Ben Bernanke tells us he wants a sound dollar and Barrack Obama tells us he wants to cut entitlements and reduce the budget deficit.

Ben Bernanke tells us he wants a sound dollar and Barrack Obama tells us he wants to cut entitlements and reduce the budget deficit.

I have no doubt that both gentlemen are honorable and doing what they believe is best for the country. Others, perhaps less naive than myself, may be inclined to believe that the Fed Chairman and President are attempting to foist a distorted view of reality on the American public. Credibility can depend on the public’s perception of reality, a fact well understood by politicians and central bankers.

“If you tell a lie big enough and keep repeating it, people will eventually come to believe it.” – Joseph Goebbels, Propaganda Minister

“When it becomes serious, you have to lie”. – Jean-Claude Juncker, Euro Finance Minister

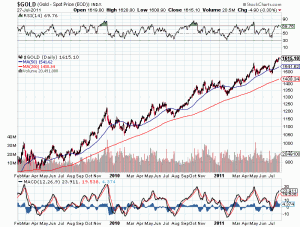

It’s not hard for politicians to fool the American public – they have had many decades of experience honing that skill. It is another matter to fool the markets and using that scorecard , our dysfunctional and highly polarized government has failed miserably. The gold market has not been fooled, holders of US dollars have not been fooled and the U.S. debt monster is visible to all.

After weeks of bitter debate, the best that the Washington elite could manage to do was agree to disagree at a later date and, of course, establish a commission to look further into the debt crisis, also at a later date.

The elegant solution to the nation’s debt problem, as described above, may finally allow John Q. Public to sleep more soundly at night. Inquiring minds, however, can cite numerous reasons why the Nation’s debt crisis will be keeping all of us awake in the near term future.

-The ultimate compromise to the debt crisis will be more debt, following in the footsteps of the EU’s grand solution to the Greek debt crisis. “I will gladly pay you tomorrow if you lend me more money today” attitude is going to quickly wear thin with U.S. creditors.

-The U.S. is borrowing trillions to pump cash into a weakening economy that already can’t create enough income to service the debt we already have – this strategy is the ultimate Ponzi scheme. The conviction that future economic growth will pay for today’s borrowings is false. Burdensome levels of public sector debt have been proven to dramatically restrain future economic growth.

-The U.S. and world economies are looking at a replay of the 1930’s depression, except this one won’t be so gentle. The American public, with the persuasion of politicians, has come to believe that the “richest nation on earth” can provide cradle to grave security based on mathematically impossible entitlement promises. The financial chaos and social breakdown resulting from broken promises to pay by the government will severely test the foundations of our democracy.

-All of the proposed “solutions” to the country’s overwhelming debt problem involve increasing the national debt by trillions more and agreeing to phantom spending cuts at some point in the future. The U.S. is on a debt treadmill and all of the political solutions coming out of Washington are equivalent to turning up the speed on the treadmill and pouring oil on the belt.

-The Dodd-Frank Act, which was supposed to solve the problem of systemically risky institutions, ignored the biggest systemic risk of all to our financial future – the U.S. government.

-The Federal Reserve, which according to Bernanke, “saved the entire world” from a depression in 2008, has strangely detached itself from the crisis by proclaiming that they are powerless and without policy tools to prevent the looming U.S. debt default. (See this on Ron Paul’s view of the Fed). If worse comes to worse, perhaps Bernanke should seek some advice from the insolvent States of California and Illinois on how to go about issuing vouchers.