The House Passes H.R. 459 Bill from Ron Paul to Audit the Fed

July 25, 2012 should go down in history as the date the Federal Reserve may become fully accountable to the US government. A motion to pass the bill as amended was unanimously approved by the house to require a full audit of the boards of governors of the Federal Reserve System and banks. This will be done by the Comptroller General of the US before the end of 2012 and they are required to issue their report within 12 months of enactment. The votes in the House in the bill’s passing this was 326 yea votes to 99 nay votes with 7 non votes. Interestingly enough it was the Republicans that strongly supported this bill with 239 yea and 1 nay vote, while the Democrats voted 88 yea and 98 nay.

http://youtu.be/C47DVVUmHDw

There are many hurdles ahead of this bill before it takes effect; it still has to be ratified by the Senate and the President. However, finally getting approved in the House is a step in the right direction. Even if it does pass how much effect will the audit have in reality? Probably not much since the banking institution known as the Federal Reserve operates outside of any law. Even if they are found guilty of any wrong doing in managing the value of the US dollar or being involved in rigging the Libor rate, who will be there to prosecute them? Remember they operate outside the law, so even if they are found guilty, it will be the US citizens and holders of paper/digital US dollars that will somehow pay for it.

In a world where bank’s losses are socialized, the Federal Reserve (the banker for banks) misconducts have always been socialized on the people. Of course, this socialization of losses by the Fed has been taking place ever since its illegal inception. In 1913, the Federal Reserve stole the power to issue and control money by introducing the Federal Reserve note, something we call the US dollar. Since then, it is estimated that the dollar has lost 95% of its purchasing power by way of inflation (the increase of the money supply), so it really has only 5% left to go. As the value of the US dollar moves towards its intrinsic value of zero, gold and silver as true money has only one way to go and that is up.

Usually first reactions are correct and looking at this news the value of the US dollar reacted negatively, while gold went higher in most major currencies around the world.

Could This be the Catalyst that Gold Needs for a Major Break Out to the Upside?

In a manipulated market, it’s tough to say, but the fact that there is support for auditing the Fed and making it accountable is definitely a step in the right direction. With the recent news about major banks manipulating the Libor rate, any investigation into the Fed’s involvement is most welcome and has to be gold-positive. Recently, we have been writing about how gold is moving towards the financial system with several different proposals for making it a tier 1 asset class and its use as collateral by financial institutions. If these proposals take effect, they are planned for January 2013, which coincides nicely with this audit being completed by the end of 2012.

Normally, the summer doldrums represent the lows in price for precious metals with a significant rally occurring in the fall and winter. With this recent down turn, we have most likely seen the lows, and there are many catalysts for G&S to move higher into next years.

For example:

1. Food inflation is rising with this drought.

2. Gold could carry a zero risk weighting on bank books by Jan 2013 (BIS and FDIC are proposing this).

3. Paper currencies are Fiat, essentially worthless, but they will be used to create inflation, there is no other choice at the moment—QE to Infinity.

4. Market manipulation by bullion banks will be overrun by physical buyer (mostly now coming from central banks).

5. The investment community is only 1% invested in gold; historically this has been 5-10%.

6. Political tensions with Iran could heat up again later this year or early next, causing higher oil prices and as such gold.

7. More banking manipulation and scandals are emerging this summer, the Libor scandal is just the tip of the iceberg.

8. They system for true price discovery is broken, regulators have failed and the LBMA & Comex have lost all control and credibility.

9. The price suppression by the west will be overrun by the East and physical buyers. The West cannot win this paper game.

10. MOST importantly: GOLD and SILVER is a hard asset and it has a history of over 5000 years being REAL MONEY. This paper/digital money has been only in place over the last 100 years and is doomed to fail.

Now is the time to be investing in gold and silver, during this consolidation. A long period of consolidation is usually followed by a major move either to the upside and downside. Given gold and silver’s favourable fundamentals, the break out will most likely be to the upside as gold moves towards the financial system. Today’s positive price action could be the start of a new trend higher going into the fall and early next year. If this trend plays out, there will be several opportunities to trade in and out of several precious metals ETFs. The gold miners are great value compared to gold and we have been evaluating several that have great upside potential and production growth.

The key is to be ahead of the curve before it happens, take a position and place a tight stop loss in case this is a fake break out and gold continues to correct lower against its fundamentals. If the correction in gold is over and we are at a start of a new trend higher over the next year, this summer will prove to one of the best buying opportunities we have seen in a very long time. Significant profits could be made buying gold and many of the producers during the summer doldrums and then selling into the fall and winter, the only question is are you positioned to take advantage of a trend change in gold when it happens.

If you enjoyed reading this article and are interested in protecting your wealth with precious metals, you can receive our free blog by visiting TDV Golden Trader.

Cheers

By Vin Maru

By Vin Maru Although Federal Reserve Chairman Ben Bernanke refuses to acknowledge that gold is money, another major regulatory agency views the value of gold money as a risk free asset for calculation of Tier 1 regulatory capital by banks. Meanwhile, as Ben Bernanke dismisses the value of gold, other central banks around the world continue to increase gold reserves. As the world financial system spirals closer to a complete breakdown, it is the holders of paper currencies that are squarely placed at the highest point of the risk spectrum.

Although Federal Reserve Chairman Ben Bernanke refuses to acknowledge that gold is money, another major regulatory agency views the value of gold money as a risk free asset for calculation of Tier 1 regulatory capital by banks. Meanwhile, as Ben Bernanke dismisses the value of gold, other central banks around the world continue to increase gold reserves. As the world financial system spirals closer to a complete breakdown, it is the holders of paper currencies that are squarely placed at the highest point of the risk spectrum.

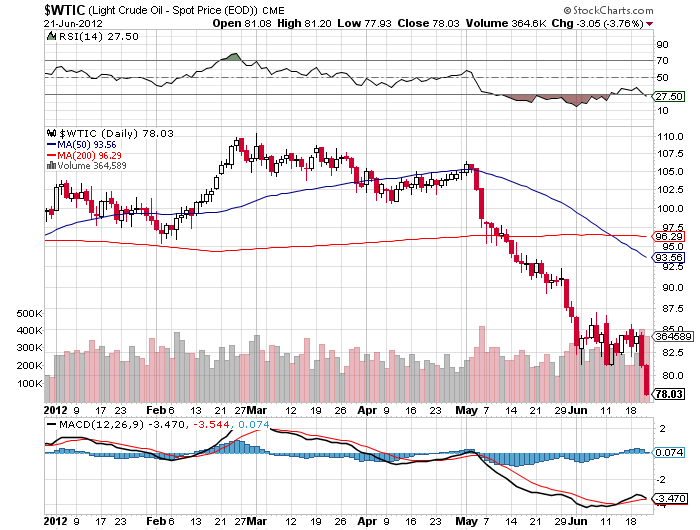

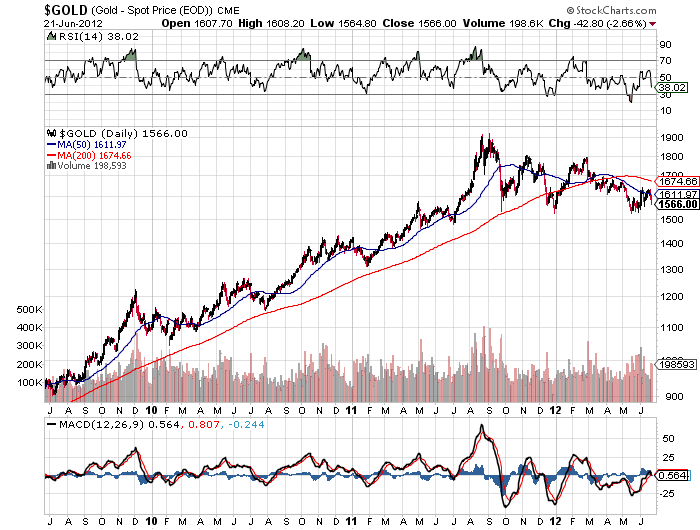

The combination of increasingly ominous economic reports along with the Fed’s failure to announce bold new monetary initiatives resulted in a brutal reassessment of risk by investors. Stock, commodity and precious metal markets all plunged with the Dow down 250 points, gold down by $41.60 per ounce to $1,566 and silver off by 4.4% to $26.98. Crude oil in New York trading was off 4%, dropping below $80 a barrel for the first time in eight months.

The combination of increasingly ominous economic reports along with the Fed’s failure to announce bold new monetary initiatives resulted in a brutal reassessment of risk by investors. Stock, commodity and precious metal markets all plunged with the Dow down 250 points, gold down by $41.60 per ounce to $1,566 and silver off by 4.4% to $26.98. Crude oil in New York trading was off 4%, dropping below $80 a barrel for the first time in eight months.