Surging silver prices over the past two years have resulted in huge gains for silver investors. The price of silver bullion has skyrocketed from the $8 level in late 2008 to a New York Spot Price of over $39 per ounce today for a gain of 388%.

Surging silver prices over the past two years have resulted in huge gains for silver investors. The price of silver bullion has skyrocketed from the $8 level in late 2008 to a New York Spot Price of over $39 per ounce today for a gain of 388%.

Besides directly purchasing silver bullion, other common ways to profit from the silver bull market include investing in silver stocks or silver Exchange Traded Funds (ETF). The inconvenience and higher transaction costs of investing directly in physical silver has resulted in a major flow of investment dollars into silver ETFs.

The largest silver ETF, the iShares Silver Trust (SLV), has attracted huge investor interest and has seen an astonishing increase in asset growth. The SLV, which held $263.5 million in silver at its inception in April 2006, closed today with total net assets of $13.7 billion. The SLV is structured so that its net asset value per share approximates the value of one ounce of silver bullion. The SLV has worked as it was designed to and the returns are comparable to the return from a direct investment in silver bullion.

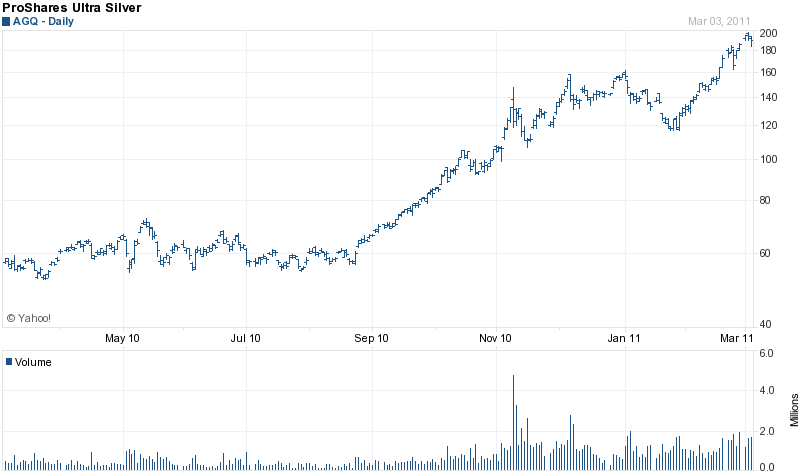

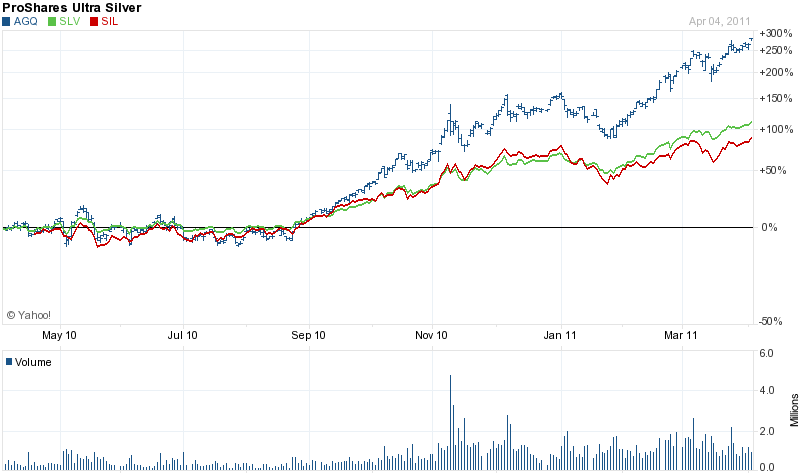

There is another silver ETF, however, that has been the standout winner for silver investors. The ProShares Ultra Silver (AGQ) has soared from its initial $22 a share price in December 2008 to a closing price today of $243.98, providing initial investors with a gain of over 1,000%. According to ProShares, the AGQ seeks to provide for a single day twice the return of silver bullion as measured by the London Fix Price. The gain on the AGQ has exceeded the returns on silver bullion, the SLV, and a basket of silver stocks by a wide margin as can be seen below.

The AGQ was launched by ProShares on December 1, 2008, trades on the New York Stock Exchange and is defined by the Commodity Exchange Act as a commodity pool. ProShares is part of the ProFunds Group which manages over $31 billion in mutual funds and ETFs. ProShares also offers the UltraShort Silver (ZSL) which is a double inverse ETF and the exact opposite of the AGQ. The ZSL seeks to produce a 200% opposite investment result of a long position in silver and will therefore increase in value if the price of silver declines.

One important element that investors should be aware of is that the AGQ does not hold physical silver, as is the case with SLV and PSLV. The AGQ seeks to achieve its stated investment objective by owning financial instruments whose underlying value is correlated to the price of silver. The AGQ may hold various complex financial instruments such as forward contracts, option contracts, swap agreements and futures contracts. As of April 5, 2011, the ProShares Ultra Silver held the majority of its assets in silver forward contracts.

The ProShares prospectus states that ProShares Ultra Silver seeks a 200% return on the performance of silver bullion “for a single day” since returns over periods greater than one day could vary in direction or amount from the target return due to compounding of daily returns. The four factors cited by ProShares that could result in differences between daily and long term returns are index volatility, inverse multiples, holding periods, and leverage.

As every investor knows, greater rewards usually involve taking greater risks and the AGQ is no exception to this rule. ProShares uses complex financial instruments that are subject to volatility in order to achieve leveraged results and the Ultra Silver ETF is therefore subject to much greater risk than investments in traditional silver securities. ProShares warns investors that certain financial instruments held by the AGQ may be “subject the fund to counterparty risk and credit risk, which could result in significant losses for the fund”. ProShares also notes that the Ultra Silver ETF is non-diversified and entails risks associated with the use of derivatives.

The bottom line is that the ProShare Ultra Silver is much riskier than investing in silver trust ETFs, silver stocks, or silver bullion and should therefore be used only by knowledgeable investors. As long as silver continues to increase in value, investors are likely to see outsized gains in the AGQ. Leverage, however, works both ways and a sharp price correction in silver would result in significant losses to investors in the AGQ. An example of how severe losses can be in a leveraged ETF can be seen by looking at the investment results of the ZSL which is designed to go up in value if the price of silver declines.

ProShares introduced the ZSL when silver was below $10 per ounce and, needless to say, initial investors who maintained an investment in the ZSL have experienced devastating losses. The ZSL has declined almost 50% this year and since its inception in late 2008, has experienced a split adjusted decline of over 95%.

The Week in Precious Metals

The Week in Precious Metals