Investors in paper currencies are running out of safe havens. As Europe totters on the brink of a debt implosion and the Dow routinely plunges 1,000 points every other week, holders of paper wealth are desperately searching for a store of stable value.

Investors in paper currencies are running out of safe havens. As Europe totters on the brink of a debt implosion and the Dow routinely plunges 1,000 points every other week, holders of paper wealth are desperately searching for a store of stable value.

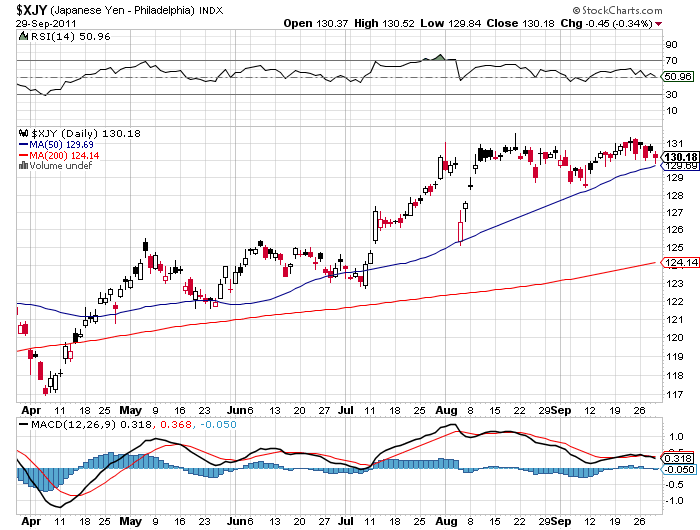

Ironically, the two currencies viewed as the least risky are the Japanese yen (issued by the country with the highest debt/GDP ratio in the world) and the U.S. dollar (issued by the country with the largest amount of debt in the world).

Investors in U.S. dollars remain forever at risk to the Fed’s policies of dollar debasement and money printing, but to seek safe haven in the yen seems like an even more foolhardy proposition. Consider It’s 1987 Without the Bubble In Japan for insights into the fundamental weakness of the economy backing the paper yen.

Japan’s labor force shrank last month to its smallest size since October 1987, when the nation’s stock-market benchmark was 185 percent higher and land prices were 85 percent greater than today.

Employers cut payrolls by 160,000 and a further 200,000 workers retired or abandoned efforts to find a job, leaving the seasonally adjusted number of employed at 59.4 million, the statistics bureau said today in Tokyo. Separate figures showed industrial production rose 0.8 percent from the previous month, less than all but three of 28 forecasts in a Bloomberg survey.

The data deepen concern that Japan’s recovery from the March earthquake will be stunted by manufacturers shifting operations abroad because of gains in the yen, a deterioration in consumer confidence and prospects for higher taxes at home. The challenges add to the burden of an economy already beset by a shrinking and aging population.

The yen traded at 76.59 as of 12:11 p.m. in Tokyo, less than 1 percent from the post-World War II record high of 75.95 on Aug. 19. The Nikkei 225 Stock Average was little changed at 8,723.12, compared with the peak of 38,915.87 when it closed out 1989, capping a four-year run when it soared almost 200 percent.

Japan has been in a contained depression for two decades, propped up by massive deficit spending and BOJ money printing. A double dip world recession will send Japan’s economy into a nosedive since exports account for 15% of GDP.

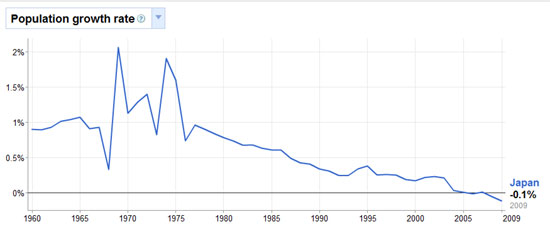

In order for Japan to service its crushing debt burden, they need rapid economic growth and and a large expansion of their labor force. Will this happen? In a word, no. The world economy has been in a downward spiral since 2007 and massive stimulus efforts by governments and central banks have failed to contain the ongoing depression. Making matters even worse for Japan is the fact that the Japanese are slowly exterminating themselves. The birth rate in Japan has been plunging since the early 1970’s and has now gone negative. An economy with a dwindling labor force and an aging population has little hope of servicing a massive debt burden.

The appreciation of the yen is forcing Japanese companies to fire domestic employees and move operations overseas in order to remain competitive. The Japanese government has intervened numerous times in the currency markets, trying to force the yen lower without success. Despite the weak fundamentals of the Japanese economy and a suffocating level of debt, the yen continues to appreciate, suggesting that investors perceive other currencies to be riskier than the yen. The yen has gained the dubious distinction of being the cleanest shirt in the dirty laundry.

There is no way of predicting how long the value of the paper yen can defy economic reality. Markets will eventually price to fundamental values and investors will question the value of all paper currencies. At this point, gold will rightfully be perceived as the only currency with real value. What price level gold will soar to during the chaos of collapsing currencies cannot be predicted – what can be predicted is that holders of gold will be the only ones left holding a currency with any value.