Most Americans under 30 have a strange sense of unease that something is very wrong with the way things are going in America. If you are 60 or older and can remember with nostalgia how life in America was prior to the days of blatant and corrupt crony capitalism, you know for sure we are heading in a very wrong direction at an accelerating pace.

Most Americans under 30 have a strange sense of unease that something is very wrong with the way things are going in America. If you are 60 or older and can remember with nostalgia how life in America was prior to the days of blatant and corrupt crony capitalism, you know for sure we are heading in a very wrong direction at an accelerating pace.

I can remember the days when the average worker could support his family without putting his wife to work, without having to give up on having children, without having to worry about banks going under, without having to worry about an implosion of the financial system and without the expectation that the government would provide handouts to solve every little one of life’s problems.

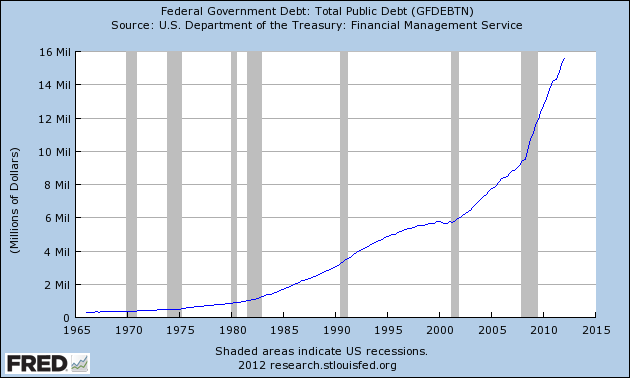

Gradually, it has begun to dawn on the average American of all ages that the Federal Reserve may be at the heart of the nation’s financial problems. Much has been written about this, but two graphs sum up the situation quite nicely. Since the Federal Reserve was created in 1913, the value of the dollar has declined to a fraction of what it was once worth and since the abandonment of the gold standard, government debt has reached levels that are no longer sustainable without further debasement of the paper dollar. The American public is beginning to connect the dots.

Ron Paul has been a lonely voice in spreading the message about the Fed but has finally reached a milestone with the House passage of his proposed “Audit The Fed” legislation. In an update Ron Paul notes that 75% of the American public supports his bill according to a recent poll.

Last week the House of Representatives overwhelmingly passed my legislation calling for a full and effective audit of the Federal Reserve. Well over 300 of my Congressional colleagues supported the bill, each casting a landmark vote that marks the culmination of decades of work. We have taken a big step toward bringing transparency to the most destructive financial institution in the world.

But in many ways our work is only beginning. Despite the Senate Majority Leader’s past support for similar legislation, no vote has been scheduled on my bill this year in the Senate. And only 29 Senators have cosponsored Senator Rand Paul’s version of my bill in the other body. If your Senator is not listed at the link above, please contact them and ask for their support. We need to push Senate leadership to hold a vote this year.

Understand that last week’s historic vote never would have taken place without the efforts of millions of Americans like you, ordinary citizens concerned about liberty and the integrity of our currency. Political elites respond to political pressure, pure and simple. They follow rather than lead. If all 100 Senators feel enough grassroots pressure, they will respond and force Senate leadership to hold what will be a very popular vote.

In fact, “Audit the Fed” is so popular that 75% of all Americans support it according to this Rasmussen poll. We are making progress.

Of course Fed apologists– including Mr. Bernanke– frequently insist that the Fed already is audited. But this is true only in the sense that it produces annual financial statements. It provides the public with its balance sheet as a fait accompli: we see only the net results of its financial transactions from the previous fiscal year in broad categories, and only after the fact.

We’re also told that the Dodd-Frank bill passed in 2010 mandates an audit. But it provides for only a limited audit of certain Fed credit facilities surrounding the crisis period of 2008. It is backward looking, which frankly is of limited benefit.

The Fed also claims it wants to be “independent” from Congress so that politics don’t interfere with monetary policy. This is absurd for two reasons.

First, the Fed already is inherently and unavoidably political. It made a political decision when it chose not to rescue Lehman Brothers in 2008, just as it made a political decision to provide liquidity for AIG in the same time period. These are just two obvious examples. Also Fed member banks and the Treasury Department are full of former– and future– Goldman Sachs officials. Are we really to believe that the interests of Goldman Sachs have absolutely no effect on Fed decisions? Clearly it’s naïve to think the Fed somehow is above political or financial influence.

Second, it’s important to remember that Congress created the Fed by statute. Congress therefore has the full, inherent authority to regulate the Fed in any way– up to and including abolishing it altogether.

My bill provides for an ongoing, thorough audit of what the Fed really does in secret, which is make decisions about the money supply, interest rates, and bailouts of favored banks, financial firms, and companies. In other words, I want the Government Accountability Office to examine the Fed’s actual monetary policy operations and make them public.

It is precisely this information that must be made public because it so profoundly affects everyone who holds, saves, or uses US dollars.

Will the bill pass the senate, considering the incestuous and corrupt self dealing relationships between too big to fail banks, government and politicians? Probably not in our lifetimes, but at least public awareness of the problem is growing. Ron Paul might have added in his update that the vast majority of Americans no longer believe they are ruled with the consent of the governed.

By Vin Maru

By Vin Maru