Gold trusts have probably been a decisive factor in promoting the ownership of gold and expanding the market to investors who would otherwise not participate in the market. Prior to the establishment of the gold trusts, investors had two primary options for investing in gold, both of which had drawbacks. Gold investors could purchase the shares of gold mining companies or physically purchase gold coins or bars.

Gold trusts have probably been a decisive factor in promoting the ownership of gold and expanding the market to investors who would otherwise not participate in the market. Prior to the establishment of the gold trusts, investors had two primary options for investing in gold, both of which had drawbacks. Gold investors could purchase the shares of gold mining companies or physically purchase gold coins or bars.

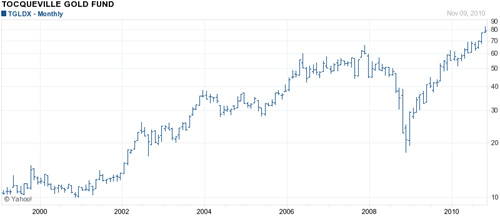

The problem with investing in gold stocks or gold mutual funds is that the investment returns may under perform the appreciation in gold bullion. Many gold stocks have vastly underperformed the price appreciation of gold bullion due to company specific issues such as ore depletion, foreign expropriation, environmental problems or financial difficulties relating to the huge cost of mine exploration, development and production. Picking the right gold stock was often difficult.

Physically purchasing gold coins or bullion presents another wide array of problems and costs. Finding a conveniently located and reputable gold bullion dealer takes time and usually entails a trip to the dealer for every transaction consummated. Liquidity is an issue as well since the physical gold would have to be physically transported or shipped to a dealer prior to receiving sales proceeds. Transactions costs on each side of the trade can easily exceed 5%. Physically holding gold is expensive due to security, storage, transportation and insurance costs. Gold coins or bullion can also be lost or stolen, the ultimate nightmare for an investor.

Investment in gold share trusts eliminates all of the problems associated with stock selection and physically holding gold. Shares representing an interest in gold can be sold at any time throughout the trading day at market prices. Investor ownership of gold trust shares represents an undivided, fractional interest in physical gold held by the trust.

Gold share trusts have become extremely popular with investors due to the advantages of owning gold via gold trust shares. Investors have poured over $57 billion into two of the largest gold share trusts, the SPDR Gold Shares Trust (GLD) and the Sprott Physical Gold Trust (PHYS).

As gold prices continue to increase, the gold share trusts are likely to be the investment of choice for many investors seeking to establish or increase an investment in gold.

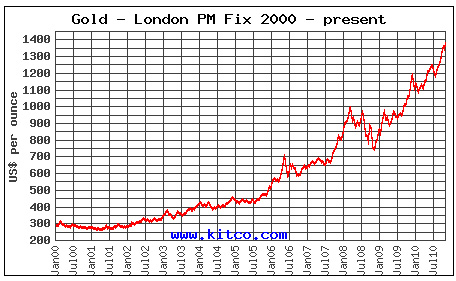

Gold just had an amazing year, in which it reached a new all time high, rising about 25%. Silver provided an even more stellar performance, with a gain of about 75% and counting. It’s no wonder then, that more and more investors are becoming interested in the potential offered by silver.

Gold just had an amazing year, in which it reached a new all time high, rising about 25%. Silver provided an even more stellar performance, with a gain of about 75% and counting. It’s no wonder then, that more and more investors are becoming interested in the potential offered by silver. Gold investors have two basic choices – buying gold bullion or buying shares in companies that produce or own gold. As we examine the two basic investment vehicles available to gold investors, it becomes apparent that choosing the best investment option can be a complex decision. Some of the questions that a gold investor should consider include the following.

Gold investors have two basic choices – buying gold bullion or buying shares in companies that produce or own gold. As we examine the two basic investment vehicles available to gold investors, it becomes apparent that choosing the best investment option can be a complex decision. Some of the questions that a gold investor should consider include the following.

I’m still catching up after a vacation in Europe. For now here are links to some recommended articles about gold, silver, and precious metals from around the net.

I’m still catching up after a vacation in Europe. For now here are links to some recommended articles about gold, silver, and precious metals from around the net.