Investors seeking to increase or establish positions in the gold market have been pouring money into gold trusts. The largest gold trust is the SPDR Gold Trust Shares (GLD) which, since its launch in November 2004, has seen huge investor demand. The GLD currently holds over 39 million ounces of gold valued at $55.5 billion.

Investors seeking to increase or establish positions in the gold market have been pouring money into gold trusts. The largest gold trust is the SPDR Gold Trust Shares (GLD) which, since its launch in November 2004, has seen huge investor demand. The GLD currently holds over 39 million ounces of gold valued at $55.5 billion.

The Sprott Physical Gold Trust (PHYS), which began trading on the New York Stock Exchange in late February 2010, is similar to the SPDR Gold Trust Shares in that the investor owns an undivided, fractional interest in gold held by the trust. The PHYS, however, has some major differences from the GLD which may result in an investor preference for PHYS.

As detailed below, the advantages of the PHYS over the GLD are a much lower tax rate on gains and government custody of the physical gold backing the PHYS.

PHYS is not an exchange traded fund (ETF) but rather a closed-end mutual fund trust which means that the physical gold holdings and investor units outstanding do not change. The PHYS holdings remain constant based on the initial trust offering. The PHYS holds over 820,000 ounces of gold valued at $1.18 billion.

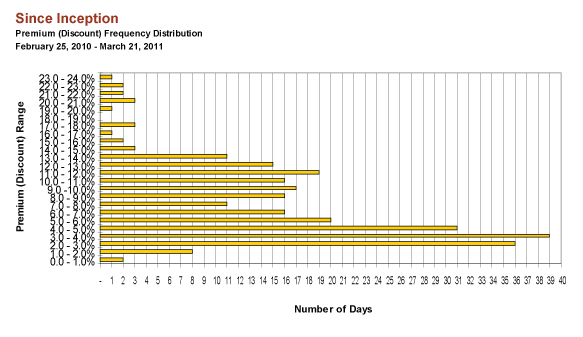

As with any closed end fund, the net asset value of the PHYS can trade at a discount or premium to the market value of gold held by the trust. Since its creation, the PHYS has consistently traded at a premium to its net asset value. The premium has at times reached a substantial 24%. To avoid paying an excessive premium, potential investors in PHYS should compare the net asset value to the purchase cost of PHYS.

PHYS Premium to net asset value - source: Sprott Gold Trust

The premium paid by an investor to own the PHYS is based on two major factors – very favorable tax treatment and extremely secure custody holding of the physical gold that backs the PHYS as explained below.

Discounts or premiums to net asset values also occur with the GLD ETF, based on investor supply and demand during the course of daily trading. Premiums or discounts on the GLD, however, are extremely small, typically ranging only plus or minus 0.5%. The very small discount or premium on the GLD is due to the complex manner in which the fund is structured.

The GLD has a complex mechanism by which shares can be “created or redeemed” by the GLD Trust via Authorized Participants. Authorized Participants are large Wall Street investment firms that profit by arbitraging against a premium or discount to the GLD. The transactions of the Authorized Participants can result in significant changes in gold holdings by the GLD . The SPDR Gold Trust was structured in this manner so that the price of the GLD would closely correspond to the underlying price movements in gold.

The PHYS holds 99.5% of its assets in physical gold bullion stored at the Royal Canadian Mint in Ottawa, Canada. The gold backing the PHYS is specifically allocated by the Royal Mint to PHYS. The Trust does not invest in gold certificates or other paper instruments. The Royal Canadian Mint of the Canadian Government is responsible for any loss or damage to the bullion held for the PHYS and the gold bullion is subject to annual audits.

The custodian for the gold held by the SPDR Gold Trust (GLD) is HSBC Bank in London. The GLD prospectus notes that the gold held by the Trust is specifically allocated to GLD and that the allocated gold bars “are not a part of the bankrupt’s estate in the event of the bankruptcy of the Custodian”. In addition, the gold bars allocated to the GLD are identified by number and updated everyday. After witnessing the failure of very large banks in 2008, investors may be more secure with a Government custodian.

A very significant advantage of the PHYS according to Sprott Asset Management is that investors holding units for more than one year are only taxed at the capital gains rate of 15% compared to a 28% tax rate on gold ETFs and physical gold coins. The gold held by investors in the GLD ETF is considered to be “collectibles” by the IRS and thus taxed at a higher 28% rate.

The prospectus for the PHYS discloses that the fund does have a physical redemption feature that is exercisable on the 15th of each month and processed at the end of the month, a setup which is designed to discourage redemptions. Given the inconvenience, cost and delays involved in redeeming units for physical gold, the Trust expects that most investors will chose to sell their units rather than redeem them for gold bullion.

The reason why the Sprott Physical Gold Trust discourages redemptions is due to the fact that a redemption would be considered a sale of gold by the Trust for tax purposes and thus be taxed at 28%. The taxes paid by the Trust would be passed on to shareholders who would then be liable for taxes above the 15% capital gain rate based on their pro rata share of the gain. Sprott Management believes that it is highly unlikely that any investors would chose redemption versus selling their units on the market.

In any event, even if a partial redemption of units occurred, the pro rata gains would still result in a tax rate significantly less than the 28% that applies to gains on the sale of an ETF. In the extremely unlikely event that all units were physically redeemed, an investor’s tax rate would still be no higher than the 28% rate that applies to an ETF.

Long term ownership of the PHYS in a non tax deferred account thus conveys significant tax advantages over an ETF. Net investment gains on the PHYS could result in a 13% higher return than an equivalent investment in a gold ETF. Investors should consult with their tax expert and read the PHYS prospectus before investing.

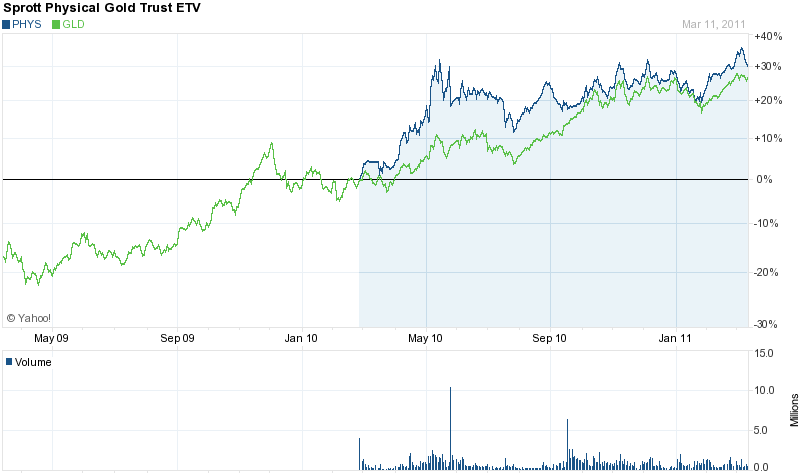

Since its inception, the PHYS has had a higher return than the GLD.

PHYS VS GLD

The PHYS fund is managed by Sprott Asset Management based in Toronto, Canada. Sprott offers hedge funds, mutual funds, fixed asset funds, limited partnerships and bullion focused funds. The holding company, Sprott, Inc. trades on the Toronto Stock Exchange under the symbol “SII”.