When Ron Paul retires after his current term in Congress, one of the most notable voices for a sound currency and protection of civil liberties against a despotic government will be gone from the official Washington scene. Although Paul was never able to rein in a government that assumes more power over our lives with each passing minute, his warnings gave Americans the opportunity to understand the threats to their financial future and personal liberties.

When Ron Paul retires after his current term in Congress, one of the most notable voices for a sound currency and protection of civil liberties against a despotic government will be gone from the official Washington scene. Although Paul was never able to rein in a government that assumes more power over our lives with each passing minute, his warnings gave Americans the opportunity to understand the threats to their financial future and personal liberties.

What may be one of Ron Paul’s last legislative efforts is his campaign to allow competing currencies in the United States in order to break the monopoly on money by the Treasury and Federal Reserve.

I recently held a hearing in my congressional subcommittee on the subject of competing currencies. This is an issue of enormous importance, but unfortunately few Americans understand how the Federal Reserve and Treasury Department impose a strict monopoly on money in America.

This monopoly is maintained using federal counterfeiting laws, which is a bit rich. If any organization is guilty of counterfeiting dollars, it is our own Treasury. But those who dare to challenge federal legal tender laws by circulating competing currencies– at least physical currencies– risk going to prison.

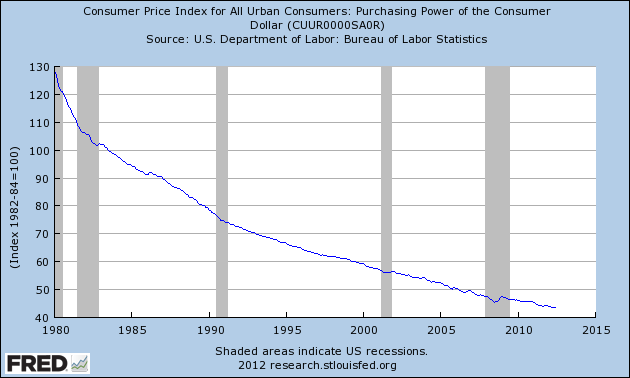

Like all government created monopolies, the federal monopoly on money results in substandard product in the form of our ever-depreciating dollars.

Yet governments have always sought to monopolize the issuance of money, either directly or through the creation of central banks. The expanding role of the Federal Reserve in the 20th century enabled our federal government to grow wildly larger than would have been possible otherwise. Our Fed, like all central banks, encourages deficits by effectively monetizing Treasury debt. But the price we pay is the terrible and ongoing debasement of our money.

Allowing individuals and business to use alternate currencies, especially currencies backed by gold and silver, would expose the whole rotten system because the marketplace would prefer such alternate currencies unless and until the Fed suddenly imposed radical discipline on its dollar inflation.

Sadly, Americans are far less free than many others around the world when it comes to protecting themselves against the rapidly depreciating US dollar. Mexican workers can set up accounts denominated in ounces of silver and take tax-free delivery of that silver whenever they want. In Singapore and other Asian countries, individuals can set up bank accounts denominated in gold and silver. Debit cards can be linked to gold and silver accounts so that customers can use gold and silver to make point of sale transactions, a service which is only available to non-Americans.

The obvious solution is to legalize monetary freedom and allow the circulation of parallel and competing currencies. There is no reason why Americans should not be able to transact, save, and invest using the currency of their choosing. They should be free to use gold, silver, or other currencies with no legal restrictions or punitive taxation standing in the way. Restoring the monetary system envisioned by the Constitution is the only way to ensure the economic security of the American people.

After all, if our monetary system is fundamentally sound– and the Federal Reserve indeed stabilizes the dollar as its apologists claim–then why fear competition? Why do we accept that centralized, monopoly control over our money is compatible with a supposedly free-market economy? In a free market, the government’s fiat dollar should compete with alternate currencies for the benefit of American consumers, savers, and investors.

As Austrian economist Ludwig von Mises explained, sound money is an instrument that protects our civil liberties against despotic government. Our current monetary system is indeed despotic, and the surest way to correct things simply is to legalize competing currencies.

Ron Paul is routinely dismissed as a naif by the Federal Reserve and Treasury. Yet a quick look at the chart of the purchasing power of the U.S. dollar (published by the St. Louis Fed) proves the legitimacy of Ron Paul’s concerns. Federal Reserve policies have resulted in the systematic destruction of the purchasing power of the consumer dollar.

Will Ron Paul be successful in his quest to legalize a competing U.S. currency? Let’s look at Paul’s track record.

Of the 620 bills that Paul had sponsored through December 2011, over a period of more than 22 years in Congress, only one had been signed into law – a lifetime success rate of less than 0.3%. The sole measure authored by Paul that was ultimately enacted allowed for a federal customhouse to be sold to a local historic preservation society (H.R. 2121 in 2009).

Although Ron Paul’s crusade against corrupt government and the Federal Reserve is a losing battle, the value of his message is invaluable. Ron Paul has seen the future of constant U.S. dollar debasement and positioned his personal portfolio heavily into gold and silver – something that the average American should think about.