Rep. Ron Paul, a long time critic of the Fed and advocate of the gold standard, is all in on gold and silver. Ron Paul has consistently warned of the dangers of a Fed gone wild on easy money and a Government that has borrowed itself into financial oblivion.

Rep. Ron Paul, a long time critic of the Fed and advocate of the gold standard, is all in on gold and silver. Ron Paul has consistently warned of the dangers of a Fed gone wild on easy money and a Government that has borrowed itself into financial oblivion.

The “Honest Money” essay on the Ron Paul website is an all time favorite explanation of how money and inflation work and has drawn almost 6,000 comments.

What, then, is fiat money? It’s exactly what we just talked about: money that can be inflated or increased at the push of a button at the say-so of a powerful person or organization. Nowadays most dollars are just blips on a computer screen and it’s extremely easy for the Federal Reserve to create money out of thin air whenever they want to.

As you can see, inflation and fiat money are very seductive and beneficial to those at the top, and very dangerous to everyone else and the nation as a whole. That’s exactly what Henry Ford was talking about. He knew that every country that relies too much on fiat money is ruined sooner rather than later.

There is only one possible solution to the inflation problem: Stop creating money out of thin air. But we’re already in such a mess that the only way to have a real impact on the money supply is to increase interest rates so that people pay back their loans and borrow less money from the banks, which decreases the amount of money in circulation. However, higher interest rates might very well crash the economy. So the Fed’s current “solution” to overcoming inflation is… creating even more of it.

Fiat money is a dangerous addiction. Even if the Fed found a way to stop inflation, as long as the current system persists the temptation will always be there to resume pushing the easy money button. That’s why we need to get back on the gold standard and eliminate the Federal Reserve altogether.

In order to protect the purchasing power of his savings, Ron Paul has implemented the sound advice that he has been dispensing to America for many years.

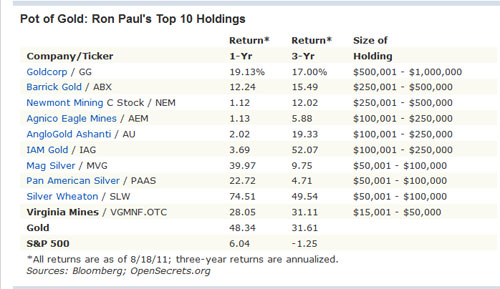

As disclosed in Barron’s this weekend, Ron Paul’s top 10 holdings listed in required financial statement disclosures show that his portfolio is 100% in gold and silver mining stocks. Ron Paul apparently also owns gold bullion, but the disclosure of asset holdings that may be considered as collectibles is not required.

Without getting into a discussion of the merits of a diversified investment portfolio, Ron Paul’s 100% investment allocation to gold and silver demonstrate his integrity. If someone believes that the Government is persistently and continually debasing the value of the currency, why would you not invest exclusively in gold and silver?

Ron Paul has taken steps to protect himself from the disastrous affects that Federal Reserve policies will ultimately have on the value of the U.S. currency. The average American would be well advised to follow his lead.

Here is Ron Paul’s portfolio as disclosed by Barron’s.