To many investors with a sense of history, the four most dangerous words are “this time it’s different”. The phrase is usually evoked in an attempt to justify why a huge price gain in a particular asset class can continue to defy common sense and historical valuation norms. A surfeit of explanations on why “this time is different” is usually enough to send seasoned investors to the exits.

To many investors with a sense of history, the four most dangerous words are “this time it’s different”. The phrase is usually evoked in an attempt to justify why a huge price gain in a particular asset class can continue to defy common sense and historical valuation norms. A surfeit of explanations on why “this time is different” is usually enough to send seasoned investors to the exits.

Silver, having defied the low expectations of many investors, has now seen a monster rally of 392% from $8.88 in October 2008 to the recent market price of $43.67. The pace of the advance has gone almost vertical with silver gaining 60% from the lows of late January.

Long term silver investors no doubt remember the aftermath of the last rapid run up in silver prices to $48.70 in January 1980. Silver prices collapsed shortly thereafter and ultimately slid to the $5 range where it remained throughout the 1990’s. Silver dropped off the radar for most investors and remained dead money for 25 years before decisively breaking out of a very long base in early 2006.

Will history repeat with another meltdown in silver prices at some near point in the future, or is the rise in silver prices indicative of a major trend change in our economic future? I have never believed that the mechanical application of past price trends was a useful tool for predicting the future. Each point is history is unique with new players and new sets of circumstances. Understanding today’s fundamentals are far more important than ascribing importance to past events that are largely irrelevant.

To understand why silver prices are in the initial stages of a long term super cycle advance rather than a replay of the 1980’s, it is necessary to review the differences of the late 1970’s compared to our current situation. Gold and silver both advanced in the 1970’s as a booming, demand driven economy fueled inflation. The huge cost of financing the Vietnam War, low employment and surging wages all contributed to a steadily rising rate of inflation which peaked at 13.5% in 1981. Federal Reserve Chairman Paul Volcker finally stopped inflation dead in its tracks through a series of massive interest rate increases which brought the prime rate to a high of 21.5% in mid 1981. High interest rates caused a severe recession but by 1983, the rate of inflation had collapsed to 3.2%.

Both gold and silver moved dramatically higher during the inflation surge of the late 1970’s and early 1980’s but the meteoric rise in silver prices was driven by specific events. Wealthy brothers Nelson and William Hunt acquired a massive position in silver in an attempt to corner the market. Prices skyrocketed on the news and silver went from $11 per ounce in late 1979 to $48.70 in early 1980. Regulators did not take kindly to market manipulation and margin requirements on commodities were dramatically raised. The Hunt brothers’ ill conceived attempt to drive silver prices higher collapsed along with their net worth. Silver prices plunged to less than $11 per ounce within two months. The last great silver “bull market” lasted less than six months, driven not by fundamental demand but rather by heavily leveraged speculators.

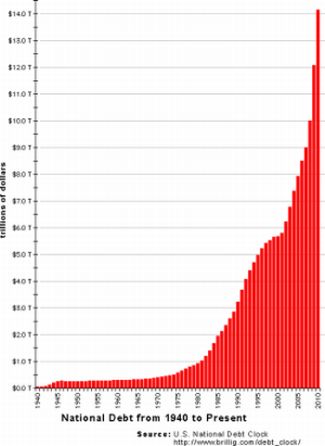

Fast forward 30 years – the finances of governments worldwide have reached the tipping point under ballooning debt levels and massive deficits. Additional borrowing by insolvent nations to rollover debt simply delays the day of reckoning – more debt is not the solution for too much debt.

The message from the gold and silver markets is clear – governments have reached the limits on borrowing and the day of debt Armageddon is approaching. The accelerating exodus from paper assets to historical stores of value is only in its initial stages as desperate governments take desperate measures to stay afloat (see Smart Money Sees The Perfect Storm for Gold and Silver).

The great debt bubble of the United States and much of the rest of the world is reaching its end game as creditors realize that a stealth default of some type is inevitable via a combination of inflation, money printing, currency debasement and/or negative interest rates. Nor is it likely that S&P’s lowered outlook on U.S. government debt to negative from stable will have any affect on reining in ballooning U.S. debt (see Why There Is No Upside Limit To Gold and Silver Prices).

From a long term perspective, perhaps this time is not different but simply a replay of the history of currencies backed only by the “full faith and credit” of governments. Voltaire had this to say regarding fiat money – “Paper money eventually returns to its intrinsic value – zero”.

Gold just had an amazing year, in which it reached a new all time high, rising about 25%. Silver provided an even more stellar performance, with a gain of about 75% and counting. It’s no wonder then, that more and more investors are becoming interested in the potential offered by silver.

Gold just had an amazing year, in which it reached a new all time high, rising about 25%. Silver provided an even more stellar performance, with a gain of about 75% and counting. It’s no wonder then, that more and more investors are becoming interested in the potential offered by silver. After putting the program on hold earlier this week, today the United States Mint has relaunched the eagerly awaited America the Beautiful Silver Bullion Coins. If primary distributors wish to purchase the coins from the Mint, they must agree to a new set of terms and conditions, which includes price caps and very specific guidelines for distribution.

After putting the program on hold earlier this week, today the United States Mint has relaunched the eagerly awaited America the Beautiful Silver Bullion Coins. If primary distributors wish to purchase the coins from the Mint, they must agree to a new set of terms and conditions, which includes price caps and very specific guidelines for distribution. Despite predictions of the silver market’s strength, prices fell from an impressive 30 year high of $30.68 recently. As of the today, COMEX silver futures have fallen about 7% from their recent peak

Despite predictions of the silver market’s strength, prices fell from an impressive 30 year high of $30.68 recently. As of the today, COMEX silver futures have fallen about 7% from their recent peak