The US Mint’s latest monthly reports on the sale of American Silver Eagle bullion sales show that investor buying has hit all time record levels.

The US Mint’s latest monthly reports on the sale of American Silver Eagle bullion sales show that investor buying has hit all time record levels.

Total sales of the American Silver Eagle bullion coins in 2010 came in at a record high of 34,662,500.

With over two months remaining in 2011, sales of the American Silver Eagle have already surpassed the record level of 2010 with sales of 36,375,500 ounces. If sales of the Silver Eagle for November and December match the levels of 2010, total sales for 2011 should total over 42 million ounces or more than 20% above the record breaking sales level of 2010.

A review of sales by month for 2011 indicate solid fundamental buying by silver investors. Typically, buying of an asset will increase as prices go higher and decrease as prices decline. This was not the case with the American Silver Eagles – despite a sharp sell off in May and September, monthly sales increased as investors took advantage of bargain prices.

Silver had a volatile year, selling at $30.67 per ounce at the beginning of the year and moving up to a high of $48.70 (as measured by the London PM Fix Price) on April 28th. Silver closed yesterday at $33.47, up $2.80 or 9.1% on the year.

Based on strong fundamental demand for physical silver, expect silver prices to end the year considerably higher.

To many investors with a sense of history, the four most dangerous words are “this time it’s different”. The phrase is usually evoked in an attempt to justify why a huge price gain in a particular asset class can continue to defy common sense and historical valuation norms. A surfeit of explanations on why “this time is different” is usually enough to send seasoned investors to the exits.

To many investors with a sense of history, the four most dangerous words are “this time it’s different”. The phrase is usually evoked in an attempt to justify why a huge price gain in a particular asset class can continue to defy common sense and historical valuation norms. A surfeit of explanations on why “this time is different” is usually enough to send seasoned investors to the exits.

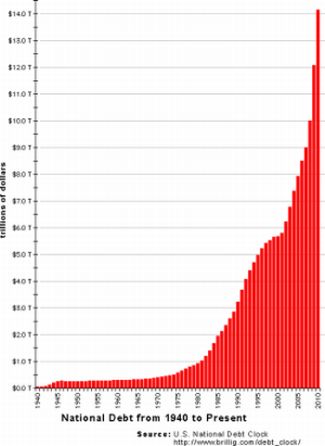

Silver prices continued streaking higher today on fears of a plunging dollar, rampant money printing by central banks, and talk in Europe of a looming debt restructuring (default) by Greece.

Silver prices continued streaking higher today on fears of a plunging dollar, rampant money printing by central banks, and talk in Europe of a looming debt restructuring (default) by Greece.

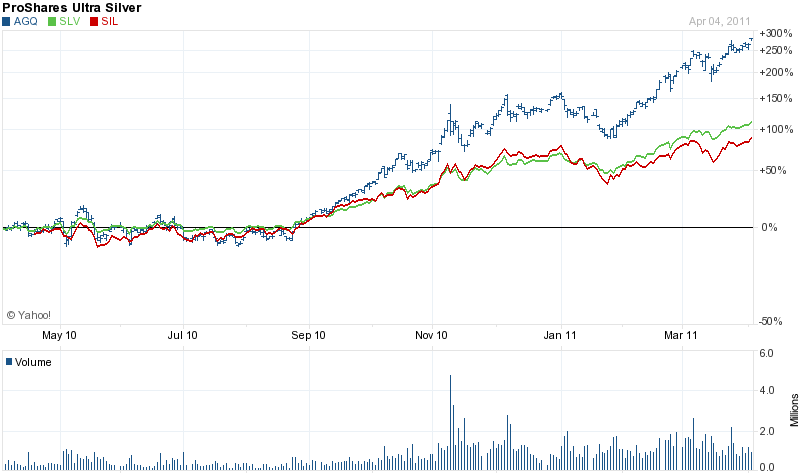

Surging silver prices over the past two years have resulted in huge gains for silver investors. The price of silver bullion has skyrocketed from the $8 level in late 2008 to a New York Spot Price of over $39 per ounce today for a gain of 388%.

Surging silver prices over the past two years have resulted in huge gains for silver investors. The price of silver bullion has skyrocketed from the $8 level in late 2008 to a New York Spot Price of over $39 per ounce today for a gain of 388%.

Many of us have been accumulating large positions in silver bullion and silver mining shares. Whether these positions have been held for decades or only for the past year, the recent explosive move up in the silver price has caused some to wonder if there is a way to protect gains from a possible pull back in silver prices.

Many of us have been accumulating large positions in silver bullion and silver mining shares. Whether these positions have been held for decades or only for the past year, the recent explosive move up in the silver price has caused some to wonder if there is a way to protect gains from a possible pull back in silver prices. As will generally be the case with silver products, the smaller weight offerings carry a larger premium than than larger weight products. This can be the result of the fixed costs associated with manufacture or volume discounts which may be available for purchases in bulk quantities.

As will generally be the case with silver products, the smaller weight offerings carry a larger premium than than larger weight products. This can be the result of the fixed costs associated with manufacture or volume discounts which may be available for purchases in bulk quantities.