The prices of gold and silver had each risen to fresh all time highs, just before the severe declines experienced over the past few days.

The prices of gold and silver had each risen to fresh all time highs, just before the severe declines experienced over the past few days.

On April 25, 2011, the price of silver touched an intraday high of $49.82 per ounce. This narrowly eclipsed the previous all time high of $49.45 reached in 1980. Silver’s recent price of $34.64 represents a decline of $15.18 or 30.47%.

After breaking above the $1,450 per ounce level in early April, the price of gold had achieved a string of new all time highs. This culminated with the most recent high of $1,577.40 per ounce reached on May 2, 2011. The recent gold price of $1,473.60 per ounce represents a decline of $103.80 or 6.58%.

The severity of the decline for silver has drastically altered the Gold Silver Ratio. This ratio measures the number of ounces of silver necessary to purchase one ounce of gold. At their respective highs, the ratio would have been 31.65. Recent prices put the ratio at 42.54.

Gold

Recent High: $1,577.40 (May 2, 2011)

Recent Price: $1,473.60 (May 5, 2011)

Decline: -$103.80 (-6.58%)

Silver

Recent High: $49.82 (April 25, 2011)

Recent Price: $34.64 (May 5, 2011)

Decline: -$15.18 (-30.47%)

Gold and silver’s stellar performance over the past several years has been interrupted by other declines, some of them even more drastic. From intermediary peaks reached in March 2008, gold and silver fell sharply as the financial world melted down later that year. Gold fell from $1,011.25 to $712.50 per ounce, losing 29.54%. Silver fell from $20.92 per ounce to $8.88, for a loss of 57.55%.

Despite the recent carnage, both gold and silver hold onto gains for the year to date. From the price levels on December 31, 2010, gold is up $63.35 per ounce or 4.49% and silver is up $4.01 per ounce of 13.09%.

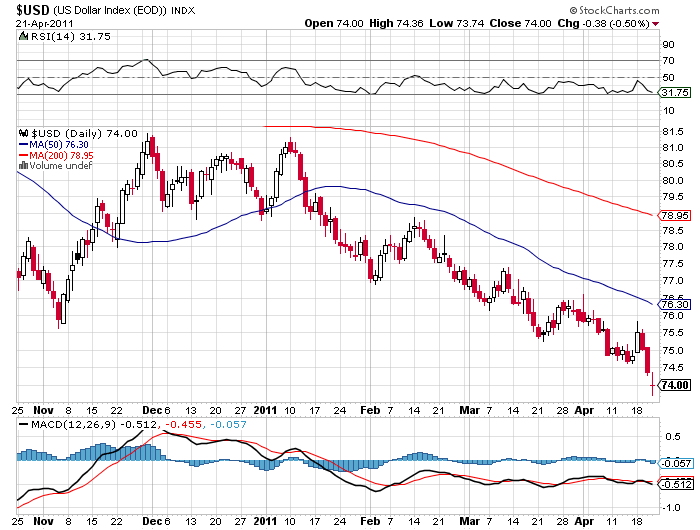

As government spending spirals out of control and the Federal Reserve perpetuates a deliberate strategy of currency debasement, precious metals prices continued to soar. Gold, as measured by the London PM Fix Price, closed at $1504.00, up $27.25 on a shortened four day trading week .

As government spending spirals out of control and the Federal Reserve perpetuates a deliberate strategy of currency debasement, precious metals prices continued to soar. Gold, as measured by the London PM Fix Price, closed at $1504.00, up $27.25 on a shortened four day trading week .

Silver prices continued streaking higher today on fears of a plunging dollar, rampant money printing by central banks, and talk in Europe of a looming debt restructuring (default) by Greece.

Silver prices continued streaking higher today on fears of a plunging dollar, rampant money printing by central banks, and talk in Europe of a looming debt restructuring (default) by Greece.