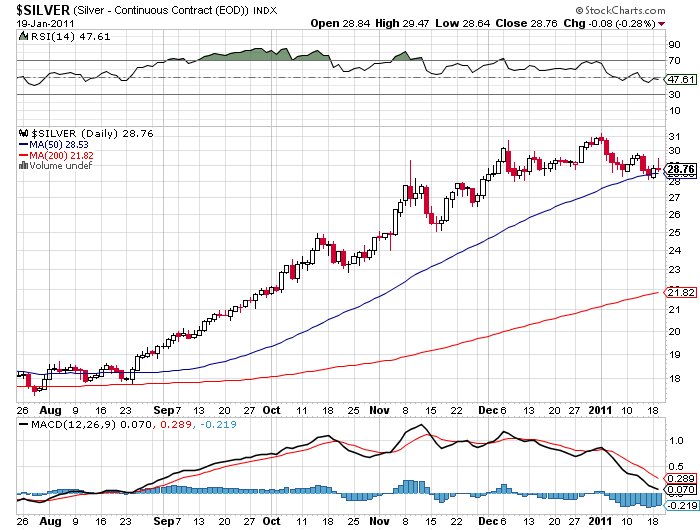

The SLV declined by 150.41 tonnes compared to a reduction of 191.46 tonnes in the previous week. Total silver held by the Silver Trust amounts to 340.004 million ounces. Silver has had a huge price move since last September when it was trading in the $18 per ounce range. Precious metals can exhibit volatile price movements, but so far silver continues to consolidate and has surrendered only a small part of its gains from the $31 per ounce level reached at the beginning of the year.

Speak Your Mind