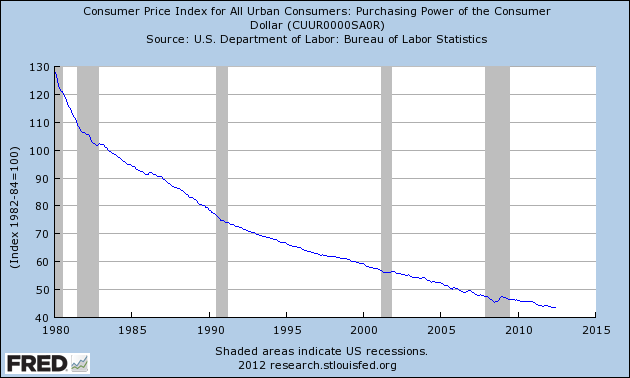

In August Ron Paul accused the U.S. Treasury “guilty of counterfeiting dollars” by virtue of its monopoly power on money in America. Paul noted that the expanding role of the Federal Reserve in monetizing government debt has resulted in a massive debasement of the purchasing power of the U.S. dollar.

In August Ron Paul accused the U.S. Treasury “guilty of counterfeiting dollars” by virtue of its monopoly power on money in America. Paul noted that the expanding role of the Federal Reserve in monetizing government debt has resulted in a massive debasement of the purchasing power of the U.S. dollar.

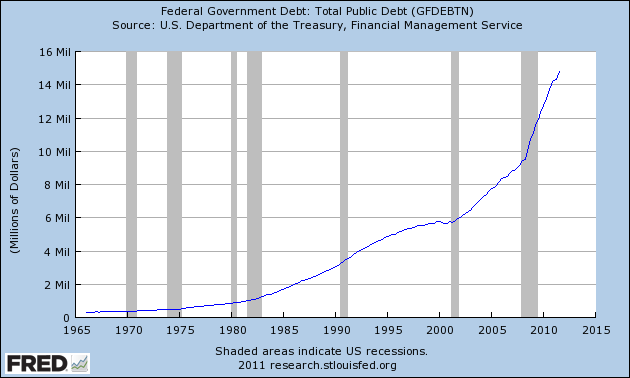

Continued reckless money printing by the Federal Reserve and massive government deficits will ultimately result in the loss of confidence by holders of U.S. dollars. Ron Paul sees the U.S. dollar inexorably losing its status as global reserve currency unless the dollar is backed by precious metals or commodities.

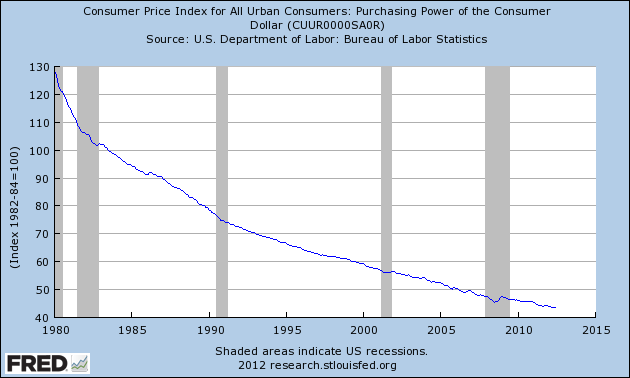

Evidence of the horrendous loss of purchasing power by the U.S. dollar is not hard to understand. The average citizen sees it everyday as higher prices and lower incomes relentlessly lower our standard of living. The systematic destruction of the U.S. dollar’s purchasing power can be seen in a chart published by the Federal Reserve Bank of St. Louis.

How Long Will the Dollar Remain the World’s Reserve Currency?

By: Congressman Ron Paul

We frequently hear the financial press refer to the U.S. dollar as the “world’s reserve currency,” implying that our dollar will always retain its value in an ever shifting world economy. But this is a dangerous and mistaken assumption.

Since August 15, 1971, when President Nixon closed the gold window and refused to pay out any of our remaining 280 million ounces of gold, the U.S. dollar has operated as a pure fiat currency. This means the dollar became an article of faith in the continued stability and might of the U.S. government.

In essence, we declared our insolvency in 1971. Everyone recognized some other monetary system had to be devised in order to bring stability to the markets.

Amazingly, a new system was devised which allowed the U.S. to operate the printing presses for the world reserve currency with no restraints placed on it– not even a pretense of gold convertibility! Realizing the world was embarking on something new and mind-boggling, elite money managers, with especially strong support from U.S. authorities, struck an agreement with OPEC in the 1970s to price oil in U.S. dollars exclusively for all worldwide transactions. This gave the dollar a special place among world currencies and in essence backed the dollar with oil.

In return, the U.S. promised to protect the various oil-rich kingdoms in the Persian Gulf against threat of invasion or domestic coup. This arrangement helped ignite radical Islamic movements among those who resented our influence in the region. The arrangement also gave the dollar artificial strength, with tremendous financial benefits for the United States. It allowed us to export our monetary inflation by buying oil and other goods at a great discount as the dollar flourished.

In 2003, however, Iran began pricing its oil exports in Euro for Asian and European buyers. The Iranian government also opened an oil bourse in 2008 on the island of Kish in the Persian Gulf for the express purpose of trading oil in Euro and other currencies. In 2009 Iran completely ceased any oil transactions in U.S. dollars. These actions by the second largest OPEC oil producer pose a direct threat to the continued status of our dollar as the world’s reserve currency, a threat which partially explains our ongoing hostility toward Tehran.

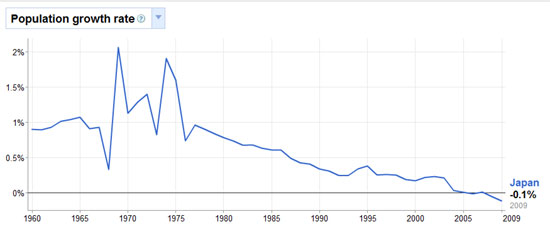

While the erosion of our petrodollar agreement with OPEC certainly threatens the dollar’s status in the Middle East, an even larger threat resides in the Far East. Our greatest benefactors for the last twenty years– Asian central banks– have lost their appetite for holding U.S. dollars. China, Japan, and Asia in general have been happy to hold U.S. debt instruments in recent decades, but they will not prop up our spending habits forever. Foreign central banks understand that American leaders do not have the discipline to maintain a stable currency.

If we act now to replace the fiat system with a stable dollar backed by precious metals or commodities, the dollar can regain its status as the safest store of value among all government currencies. If not, the rest of the world will abandon the dollar as the global reserve currency.

Both Congress and American consumers will then find borrowing a dramatically more expensive proposition. Remember, our entire consumption economy is based on the willingness of foreigners to hold U.S. debt. We face a reordering of the entire world economy if the federal government cannot print, borrow, and spend money at a rate that satisfies its endless appetite for deficit spending.

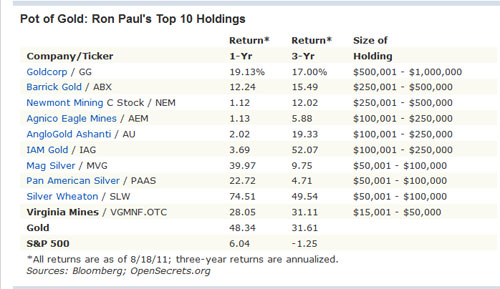

When Ron Paul retires after his current term in Congress, one of the most notable voices for a sound currency and protection of civil liberties against a despotic government will be gone from the official Washington scene. Although Paul was never able to rein in a government that assumes more power over our lives with each passing minute, his warnings gave Americans the opportunity to understand the threats to their financial future and personal liberties.

When Ron Paul retires after his current term in Congress, one of the most notable voices for a sound currency and protection of civil liberties against a despotic government will be gone from the official Washington scene. Although Paul was never able to rein in a government that assumes more power over our lives with each passing minute, his warnings gave Americans the opportunity to understand the threats to their financial future and personal liberties.