Have too many investors gotten overly bullish on gold?

Have too many investors gotten overly bullish on gold?

After a stunning advance of almost $200 per ounce from last year’s closing price, some are asking if gold has gotten ahead of itself. After advancing almost nonstop since the beginning of the year, gold sold off sharply, dropping by $32.50 to close in New York trading at $1725.90.

Analyst Mark Hulbert, who tracks investor sentiment as reported in the Hulbert Gold Newsletter, reports that bullish sentiment on gold has become extreme. At the end of 2011, short term gold timers were completely out of the gold market. The Hulbert Gold Newsletter Sentiment Index (HGNSI) registered 0.3% on December 29th compared to 51% today. Mr. Hulbert sees the rapid return to bullishness by gold investors as a worrisome signal and notes that the HGNSI never got as high as it is today when gold previously traded at current price levels.

Mr. Hulbert notes that his indicator can be early as was the case last year. In early December Hulbert noted that bearish sentiment was reaching extreme levels but gold subsequently plunged from $1,752 on December 1st to $1,574.50 on December 30th.

One indicator of gold sentiment that does not seem to be signaling an imminent sharp correction in gold is the CBOE Gold ETF Volatility Index (Gold VIX) which measures gold volatility based on SPDR Gold Trust (GLD) options trading. As bearish put positions on the GLD increase, the VIX rises as it did last August prior to a sharp correction in the price of gold. After peaking at 40 last year, the VIX is currently at 22.

Could the price of gold correct in the short term? Yes. Should long term investors who hold gold as a safe haven against a government that has an official policy of debasing the currency be worried? No.

A short term correction is nothing more than a buying opportunity for long term investors. Why would one care if gold corrects to $1,600 on its way to $5,000? Here are a few items for consideration by those worried about a “correction” in the price of gold.

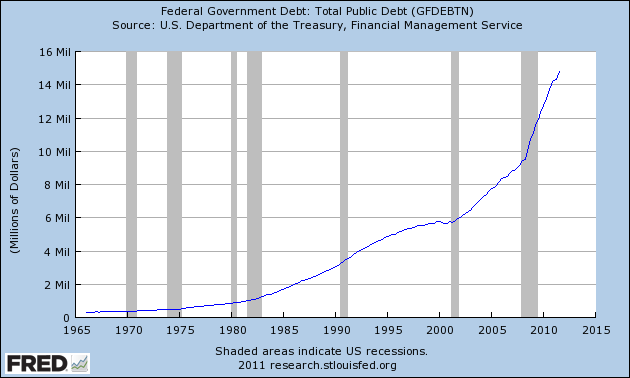

The U.S. has accumulated debt obligations and promises that are mathematically impossible to repay. Neither future economic growth nor tax increases will be sufficient for the government to meet its obligations without debasing the value of the dollar. The government is spending $1.60 for every $1.00 collected in revenues, half of all families receive some type of government payment and half of all wage earners pay no taxes.

The government’s “solution” for too much debt remains the same – more debt. Here’s what Treasury Secretary Geithner said when he asked Congress to raise the debt limit in August 2009 when government debt totaled “only” $12.1 trillion.

“Congress has never failed to raise the debt limit when necessary. Because members of both parties have long recognized the need to keep politics away from this issue, these actions have traditionally received bipartisan support. This is clearly a moment in our history that calls for continuation of that tradition.”

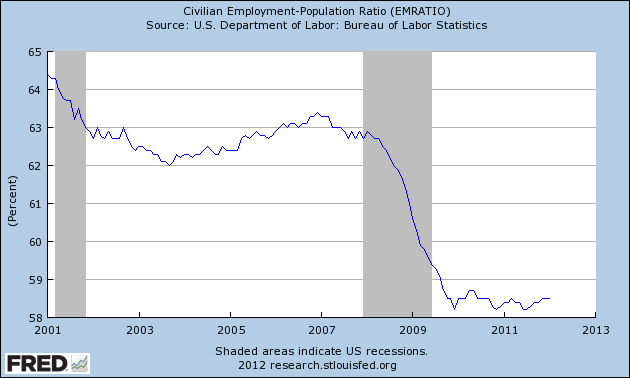

As the debt burden approaches the day of reckoning, the proportion of the population actually working continues to decline.

Investors late to the party attempting to diversity into gold may find that it’s too late – gold may not be available at any price.

Gregor Macdonald notes that global gold production over the last decade has been below the average of the past 110 years. Normally, higher prices will result in higher supplies as producers rush to capitalize on higher prices. Despite the fact that the price of gold has increased every year for the past decade, gold production has barely increased – there is simply not that much gold left which hasn’t already been mined.

A looming price correction in gold? Bring it on!