Despite the fact that gold has outperformed virtually every other asset class for the past decade, the September correction in gold prices has caused market sentiment to turn decidedly bearish. As measured by the London closing fix price, gold reached an all time high of $1,895 on September 5th. Within the next three weeks, gold had plunged by almost $300 per ounce, closing at $1,598 on September 26th.

Despite the fact that gold has outperformed virtually every other asset class for the past decade, the September correction in gold prices has caused market sentiment to turn decidedly bearish. As measured by the London closing fix price, gold reached an all time high of $1,895 on September 5th. Within the next three weeks, gold had plunged by almost $300 per ounce, closing at $1,598 on September 26th.

Did September mark a turning point in the decade long gold rally, as many have suggested, or is it a buying opportunity? A review of the factors contributing to the September sell off suggest that from a contrarian and fundamental point of view, the groundwork is being laid for a move to new highs in gold.

Extreme volatility in global equity markets due to the European debt crisis resulted in losses and subsequent margin calls for many leveraged investors who indiscriminately liquidated whatever they owned, including gold investments.

In mid November, SEC documents disclosed that Paulson & Co., the hedge fund run by legendary investor John Paulson had liquidated 11.2 million shares of the SPDR Gold Trust (GLD) during the quarter ending September 30th. Paulson’s exact motives in selling the GLD remain unknown, but is was reported that huge losses in his hedge funds had resulted in the forced selling of SPDR Gold Trust shares.

Besides helping to drive down the price of gold, investors may view Paulson’s large sale as a bearish signal from an investor who has an incredibly successful long term track record. Paulson, however, still remains the largest shareholder in the SPDR Gold Trust with a position of 20.3 million shares at September 30th. In addition, Paulson reportedly remains long term bullish on gold and may have large positions in physical gold through allocated bullion accounts.

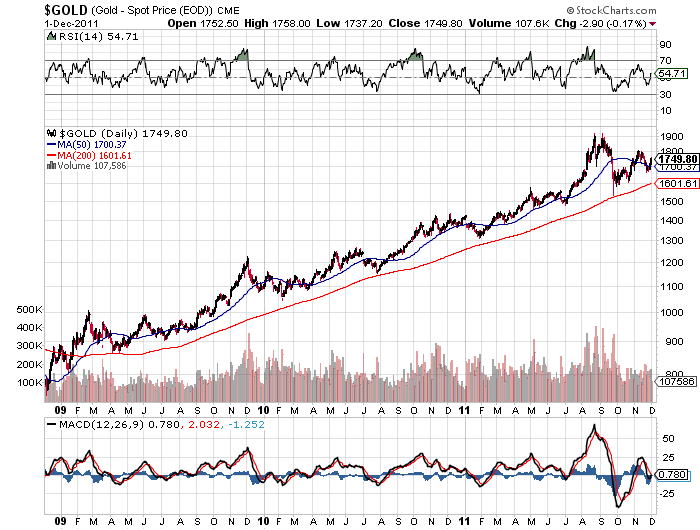

In addition to the factors mentioned above, gold may simply have gotten ahead of the fundamentals. Every long term bull market experiences episodes of sharp price corrections and consolidation. Over the past decade, with a brief exception in 2008, gold has found solid support at the 200 day moving average. In April 2009, July 2010 and February 2011, gold experienced a sustained multi-month rally after correcting down to the 200 day moving average. Currently, a retreat to the 200 day moving average would bring gold down to the $1,600 level.

Mark Hulbert, of the Hulbert Gold Newsletter, who tracks investor sentiment on gold says that the bearish sentiment on gold is reaching extreme levels. Hulbert says “According to contrarian analysis, this is building a strong foundation for a fresh assault on gold’s recent all-time high above $1,900 an ounce. This doesn’t guarantee that gold will rise from here, of course, or that it will do so right away. But it does mean that contrarian analysis is currently on the side of the bulls”.

Patient long term investors in gold have been well rewarded. Despite the September correction, gold prices have advanced by $364 per ounce in 2011, for a gain of 26%.

If anyone is interested in gold fractionals, these guys are running a pretty decent deal:

The premiums are the following.

1/10 oz. Gold Eagles: 11.75%

1/4 oz. Gold Eagles: 8.5%

1/2 oz. Gold Eagles: 6%

https://www.texmetals.com/gold-coins/gold-american-eagles.html