Since establishing multiple chart bottoms at $1,400 during June and July, platinum has soared along with other precious metals. Based on the London Fix Price, platinum has soared 16.5% from a low of $1,390 on August 3, 2012 to a September 20 closing price of $1,620.

Since establishing multiple chart bottoms at $1,400 during June and July, platinum has soared along with other precious metals. Based on the London Fix Price, platinum has soared 16.5% from a low of $1,390 on August 3, 2012 to a September 20 closing price of $1,620.

In early August, Gold and Silver Blog examined the ostensibly poor fundamentals which had driven down the price of platinum and concluded that, based on the widely held bearish consensus and chart action, platinum had already fully discounted all bearish news. In addition, the gold to platinum ratio had reached a low not seen since 1985, another signal that platinum was undervalued. (See Platinum Perspectives – Time To Buy or Will The Bears Win?)

Despite the recent normal consolidation in platinum, prices are likely to move substantially higher over time along with the rest of the precious metals complex.

As noted in early August, Platinum can be purchased from the U.S. Mint in the form of Proof Platinum Eagles.

The U.S. Mint has been producing the Proof American Platinum Eagle since 2009. According to MintNewsBlog, the entire 2009 production of 8,000 Proof Platinum Eagles sold out in a week. During 2010, the U.S. Mint produced 10,000 Proof Platinum coins which also quickly sold out. During 2011, the mintage was set at 15,000 coins but the sales pace slowed considerably with pricing set at $2,092 and the coin has still not sold out with total sales of 14,760 as of the last U.S. Mint report. On August 9th, the U.S. Mint announced that production of the 2012 Proof American Platinum Eagles will be set at 15,000 coins. Orders are limited to 5 per household with initial pricing at $1,692.

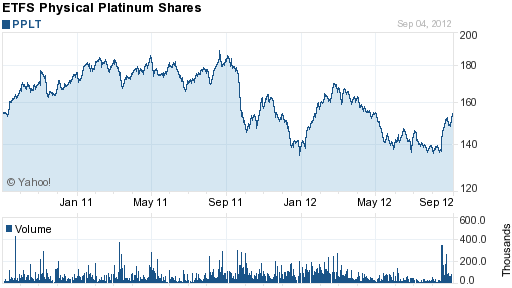

For investors disinclined to hold physical platinum, positions can be easily established through the purchase of the ETFS Physical Platinum Shares (PPLT) which holds physical platinum. The PPLT holds a relatively small amount of platinum reflecting the lack of broad investor participation in the platinum sector. The PPLT recently held about 5,000 ounces of platinum valued at $79.6 million. Gold remains the premier investment choice in precious metals but a position in platinum could add some luster to an investor’s precious metals portfolio.

More on this topic:

Closed Platinum Mines Offset By Stockpile Surplus – Is A Surprise Platinum Rally Coming?

Platinum Soars $78 On Week As Bodies Pile Up In South Africa