The SPDR Gold Shares Trust (GLD) reported that holdings of gold bullion remained unchanged from the previous week, after dropping by 39.67 tonnes for the week ending August 24th.

The SPDR Gold Shares Trust (GLD) reported that holdings of gold bullion remained unchanged from the previous week, after dropping by 39.67 tonnes for the week ending August 24th.

On a year to date basis, GLD gold holdings have declined by 48.41 tonnes as the price of gold has increased by $425 (30.6%) from the first of the year. Why would the GLD show a decline in gold holdings as the price of gold has soared? Even more interesting, the GLD reached a record high of gold holdings on June 29, 2010 when it held 1,320.47 tonnes and gold was selling at $1,234.50. From June 29, 2010, while gold has soared by $579 per ounce, the GLD has actually seen a decline in gold holdings of 88.16 tonnes.

The decline of gold holdings by the GLD as the price of gold bullion has skyrocketed indicates that investor preference for gold investment has diversified. The demand for physical gold has soared as the world financial system becomes more precarious with each passing day. Confidence in paper assets is becoming more fragile as hapless central banks desperately print money and drive rates to zero in a futile attempt to restore economic growth. Investors looking for the ultimate safe haven feel more comfortable holding physical gold.

There have been questions raised about the safe keeping and even the existence of the gold held by the GLD. Although these concerns appear to be unwarranted, the financial panic of 2008 blatantly exposed the fact that even institutions considered to be rock solid wound up failing. (Also see GATA dispatch – How exchange traded fund GLD lets you pretend to own gold).

The SPDR website stresses that the gold with the SPDR Trust is deposited in an allocated account. According to the SPDR Gold Trust, “An allocated account is an account with a bullion dealer, which may also be a bank, to which individually identified gold bars owned by the account holder are credited. The account holder has full ownership of the gold bars and, except as instructed by the account holder, the bullion dealer may not trade, lease or lend the bars.”

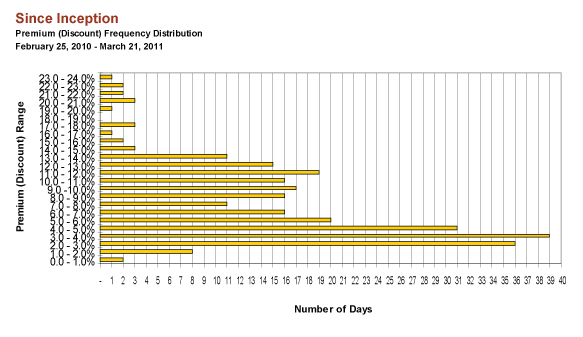

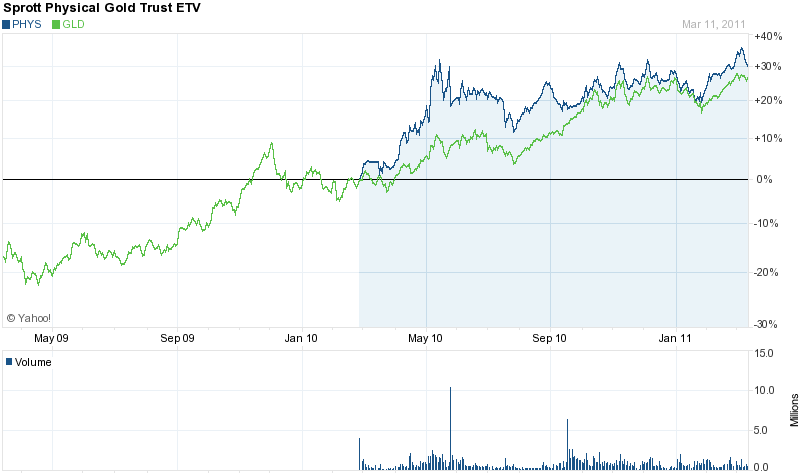

Another reason why the GLD gold holdings have not expanded is competition from numerous other gold trusts such as the Sprott Physical Gold Trust which has advantages over the SPDR Gold Trust.

In addition, the shares of many gold mining companies are selling at extreme discounts and investors may be moving funds from gold trusts such as the GLD into mining shares (see Gold Shares Are Positioned For Explosive Move Up).

The GLD currently holds 39.6 million ounces of gold valued at $71.8 billion.

Meanwhile, the case for holding gold grows stronger as concerns about the stability of the world financial system continue to increase.

The Wall Street Journal disclosed today that Goldman Sachs, in a confidential report, estimates that European banks will need as much as $1 trillion in additional capital and that the current situation in world markets is similar to those that preceded the 2008 financial panic.

According to the Wall Street Journal, strategist Alan Brazil of Goldman told clients “Here we go again. Solving a debt problem with more debt has not solved the underlying problem. In the US, Treasury debt growth financed the US consumer but has not had enough of an impact on job growth. Can the US continue to depreciate the world’s base currency?”

GLD and SLV Holdings (metric tonnes)

| August 31-2011 | Weekly Change | YTD Change | |

| GLD | 1,232.31 | 00.00 | -48.41 |

| SLV | 9,836.18 | -89.38 | -1,174.77 |

Holdings of the iShares Silver Trust (SLV) dropped by 89.38 tonnes this week after increasing by 109.08 tonnes for the week ending August 24th. The SLV currently holds 313.4 million ounces of silver valued at $13 billion.

Gold trusts have probably been a decisive factor in promoting the ownership of gold and expanding the market to investors who would otherwise not participate in the market. Prior to the establishment of the gold trusts, investors had two primary options for investing in gold, both of which had drawbacks. Gold investors could purchase the shares of gold mining companies or physically purchase gold coins or bars.

Gold trusts have probably been a decisive factor in promoting the ownership of gold and expanding the market to investors who would otherwise not participate in the market. Prior to the establishment of the gold trusts, investors had two primary options for investing in gold, both of which had drawbacks. Gold investors could purchase the shares of gold mining companies or physically purchase gold coins or bars. Investors seeking to increase or establish positions in the gold market have been pouring money into gold trusts. The largest gold trust is the SPDR Gold Trust Shares (GLD) which, since its launch in November 2004, has seen huge investor demand. The GLD currently holds over 39 million ounces of gold valued at $55.5 billion.

Investors seeking to increase or establish positions in the gold market have been pouring money into gold trusts. The largest gold trust is the SPDR Gold Trust Shares (GLD) which, since its launch in November 2004, has seen huge investor demand. The GLD currently holds over 39 million ounces of gold valued at $55.5 billion.